This version of the form is not currently in use and is provided for reference only. Download this version of

Form RI-2210C

for the current year.

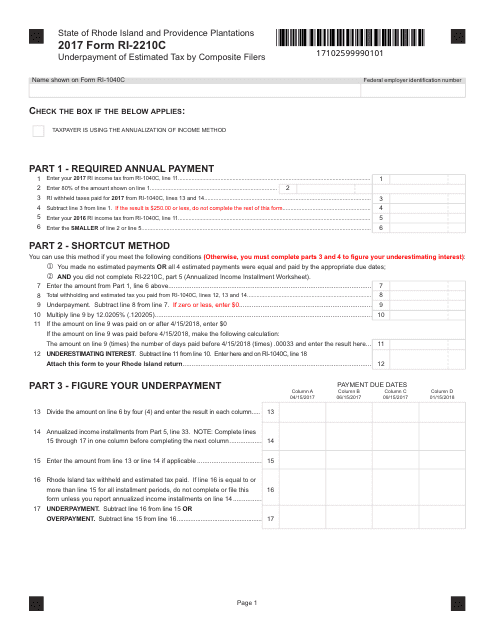

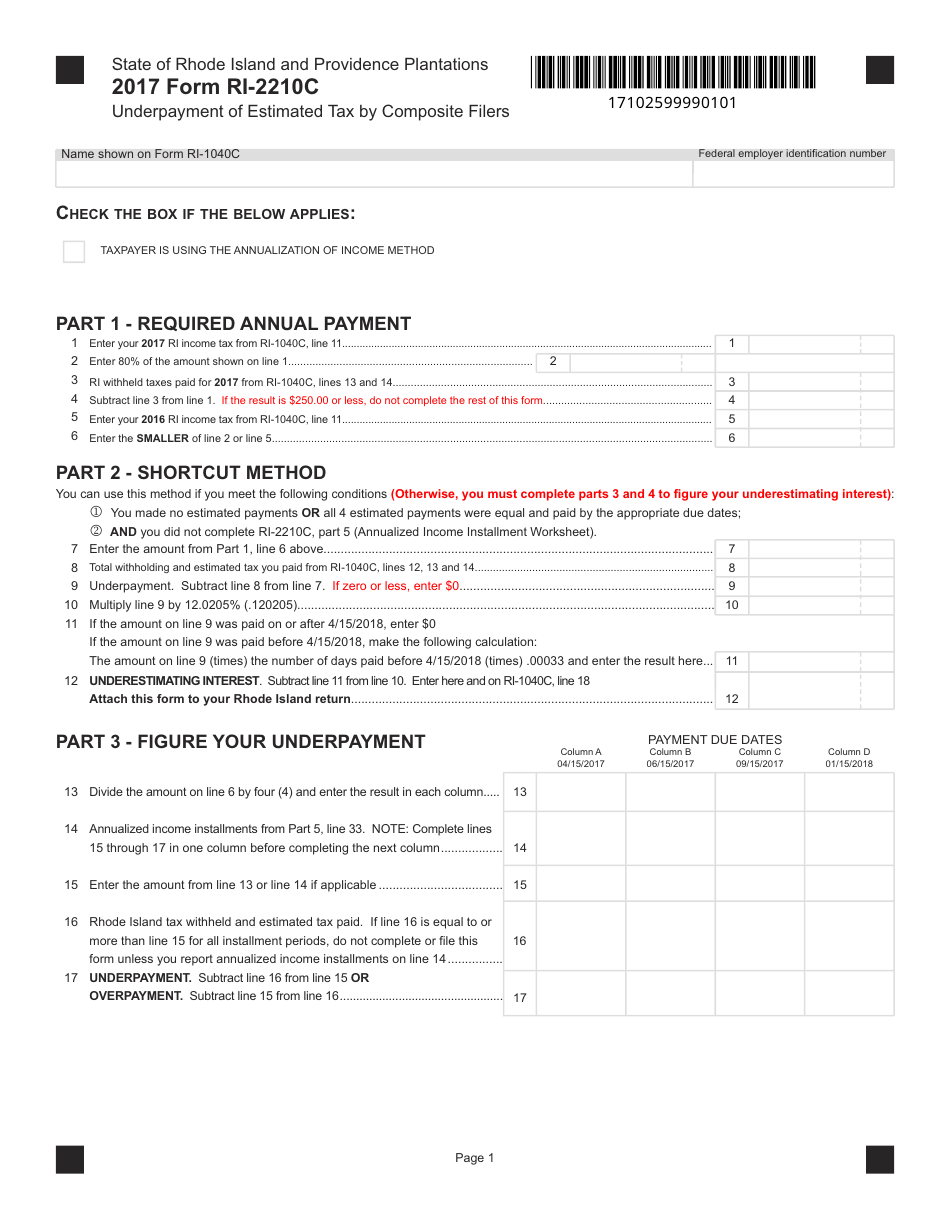

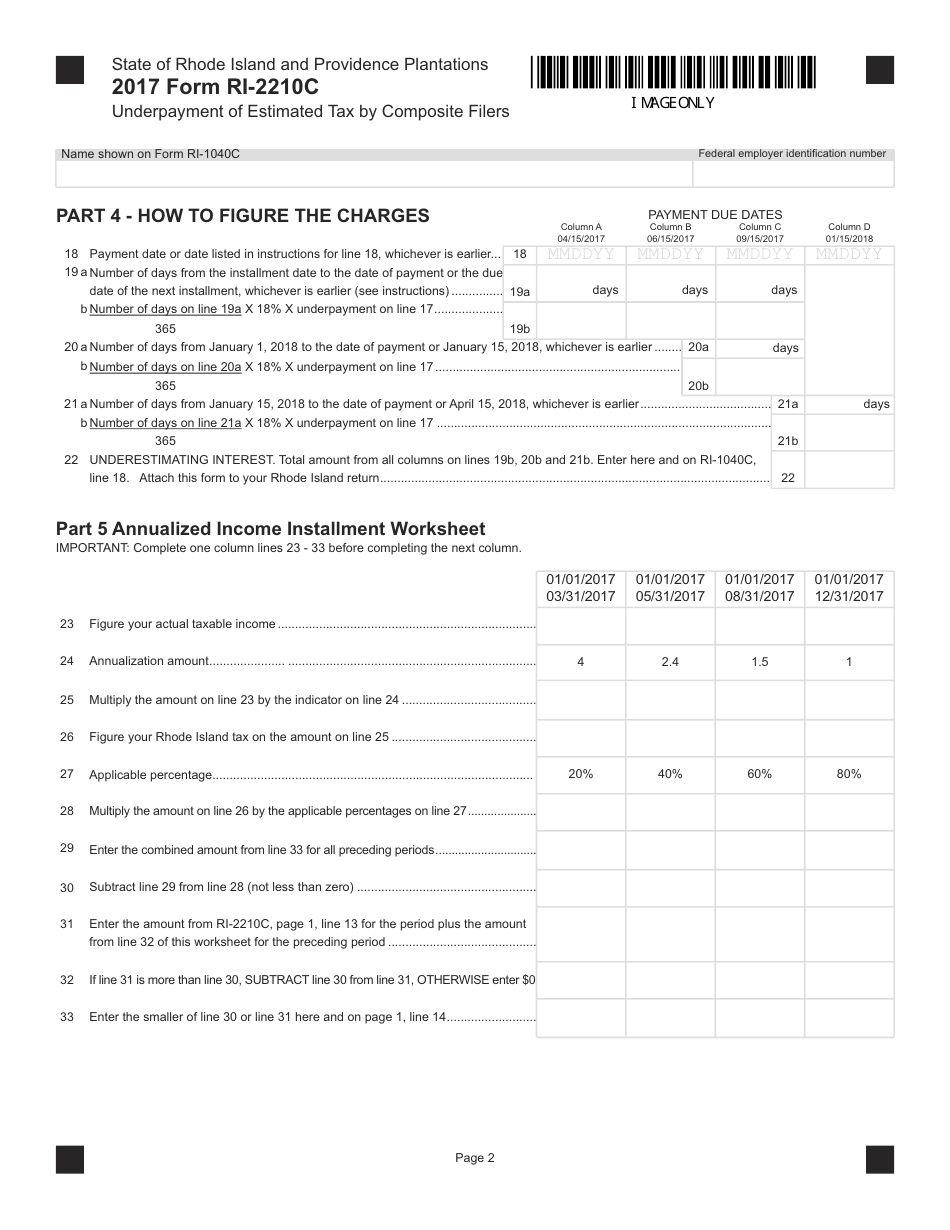

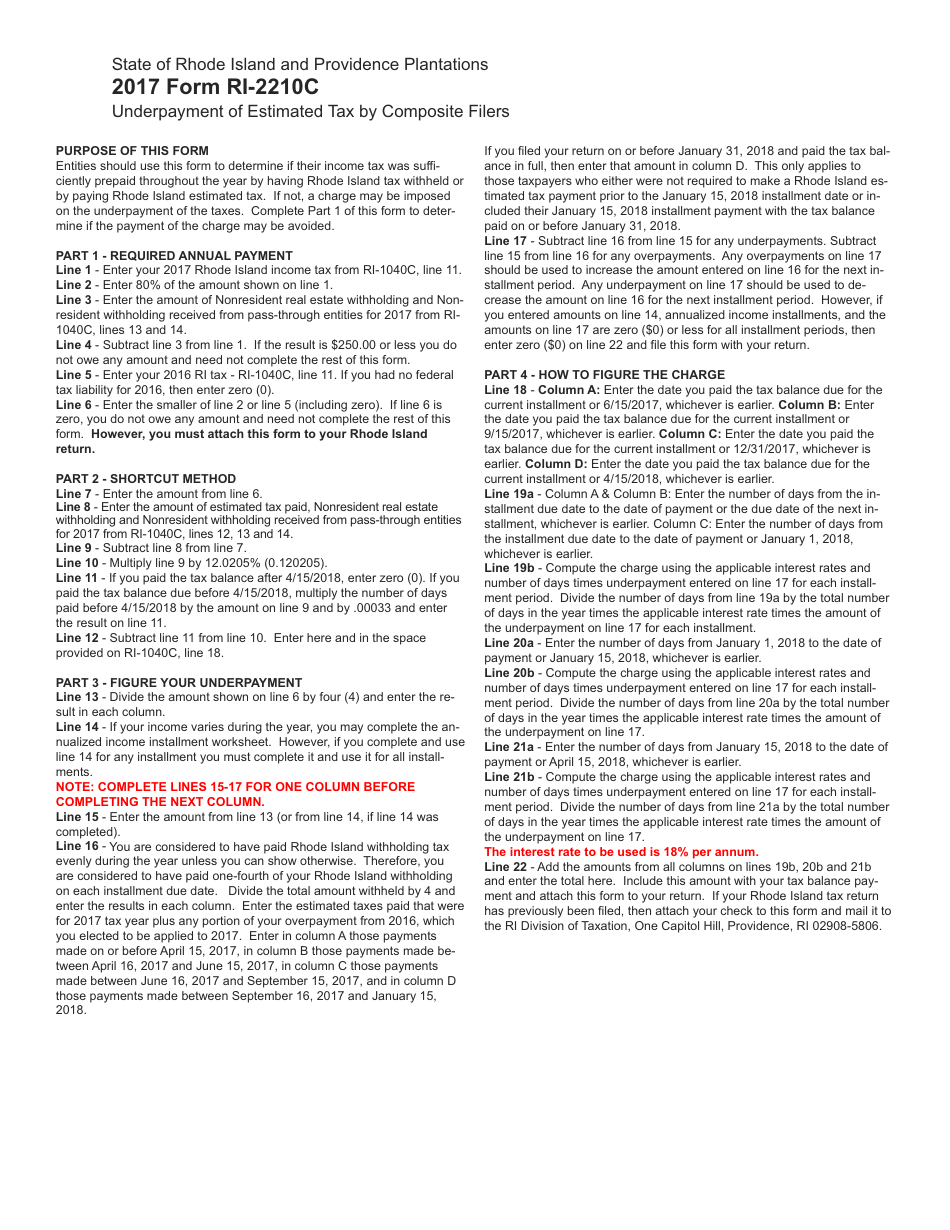

Form RI-2210C Underpayment of Estimated Tax by Composite Filers - Rhode Island

What Is Form RI-2210C?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form RI-2210C?

A: Form RI-2210C is a tax form used by composite filers in Rhode Island to report underpayment of estimated tax.

Q: Who needs to file form RI-2210C?

A: Composite filers in Rhode Island who have underpaid their estimated tax need to file form RI-2210C.

Q: What is a composite filer?

A: A composite filer is a entity or individual who files a composite tax return on behalf of nonresident members.

Q: How is underpayment of estimated tax calculated?

A: Underpayment of estimated tax is calculated based on the difference between the total estimated tax liability and the total estimated tax payments made.

Q: When is form RI-2210C due?

A: Form RI-2210C is due on or before the original due date of the Rhode Island composite return.

Q: What happens if I don't file form RI-2210C?

A: Failure to file form RI-2210C may result in penalties and interest charges.

Q: Is form RI-2210C only applicable to composite filers?

A: Yes, form RI-2210C is specifically designed for composite filers in Rhode Island.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-2210C by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.