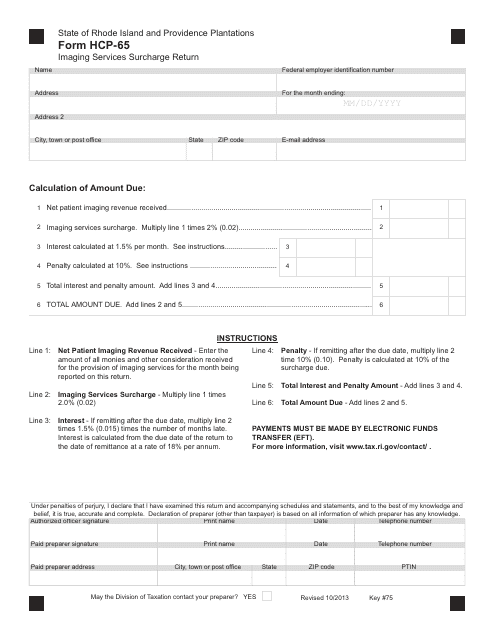

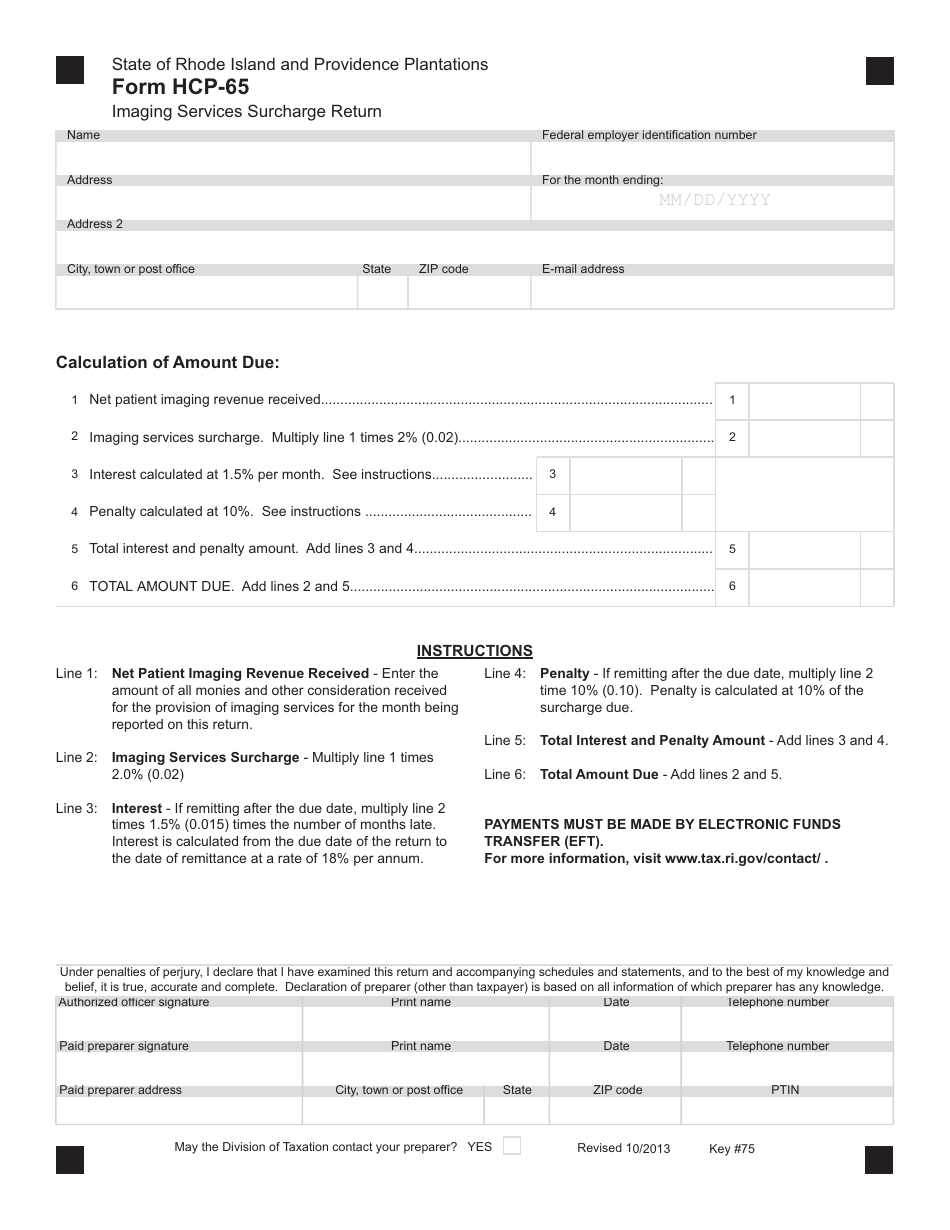

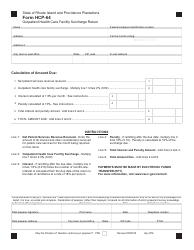

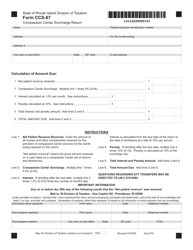

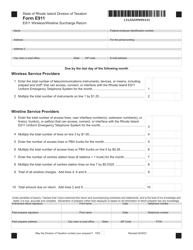

Form HCP-65 Imaging Services Surcharge Return - Rhode Island

What Is Form HCP-65?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form HCP-65?

A: Form HCP-65 is the Imaging Services Surcharge Return.

Q: Who needs to file Form HCP-65?

A: Health care providers in Rhode Island who provide imaging services need to file Form HCP-65.

Q: What is the purpose of Form HCP-65?

A: Form HCP-65 is used to report and remit the imaging services surcharge, which is imposed on health care providers in Rhode Island.

Q: When is Form HCP-65 due?

A: Form HCP-65 is due quarterly, by the 15th of the month following the end of the quarter.

Q: What information is required on Form HCP-65?

A: Form HCP-65 requires information about the health care provider, the amount of imaging services provided, and the surcharge owed.

Q: Are there any penalties for not filing Form HCP-65?

A: Yes, penalties may be imposed for failure to file Form HCP-65 or for underreporting the surcharge owed.

Q: Is there a minimum threshold for filing Form HCP-65?

A: Yes, if a health care provider's imaging services surcharge does not exceed $100 in a quarter, they are not required to file Form HCP-65.

Q: Can I e-file Form HCP-65?

A: Yes, electronic filing of Form HCP-65 is available.

Q: Who can I contact for more information about Form HCP-65?

A: For more information about Form HCP-65, you can contact the Rhode Island Division of Taxation.

Form Details:

- Released on October 1, 2013;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form HCP-65 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.