This version of the form is not currently in use and is provided for reference only. Download this version of

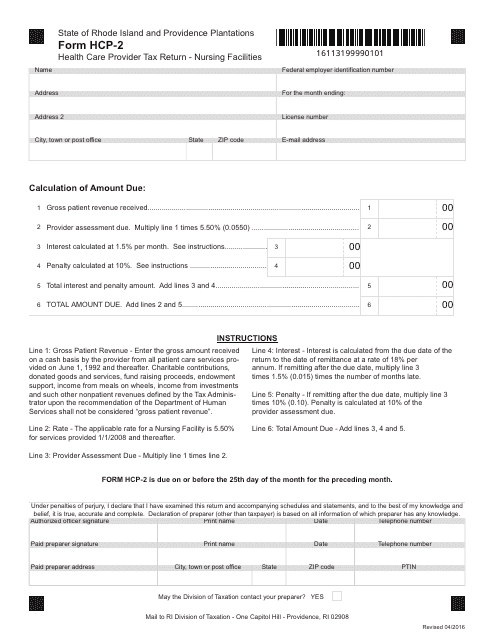

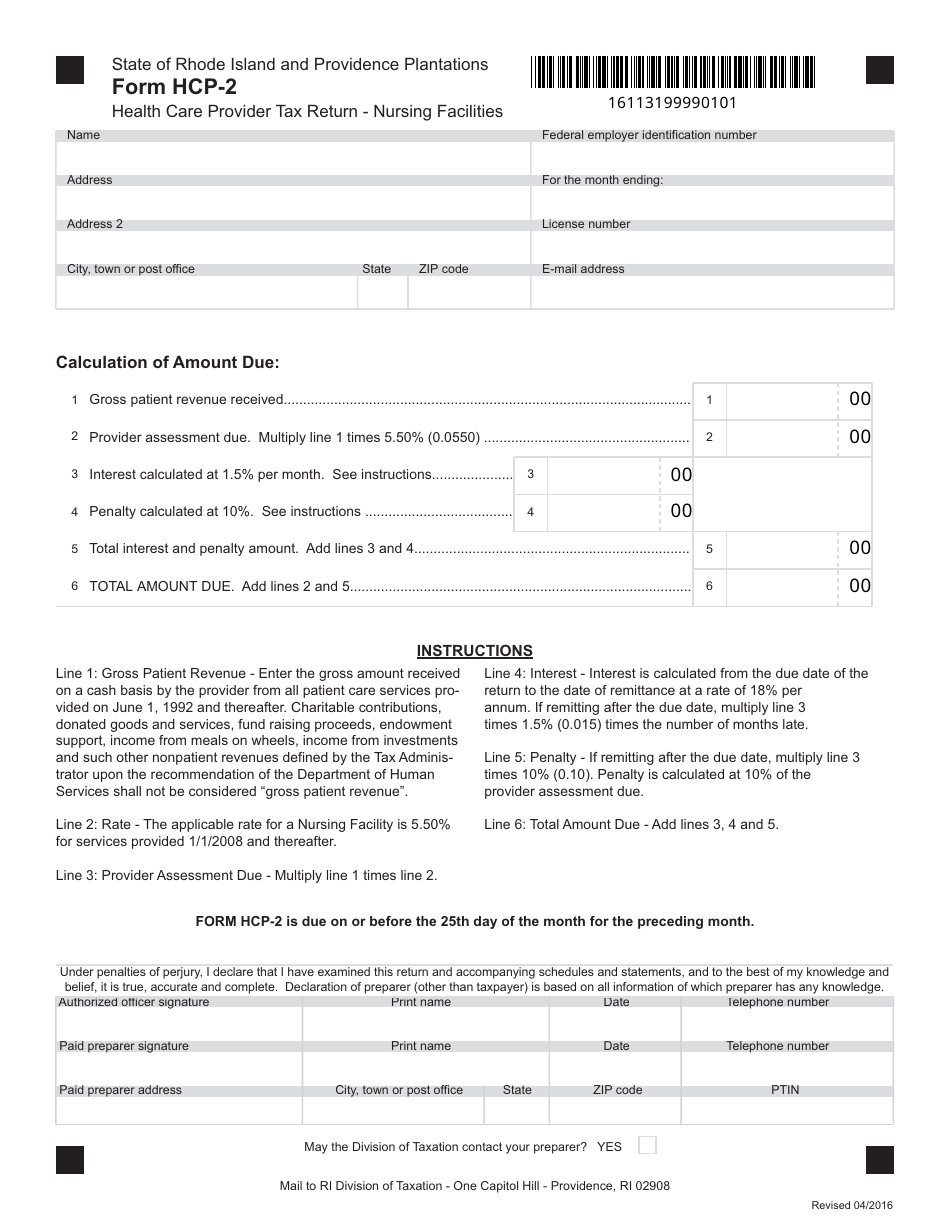

Form HCP-2

for the current year.

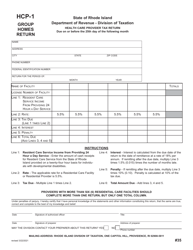

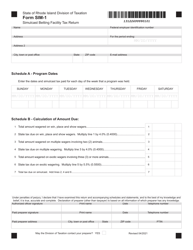

Form HCP-2 Health Care Provider Tax Return - Nursing Facilities - Rhode Island

What Is Form HCP-2?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form HCP-2?

A: Form HCP-2 is the Health Care Provider Tax Return for Nursing Facilities in Rhode Island.

Q: Who needs to file Form HCP-2?

A: Nursing facilities in Rhode Island need to file Form HCP-2.

Q: What is the purpose of Form HCP-2?

A: The purpose of Form HCP-2 is to report and pay the health care provider tax for nursing facilities in Rhode Island.

Q: When is Form HCP-2 due?

A: Form HCP-2 is due on a quarterly basis. The due dates are April 30th, July 31st, October 31st, and January 31st.

Q: Are there any penalties for late filing of Form HCP-2?

A: Yes, there are penalties for late filing of Form HCP-2. It is important to file the form and pay the tax on time to avoid penalties.

Q: How do I contact the Rhode Island Department of Revenue?

A: You can contact the Rhode Island Department of Revenue at (401) 574-8989 for more information about Form HCP-2.

Form Details:

- Released on April 1, 2016;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form HCP-2 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.