This version of the form is not currently in use and is provided for reference only. Download this version of

Form T-74

for the current year.

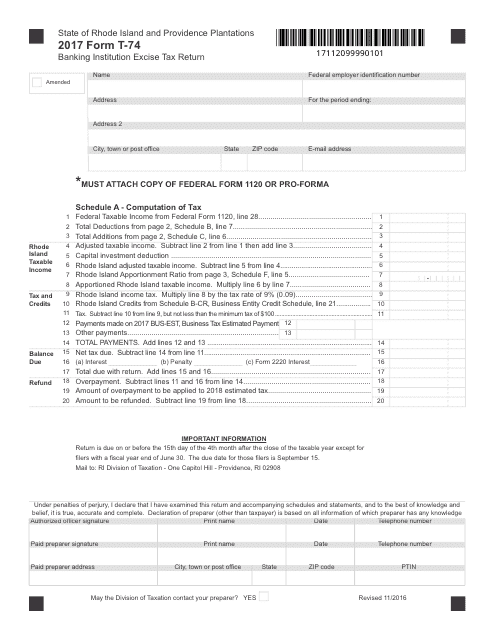

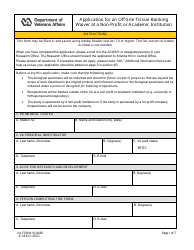

Form T-74 Banking Institution Excise Tax Return - Rhode Island

What Is Form T-74?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form T-74?

A: Form T-74 is the Rhode Island Banking InstitutionExcise Tax Return.

Q: Who needs to file Form T-74?

A: Rhode Island banking institutions need to file Form T-74.

Q: What is the purpose of Form T-74?

A: The purpose of Form T-74 is to report and pay the banking institution excise tax.

Q: When is Form T-74 due?

A: Form T-74 is due on or before the 15th day of the fourth month following the end of the taxable year.

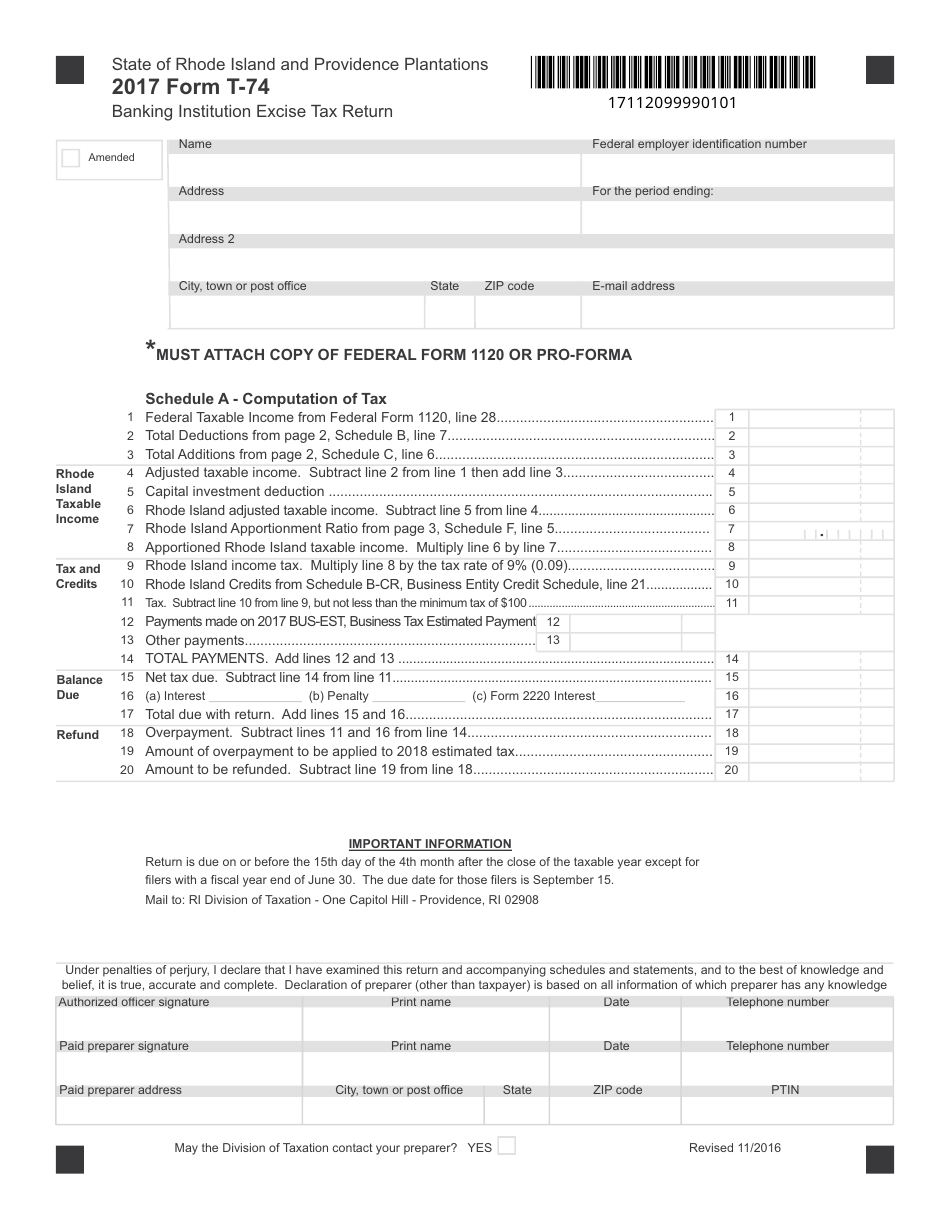

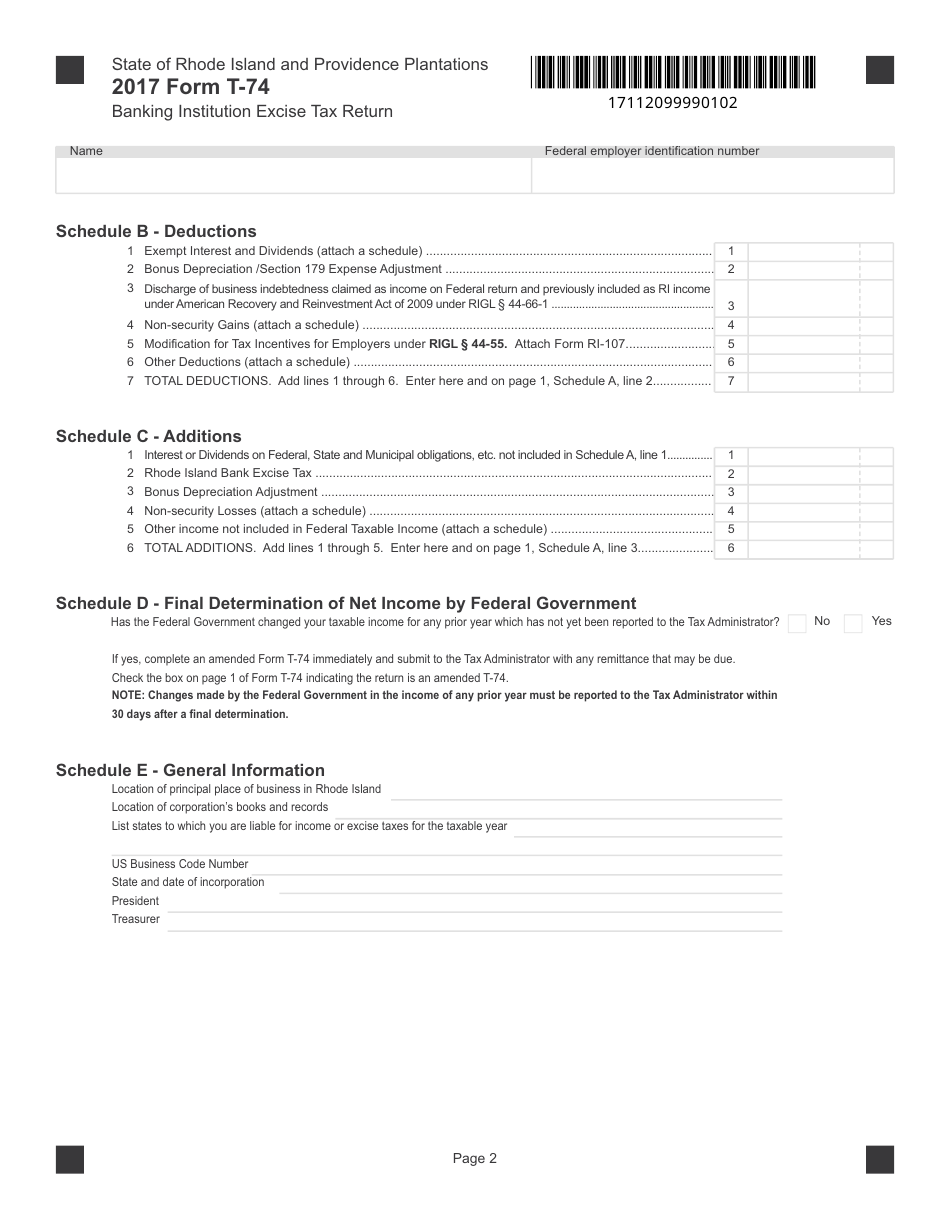

Q: What information is required on Form T-74?

A: Form T-74 requires information about the banking institution's income, deductions, and tax liability.

Q: Are there any penalties for late filing or payment?

A: Yes, there may be penalties for late filing or payment of the banking institution excise tax.

Q: Are there any exceptions or exemptions to the banking institution excise tax?

A: Yes, certain exemptions and deductions may apply. It is recommended to consult the Rhode Island Division of Taxation or a tax professional for specific guidance.

Form Details:

- Released on November 1, 2016;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form T-74 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.