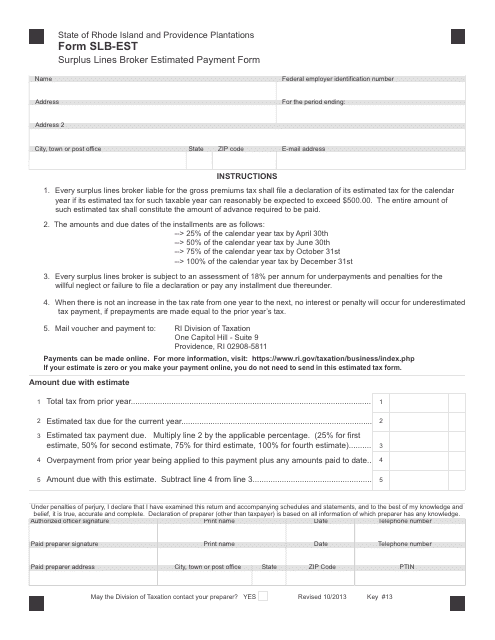

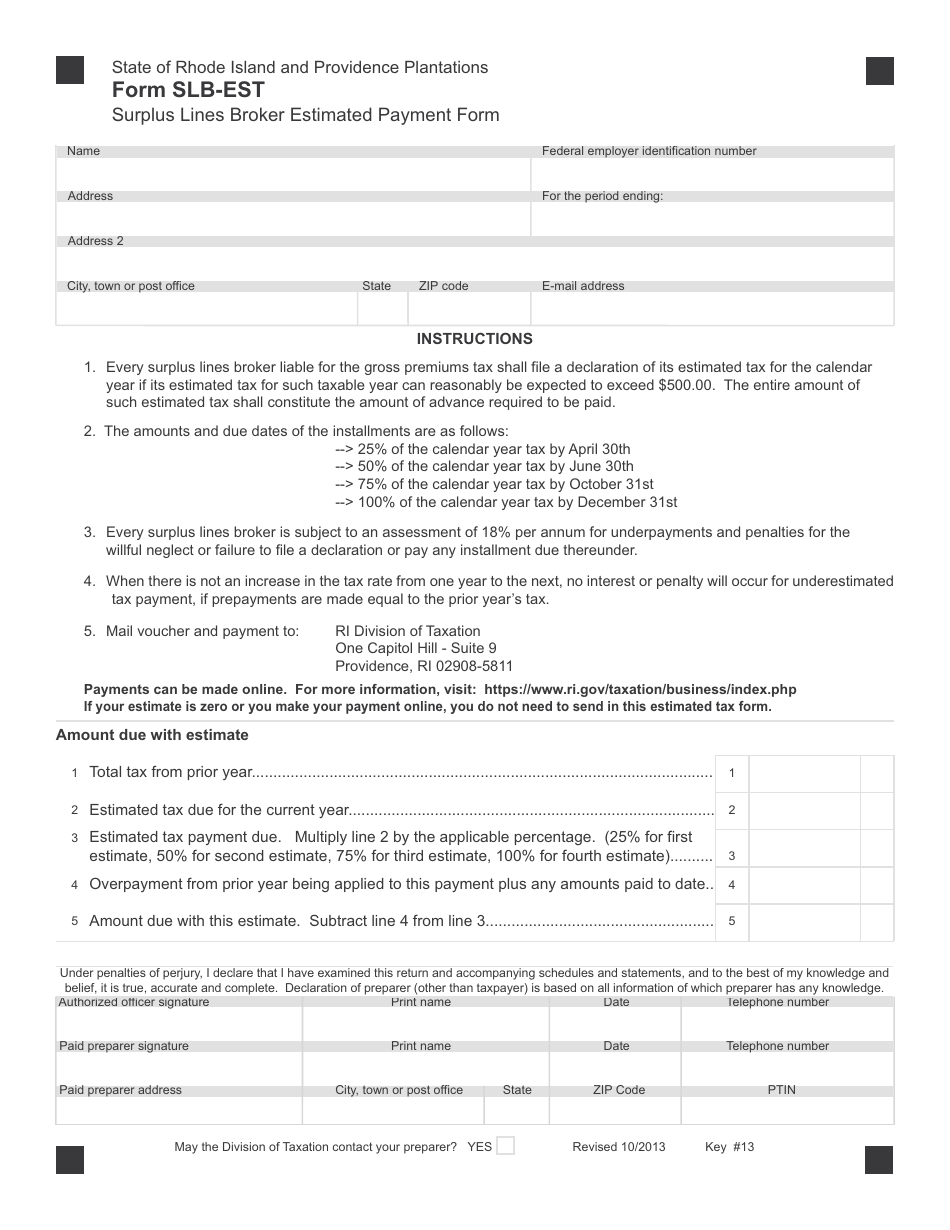

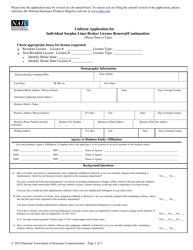

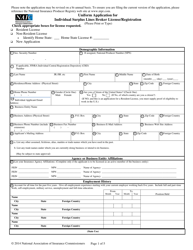

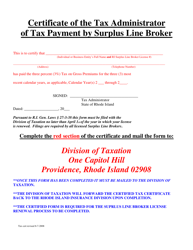

Form SLB-EST Surplus Lines Broker Estimated Payment Form - Rhode Island

What Is Form SLB-EST?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the SLB-EST Surplus Lines Broker Estimated Payment Form?

A: The SLB-EST Surplus Lines Broker Estimated Payment Form is a form used by surplus lines brokers in Rhode Island to estimate and pay their quarterly surplus lines taxes.

Q: Who needs to use the SLB-EST Surplus Lines Broker Estimated Payment Form?

A: Surplus lines brokers in Rhode Island need to use the SLB-EST form to estimate and pay their quarterly surplus lines taxes.

Q: What is the purpose of the SLB-EST Surplus Lines Broker Estimated Payment Form?

A: The purpose of the SLB-EST form is to provide surplus lines brokers with a means to estimate and pay their quarterly surplus lines taxes in Rhode Island.

Q: How often do surplus lines brokers need to use the SLB-EST Surplus Lines Broker Estimated Payment Form?

A: Surplus lines brokers need to use the SLB-EST form on a quarterly basis to estimate and pay their surplus lines taxes.

Q: Is the SLB-EST Surplus Lines Broker Estimated Payment Form specific to Rhode Island?

A: Yes, the SLB-EST form is specific to Rhode Island and is used by surplus lines brokers in the state to estimate and pay their quarterly surplus lines taxes.

Form Details:

- Released on October 1, 2013;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SLB-EST by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.