This version of the form is not currently in use and is provided for reference only. Download this version of

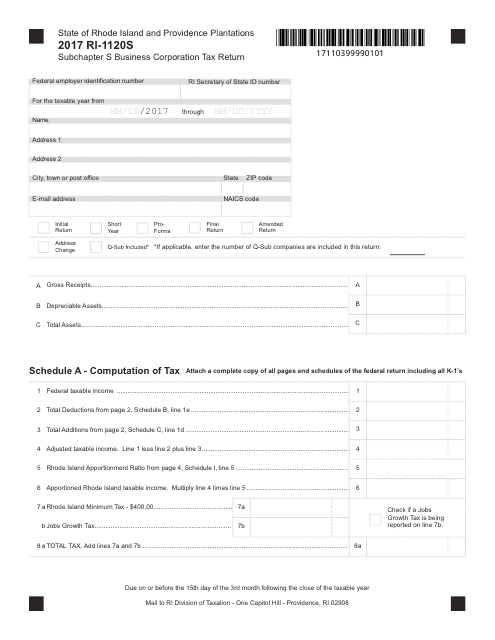

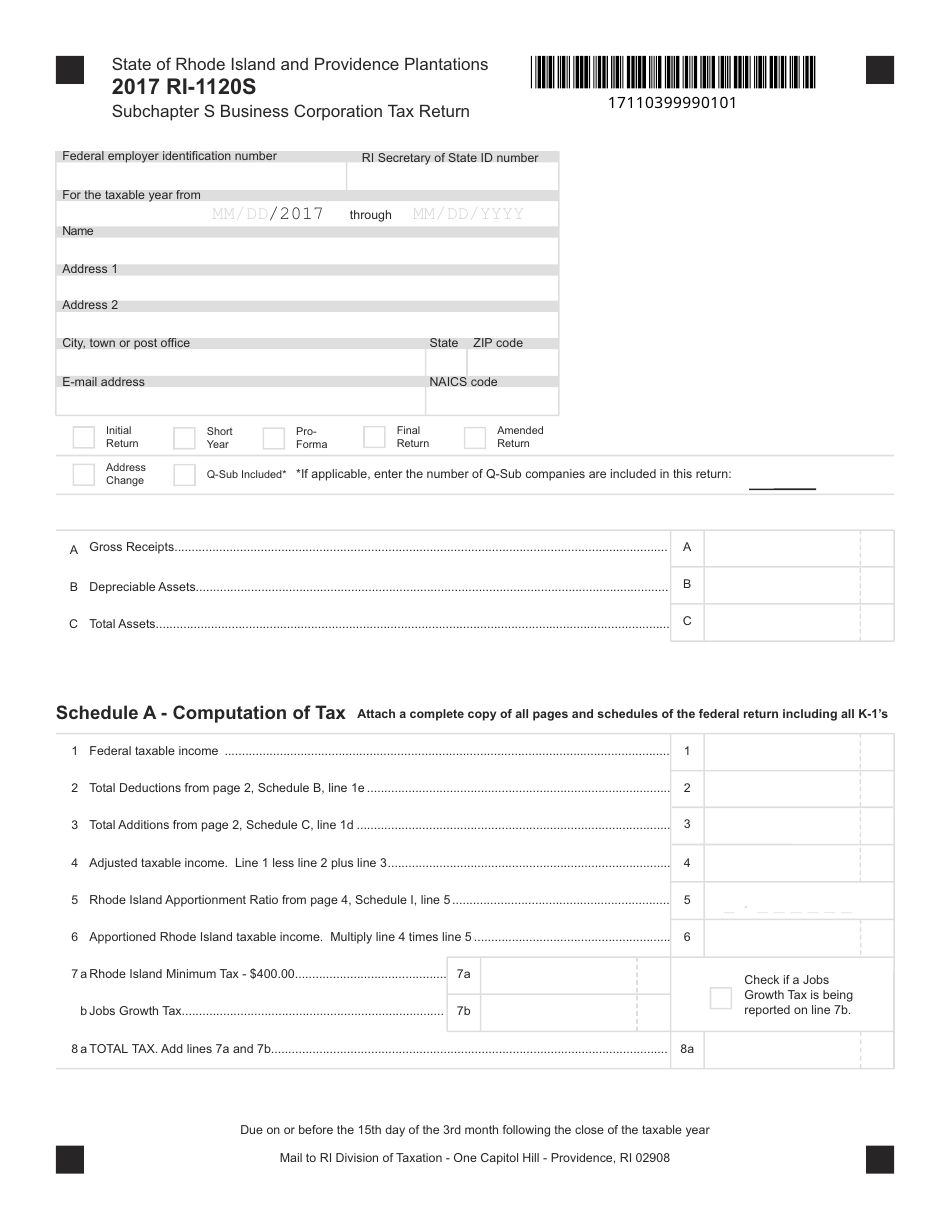

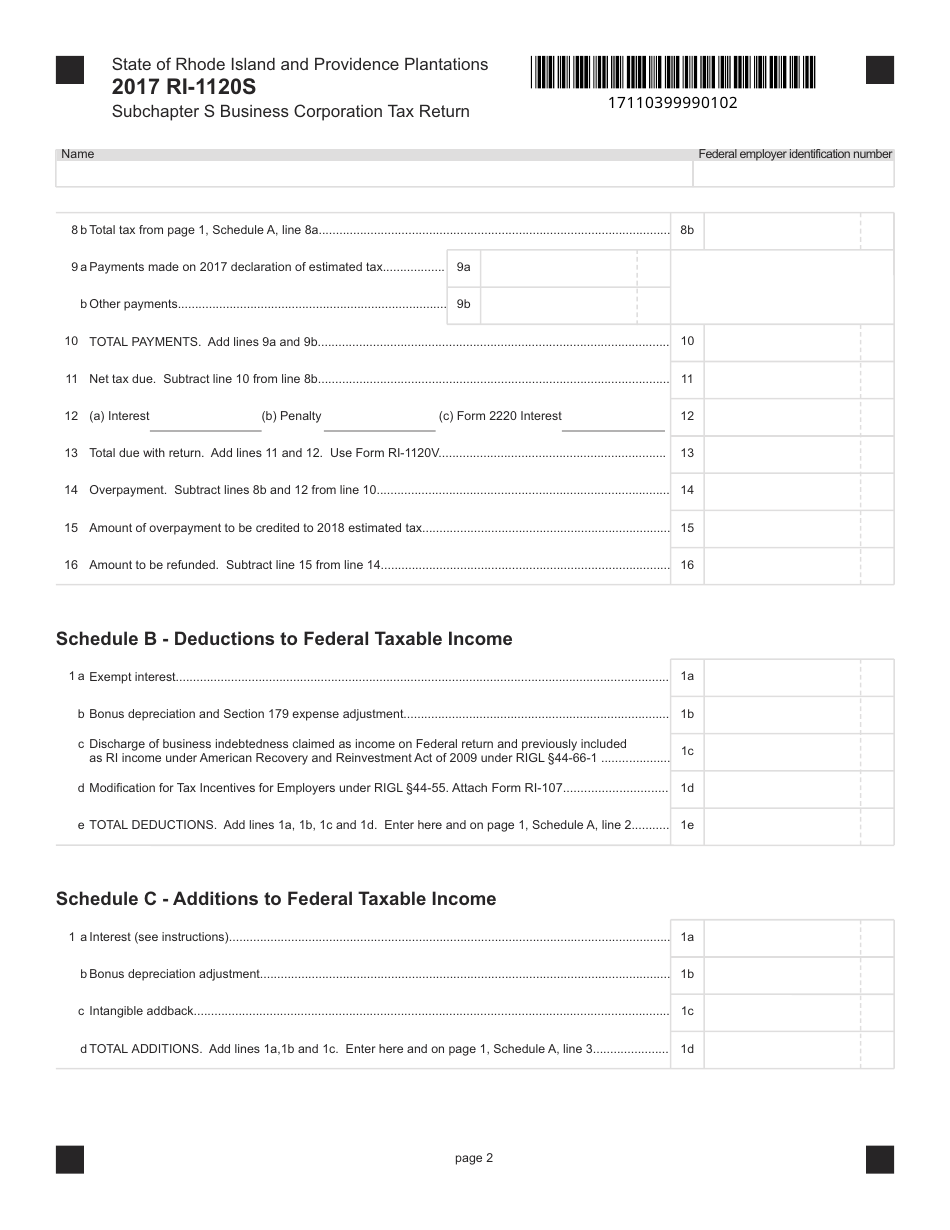

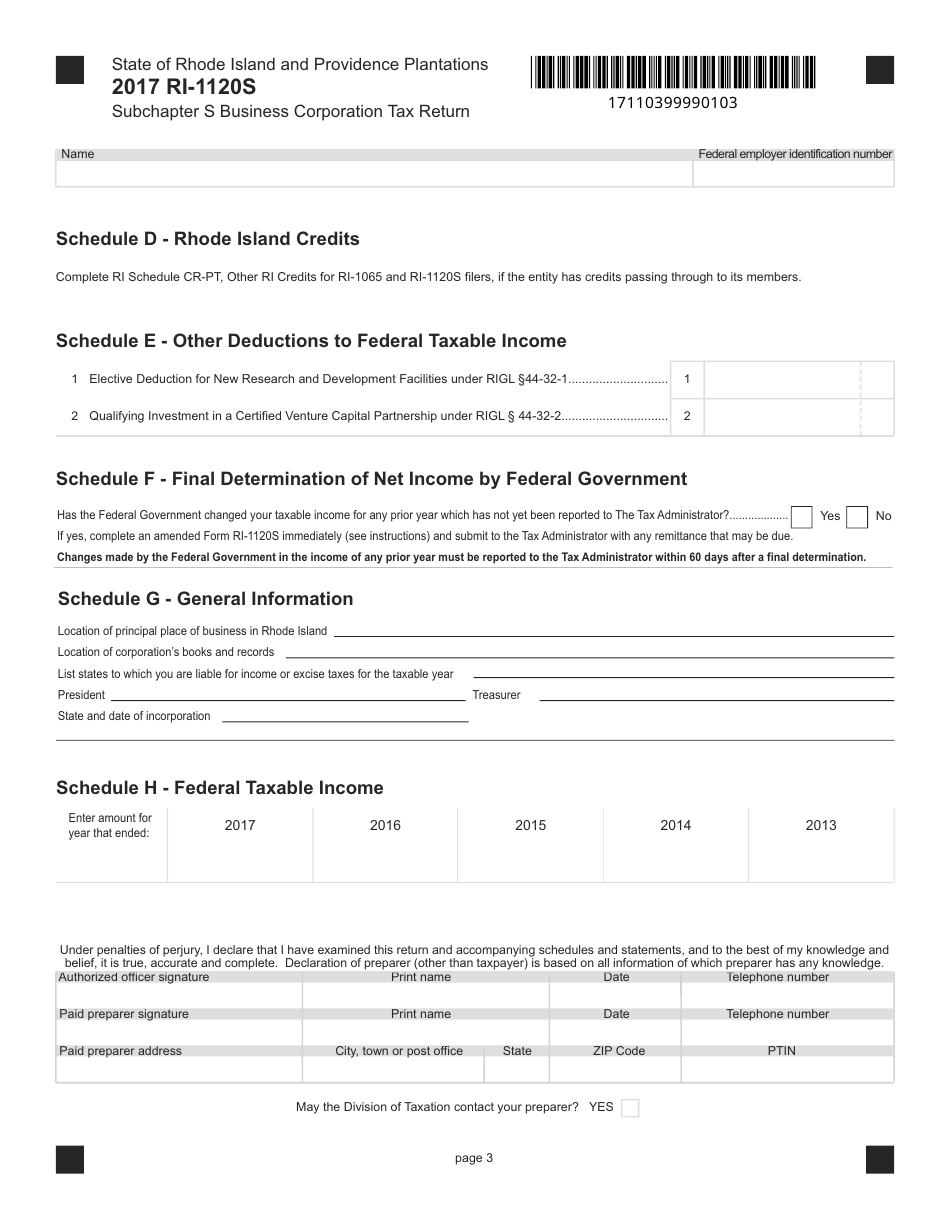

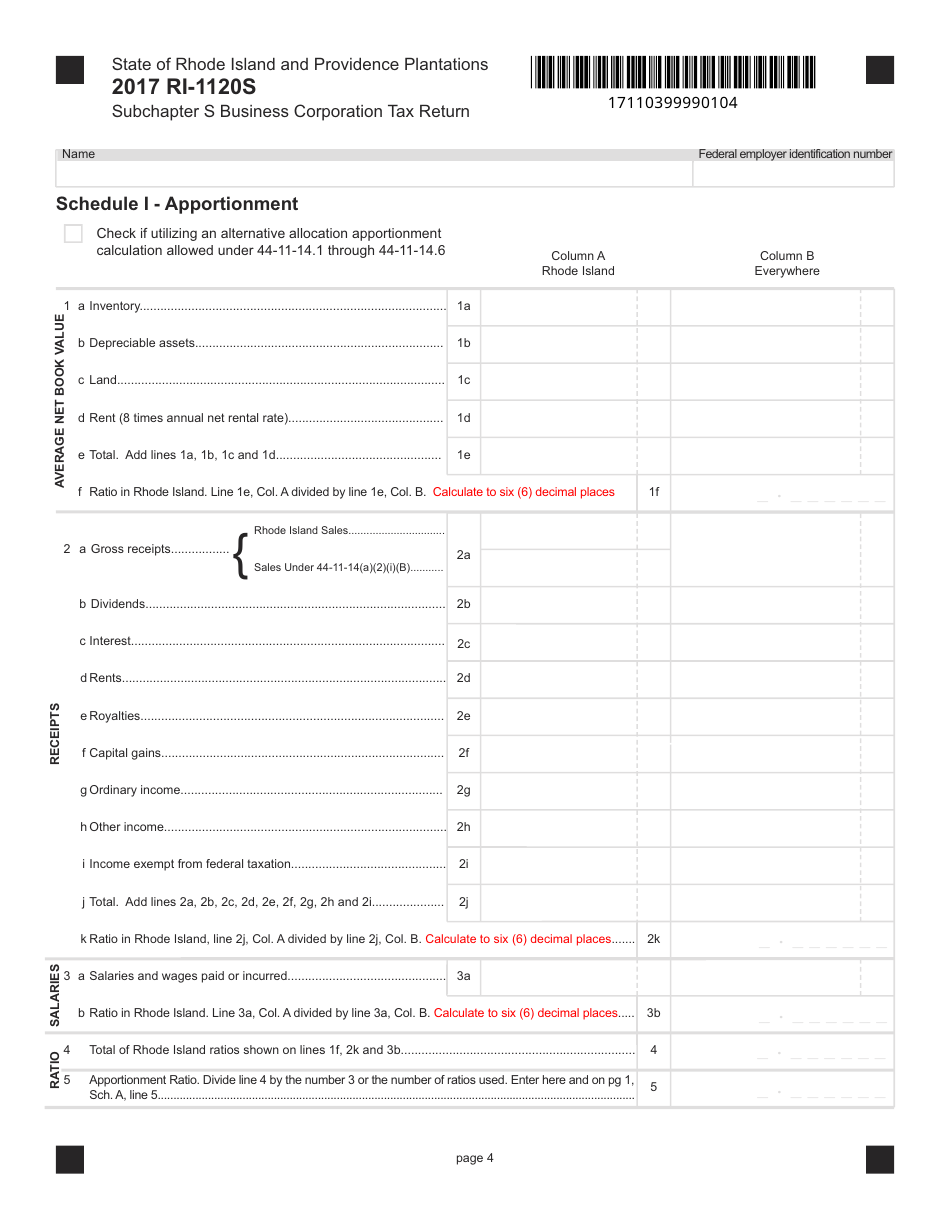

Form RI-1120S

for the current year.

Form RI-1120S Subchapter S Business Corporation Tax Return - Rhode Island

What Is Form RI-1120S?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a Form RI-1120S?

A: Form RI-1120S is the tax return specifically designed for Subchapter S Business Corporations in Rhode Island.

Q: What is a Subchapter S Business Corporation?

A: A Subchapter S Business Corporation is a type of corporation that elects to pass corporate income, deductions, and credits through to their shareholders for federal tax purposes.

Q: Who needs to file Form RI-1120S?

A: Subchapter S Business Corporations operating in Rhode Island are required to file Form RI-1120S.

Q: What information is required on Form RI-1120S?

A: Form RI-1120S requires information about the corporation's income, deductions, credits, and other relevant details.

Q: When is the deadline for filing Form RI-1120S?

A: The deadline for filing Form RI-1120S is the same as the federal deadline for S-Corporations, which is the 15th day of the third month after the close of the tax year.

Q: Is there a filing fee for Form RI-1120S?

A: Yes, there is a $400 filing fee for Form RI-1120S in Rhode Island.

Q: Are there any special considerations for Rhode Island Subchapter S Business Corporations?

A: Rhode Island follows federal rules for Subchapter S Business Corporations, but there may be some state-specific adjustments and requirements. It is recommended to consult with a tax professional or refer to the official taxation guidance provided by the Rhode Island Division of Taxation.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-1120S by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.