This version of the form is not currently in use and is provided for reference only. Download this version of

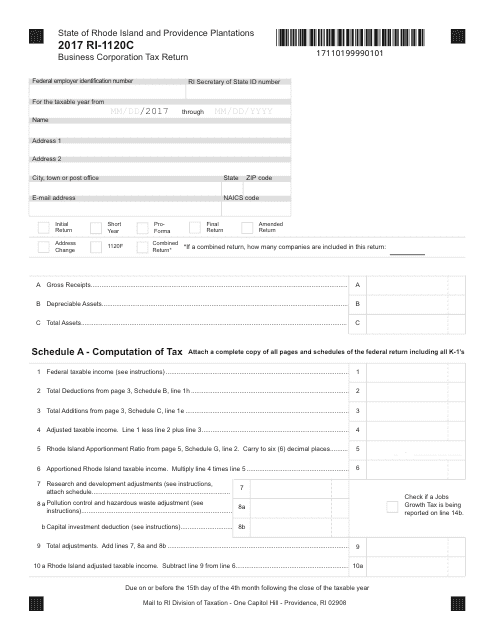

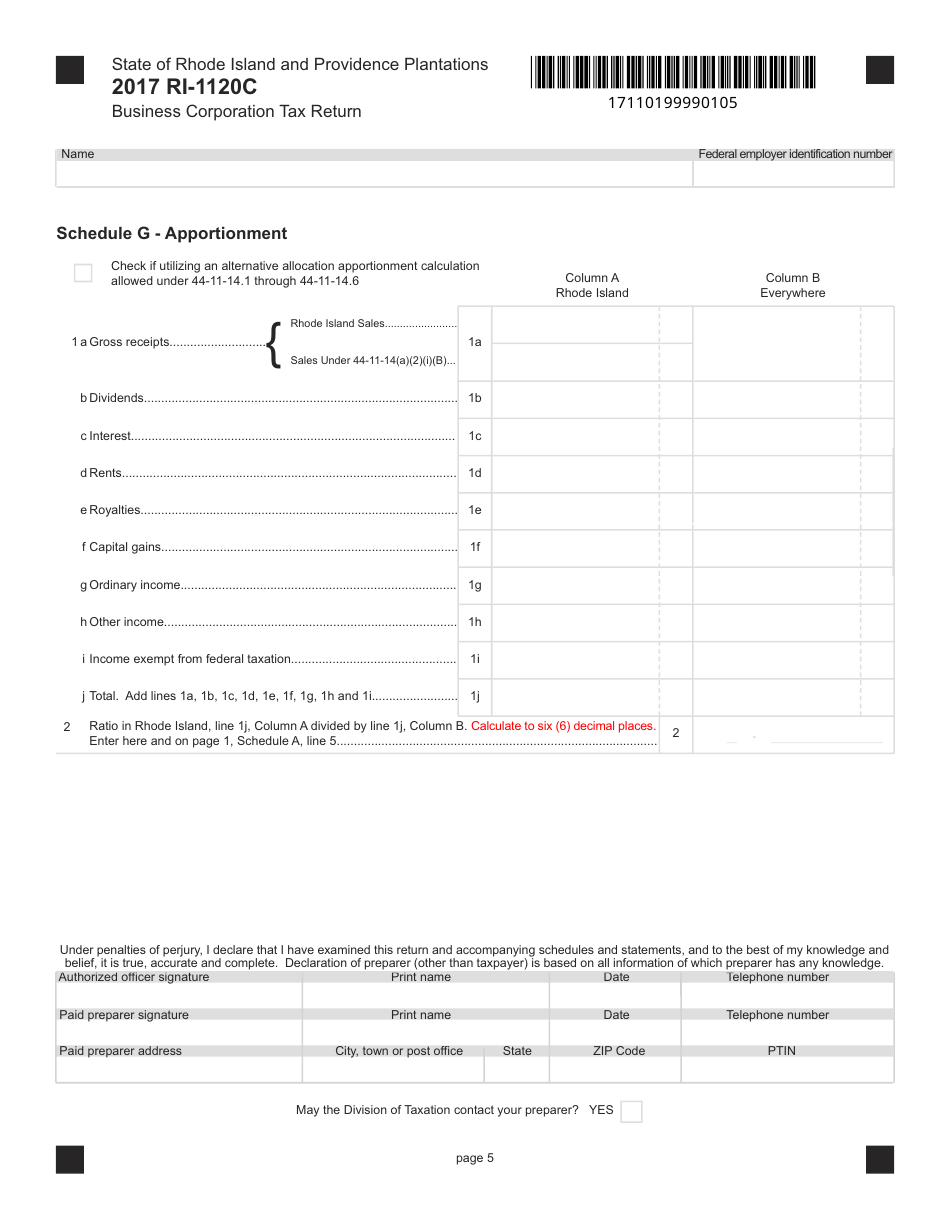

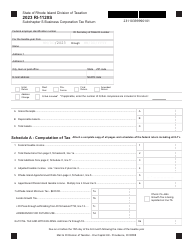

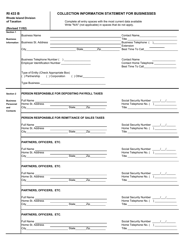

Form RI-1120C

for the current year.

Form RI-1120C Business Corporation Tax Return - Rhode Island

What Is Form RI-1120C?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the Form RI-1120C?

A: The Form RI-1120C is the Business Corporation Tax Return for Rhode Island.

Q: Who needs to file the Form RI-1120C?

A: Business corporations in Rhode Island are required to file the Form RI-1120C.

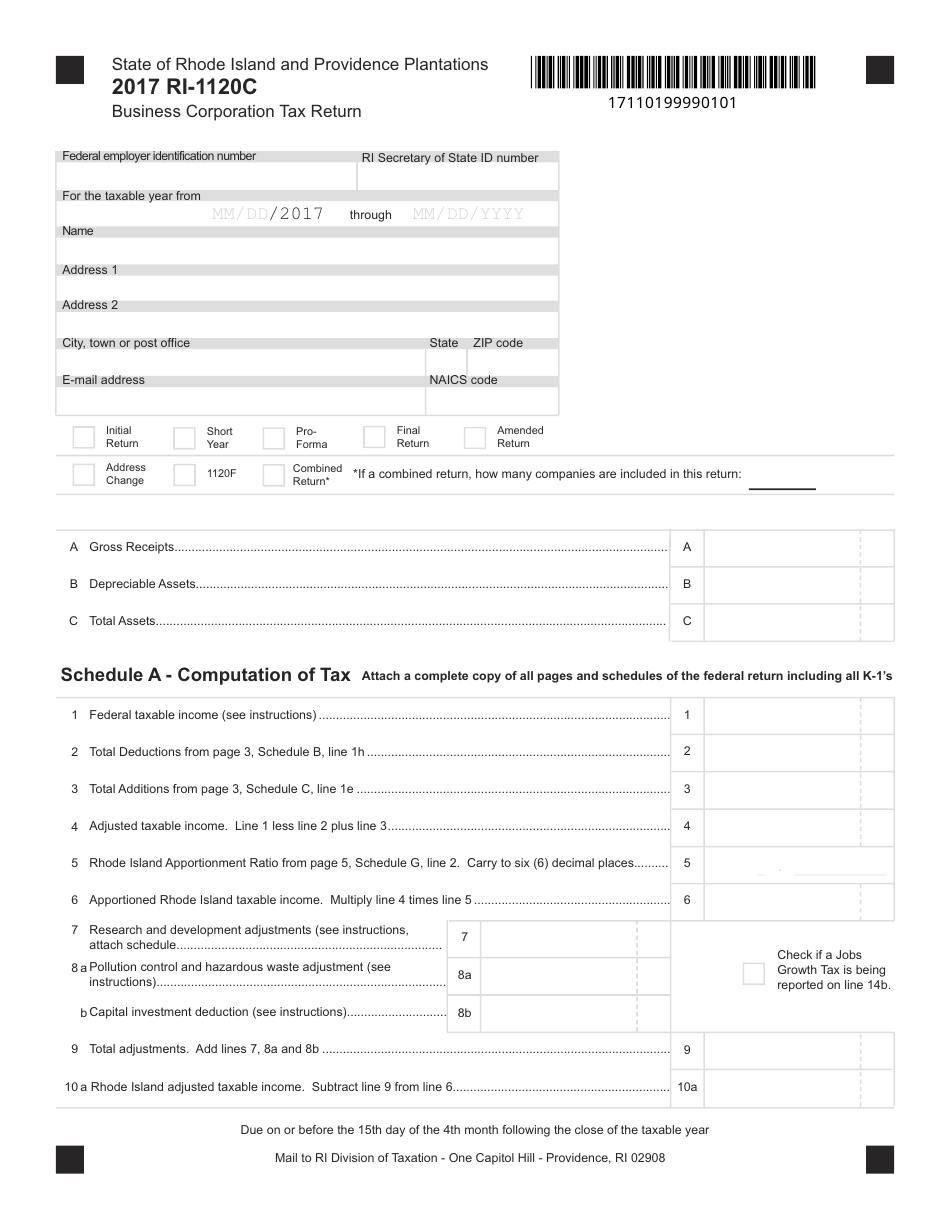

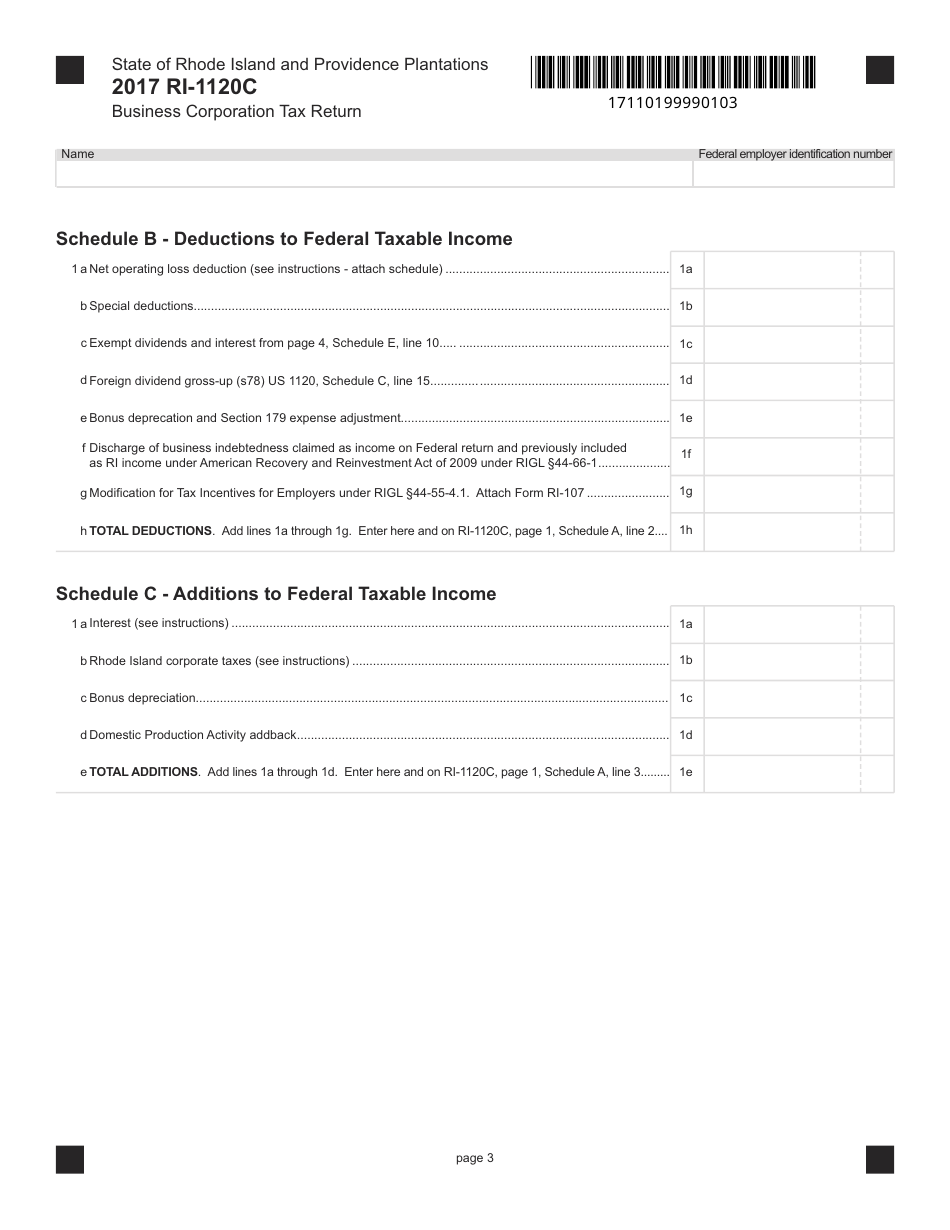

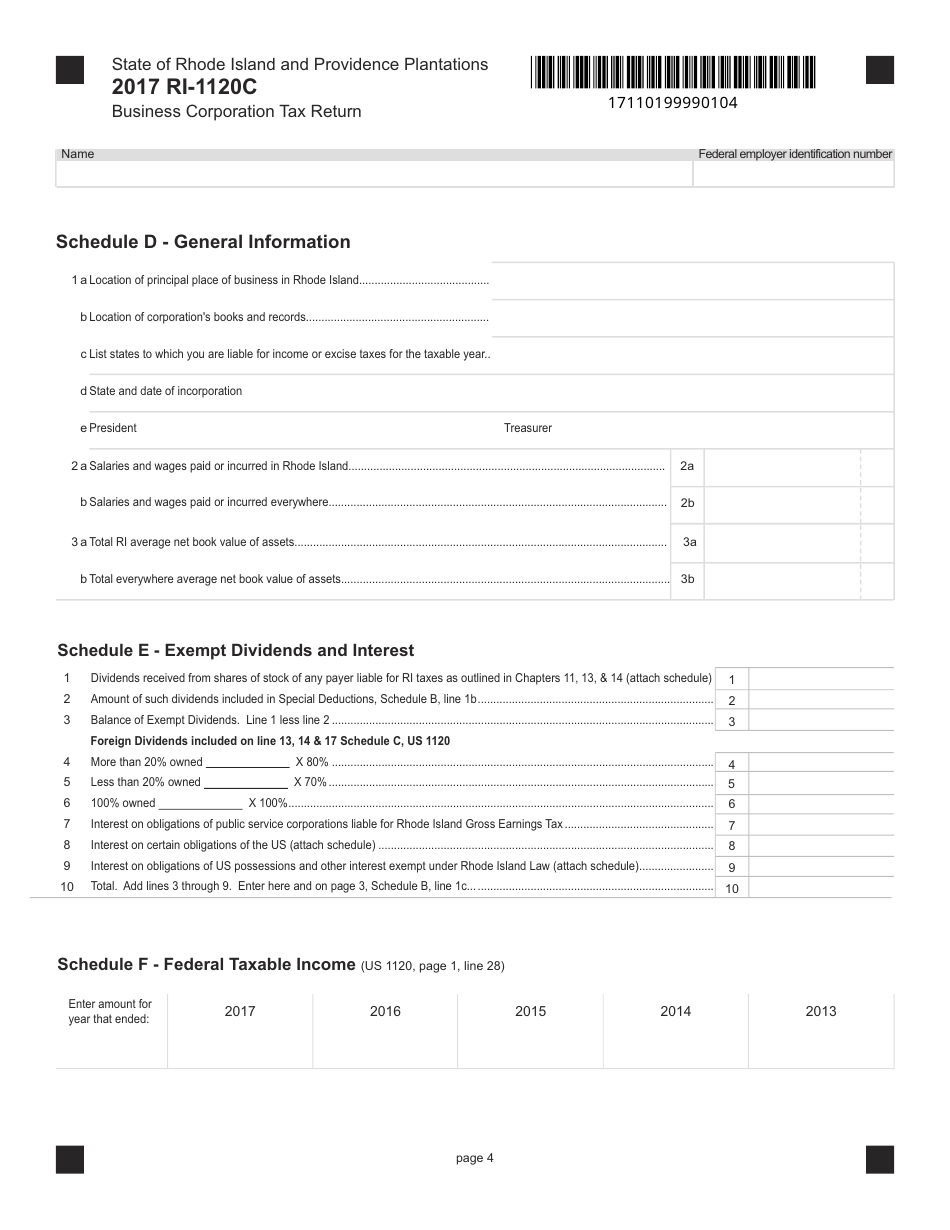

Q: What information is required on the Form RI-1120C?

A: The form requires information about the corporation's income, deductions, credits, and other tax-related details.

Q: When is the deadline to file the Form RI-1120C?

A: The deadline to file the Form RI-1120C is typically on or before the 15th day of the 4th month following the close of the corporation's tax year.

Q: Are there any penalties for not filing the Form RI-1120C?

A: Yes, if the Form RI-1120C is not filed or is filed late, the corporation may be subject to penalties and interest.

Q: Is there a separate form for federal corporate tax return?

A: Yes, the Form RI-1120C is specific to Rhode Island state taxes. A separate federal corporate tax return form, such as the Form 1120, should also be filed with the IRS.

Q: Are there any other related forms or schedules that need to be filed with the Form RI-1120C?

A: Yes, depending on the corporation's specific circumstances, additional forms or schedules may need to be filed along with the Form RI-1120C.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-1120C by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.