This version of the form is not currently in use and is provided for reference only. Download this version of

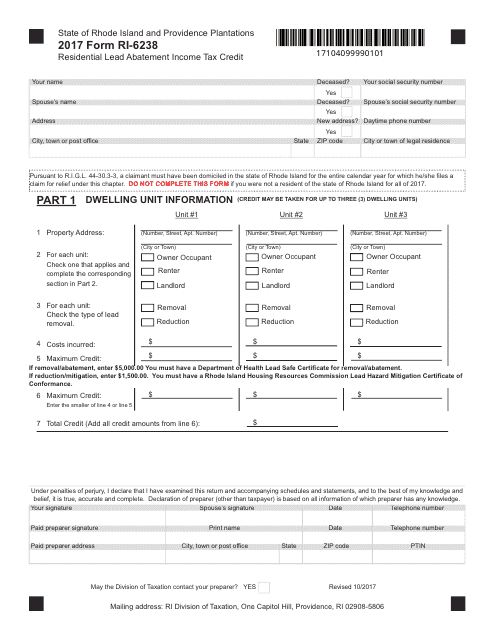

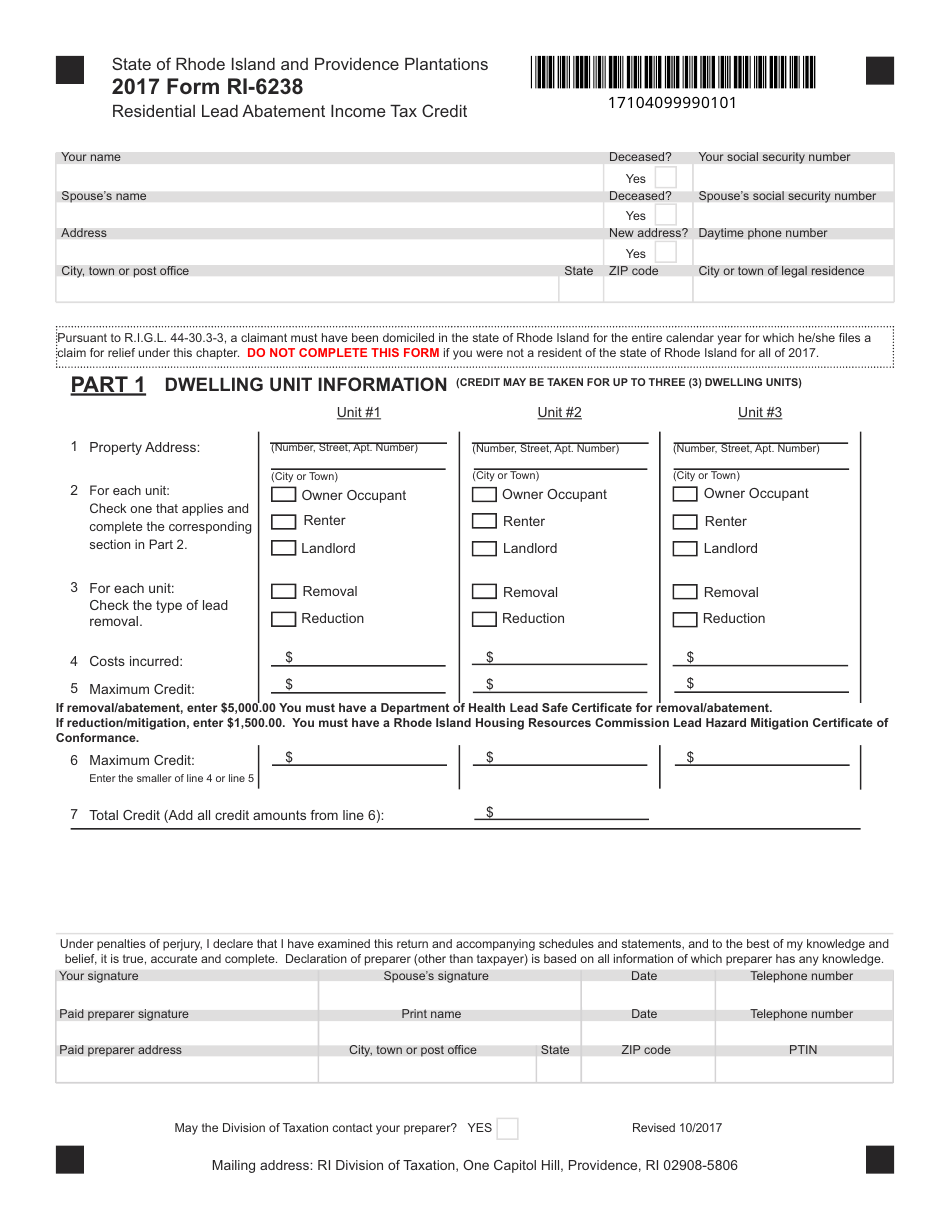

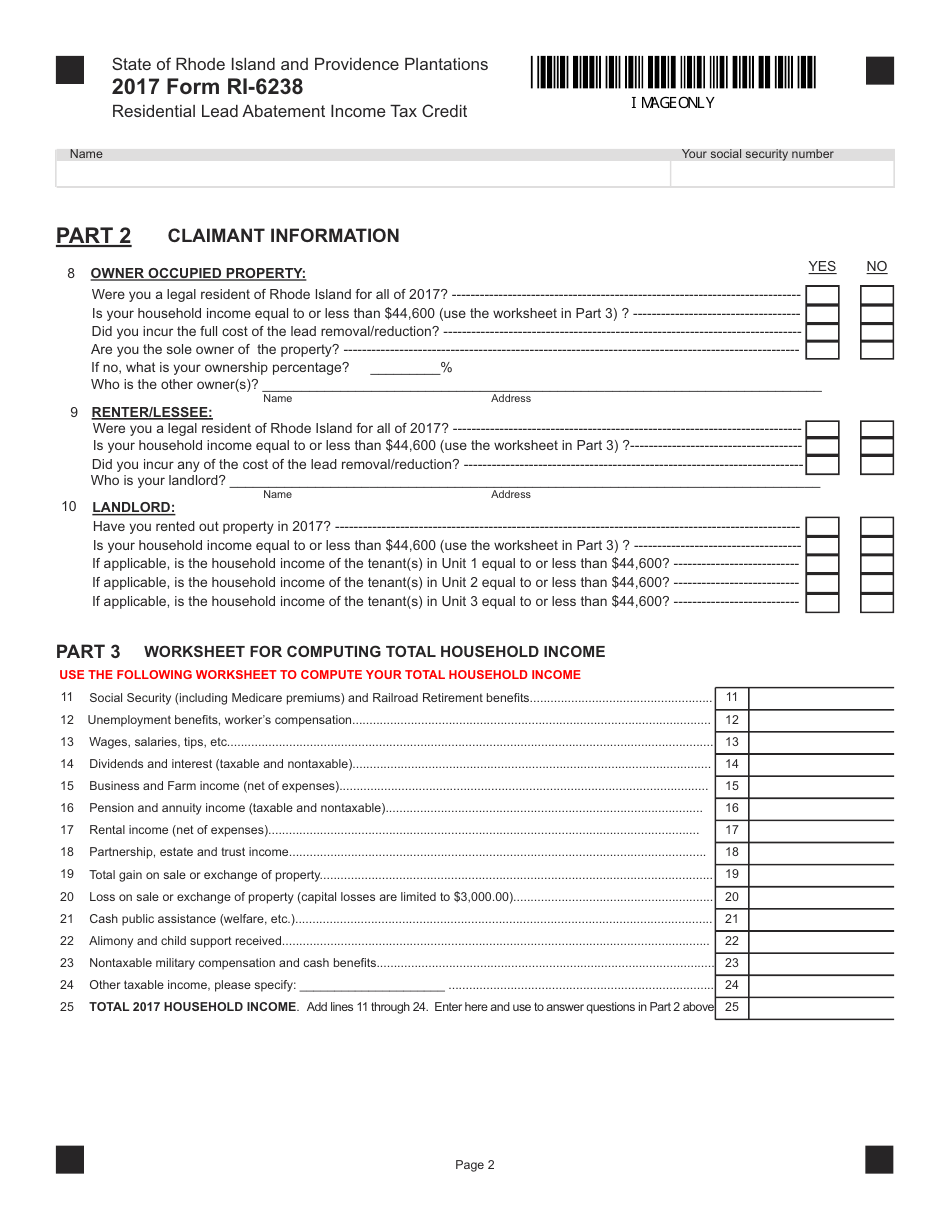

Form RI-6238

for the current year.

Form RI-6238 Residential Lead Abatement Income Tax Credit - Rhode Island

What Is Form RI-6238?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RI-6238?

A: Form RI-6238 is the application form for the Residential Lead AbatementIncome Tax Credit in Rhode Island.

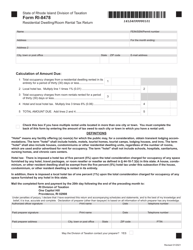

Q: What is the Residential Lead Abatement Income Tax Credit?

A: The Residential Lead Abatement Income Tax Credit is a tax credit available to Rhode Island residents who have completed lead abatement activities in their residential property.

Q: Who is eligible for the Residential Lead Abatement Income Tax Credit?

A: Rhode Island residents who have completed lead abatement activities in their residential property are eligible for the tax credit.

Q: How much is the Residential Lead Abatement Income Tax Credit?

A: The amount of the tax credit is based on the cost of the lead abatement activities, up to a maximum of $10,000.

Q: How do I apply for the Residential Lead Abatement Income Tax Credit?

A: To apply for the tax credit, you need to complete Form RI-6238 and submit it to the Rhode Island Division of Taxation.

Q: Is there a deadline to apply for the Residential Lead Abatement Income Tax Credit?

A: Yes, the application must be submitted within 3 years from the date the lead abatement activities were completed.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-6238 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.