This version of the form is not currently in use and is provided for reference only. Download this version of

Form RI-1120S

for the current year.

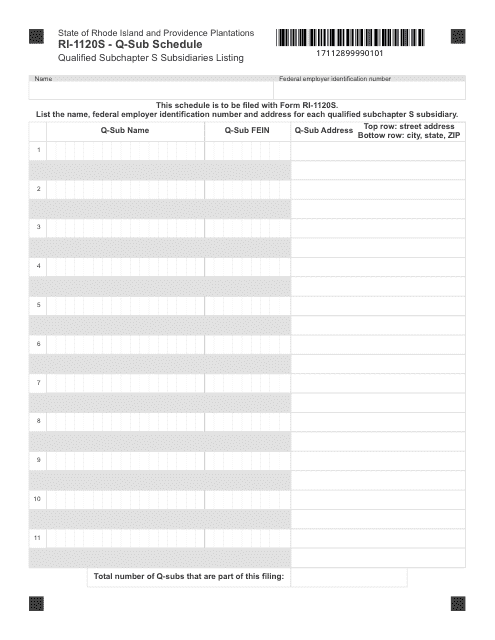

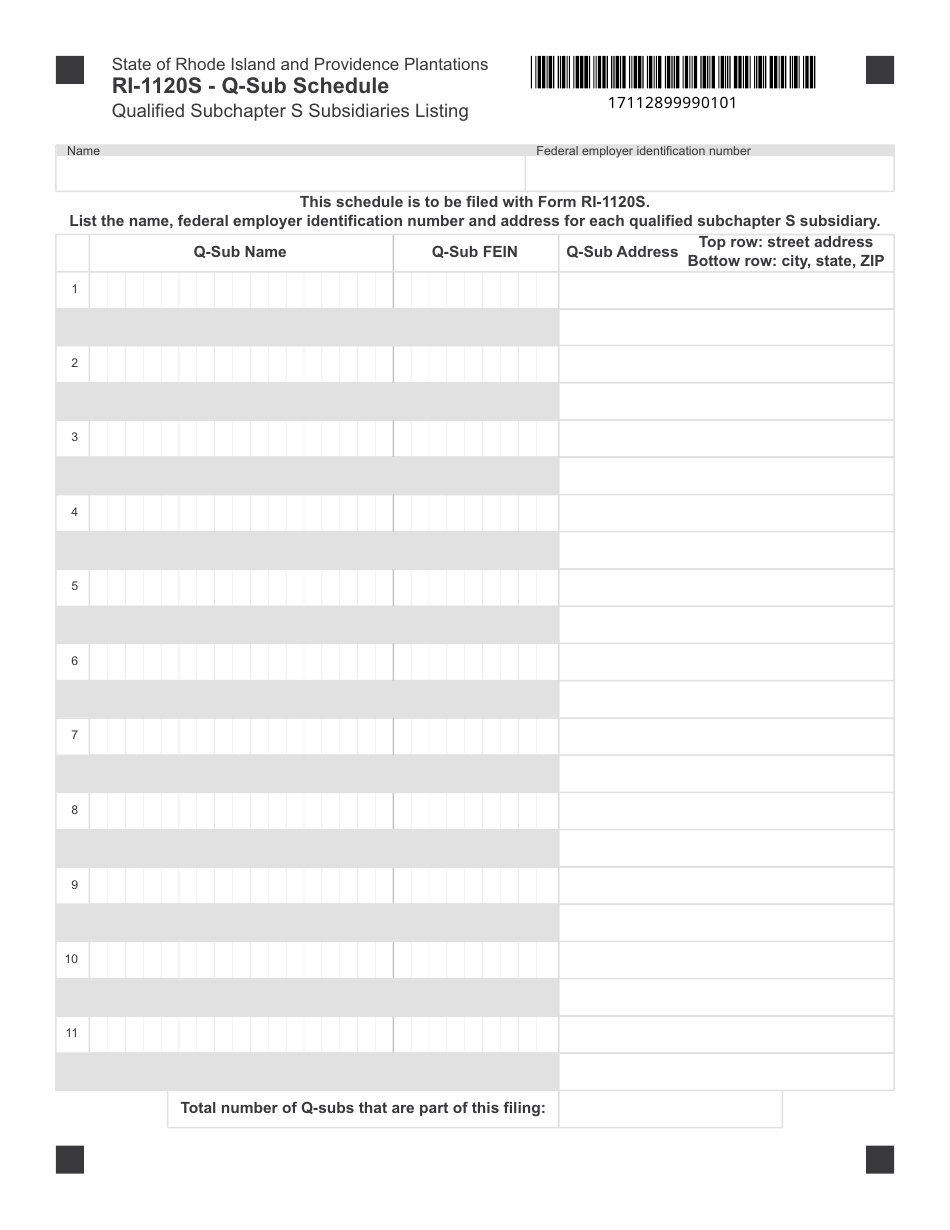

Form RI-1120S Q-Sub Schedule - Qualified Subchapter S Subsidiaries Listing - Rhode Island

What Is Form RI-1120S?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RI-1120S Q-Sub Schedule?

A: Form RI-1120S Q-Sub Schedule is a tax form used in Rhode Island to report information about Qualified Subchapter S Subsidiaries (Q-Subs).

Q: What are Qualified Subchapter S Subsidiaries (Q-Subs)?

A: Qualified Subchapter S Subsidiaries (Q-Subs) are subsidiaries of an S Corporation that elect to be treated as part of the parent S Corporation for federal income tax purposes.

Q: Why do I need to fill out the Q-Sub Schedule in Rhode Island?

A: You need to fill out the Q-Sub Schedule in Rhode Island to report information about any Q-Subs you have if you are an S Corporation.

Q: What information do I need to provide on the Q-Sub Schedule form?

A: On the Q-Sub Schedule form, you will need to provide details about each Q-Sub, including their name, federal employer identification number (EIN), and relationship to the parent S Corporation.

Q: Do I need to file the Q-Sub Schedule every year?

A: Yes, if you have Q-Subs and are an S Corporation, you will need to file the Q-Sub Schedule every year as part of your Rhode Island tax return.

Q: Are there any specific requirements or regulations for Q-Subs in Rhode Island?

A: Yes, Rhode Island has specific regulations regarding Q-Subs, including eligibility requirements and reporting obligations. It is advisable to consult with a tax professional or refer to the state's tax laws for more information.

Q: Are there any deadlines for filing the Q-Sub Schedule in Rhode Island?

A: The deadline for filing the Q-Sub Schedule in Rhode Island is the same as the deadline for filing your S Corporation tax return, which is typically April 15th. However, it is recommended to check for any updates or extensions issued by the state's tax authorities.

Q: What should I do if I have questions or need assistance with the Q-Sub Schedule in Rhode Island?

A: If you have questions or need assistance with the Q-Sub Schedule in Rhode Island, you can contact the Rhode Island Division of Taxation or seek guidance from a tax professional.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-1120S by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.