This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

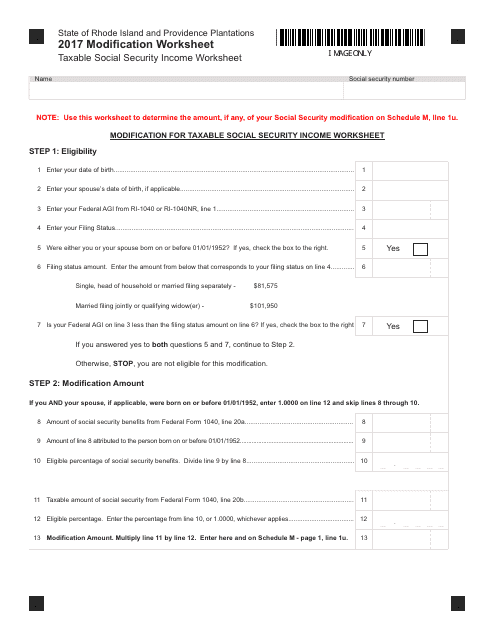

Modification Worksheet - Taxable Social Security Income Worksheet - Rhode Island

Modification Worksheet - Taxable Social Security Income Worksheet is a legal document that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island.

FAQ

Q: What is the Modification Worksheet?

A: The Modification Worksheet is a form used to calculate changes or modifications to your taxable income.

Q: What is the Taxable Social Security Income Worksheet?

A: The Taxable Social Security Income Worksheet is a specific worksheet used to determine the taxable portion of your Social Security income.

Q: How is the Modification Worksheet used?

A: The Modification Worksheet is used to make adjustments to your taxable income, such as deductions or credits.

Q: Why would someone use the Taxable Social Security Income Worksheet?

A: The Taxable Social Security Income Worksheet is used to determine how much of your Social Security benefits are subject to federal income tax.

Q: Is the Taxable Social Security Income Worksheet specific to Rhode Island?

A: No, the Taxable Social Security Income Worksheet is not specific to Rhode Island. It is a federal form used by all states.

Q: Can the Modification Worksheet and Taxable Social Security Income Worksheet affect my tax liability?

A: Yes, these worksheets can have an impact on your tax liability by either reducing or increasing your taxable income.

Q: Should I consult a tax professional when using the Modification Worksheet or Taxable Social Security Income Worksheet?

A: If you have any doubts or concerns about using these worksheets, it is always recommended to consult a tax professional for guidance.

Q: Are there any specific rules or guidelines to follow when using these worksheets?

A: Yes, there are specific rules and guidelines outlined in the instructions for these worksheets. It is important to carefully follow these instructions to ensure accurate calculations.

Form Details:

- The latest edition currently provided by the Rhode Island Department of Revenue - Division of Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.