This version of the form is not currently in use and is provided for reference only. Download this version of

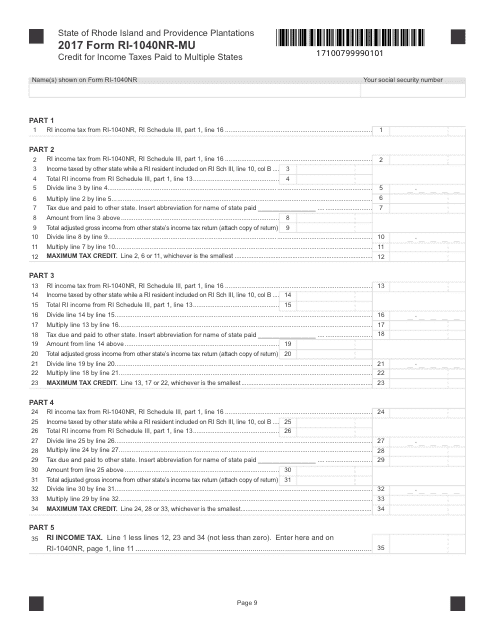

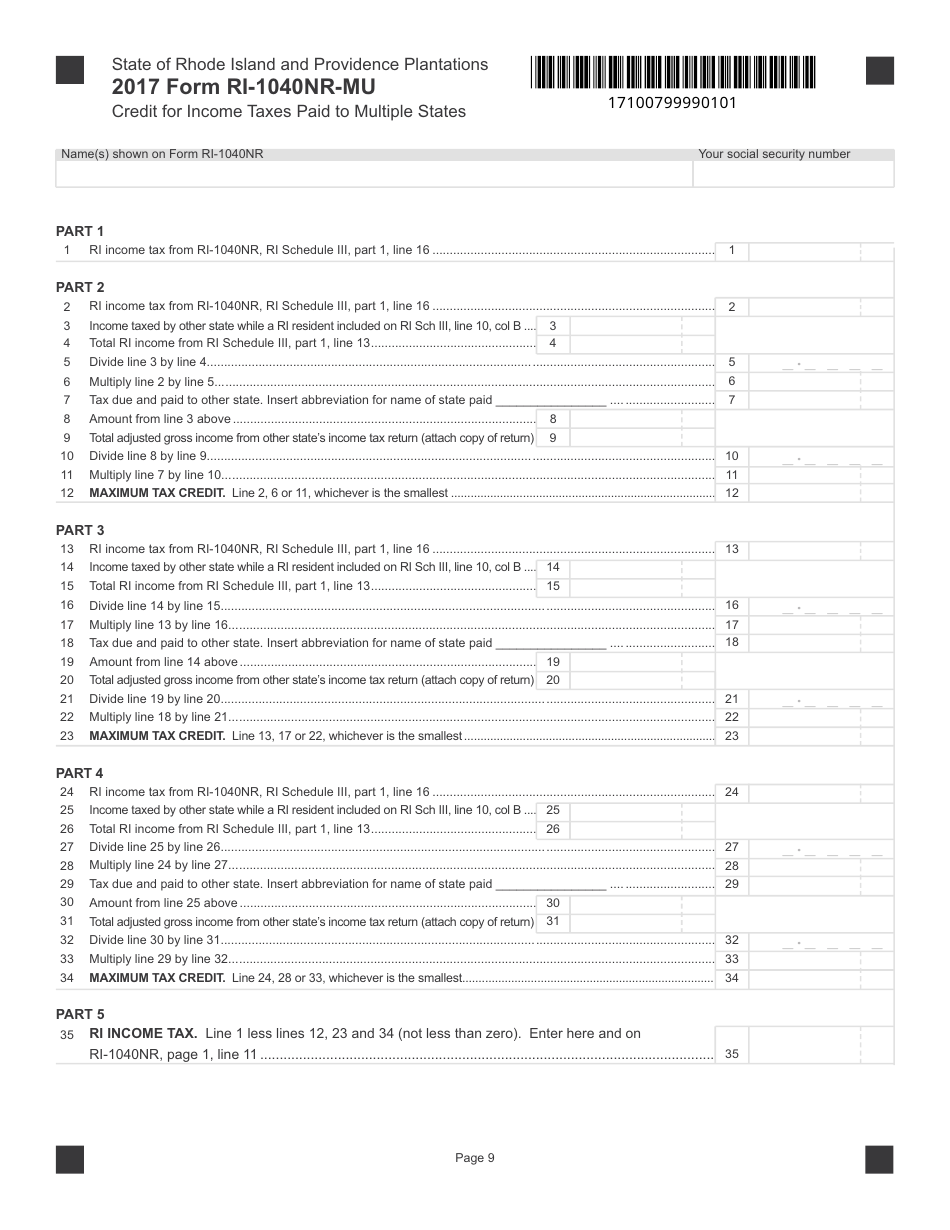

Form RI-1040NR-MU

for the current year.

Form RI-1040NR-MU Credit for Income Taxes Paid to Multiple States - Rhode Island

What Is Form RI-1040NR-MU?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form RI-1040NR-MU?

A: The Form RI-1040NR-MU is the Rhode Island tax form for claiming credit for income taxes paid to multiple states.

Q: Who can use the Form RI-1040NR-MU?

A: The Form RI-1040NR-MU is for non-residents of Rhode Island who have income from multiple states and want to claim a credit for taxes paid to those states.

Q: What is the purpose of the Form RI-1040NR-MU?

A: The purpose of the Form RI-1040NR-MU is to calculate and claim a credit for income taxes paid to other states.

Q: When is the deadline to file the Form RI-1040NR-MU?

A: The deadline to file the Form RI-1040NR-MU is the same as the deadline for filing your Rhode Island income tax return, which is usually April 15th.

Q: Do I need to include supporting documents with the Form RI-1040NR-MU?

A: Yes, you will need to attach copies of your tax returns filed with the other states and any other supporting documents to substantiate the taxes paid to those states.

Q: Can I e-file the Form RI-1040NR-MU?

A: No, the Form RI-1040NR-MU cannot be e-filed. It must be filed by mail.

Q: Are there any special instructions for filling out the Form RI-1040NR-MU?

A: Yes, make sure to carefully read the instructions provided with the form to accurately fill it out and provide all the necessary information.

Q: What if I made a mistake on the Form RI-1040NR-MU?

A: If you made a mistake on the Form RI-1040NR-MU, you may need to file an amended return to correct the error. Consult the Rhode Island Division of Taxation for guidance.

Q: Is there a fee for filing the Form RI-1040NR-MU?

A: There is no fee for filing the Form RI-1040NR-MU. However, you may be required to pay taxes owed to Rhode Island based on your income and credit calculations.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-1040NR-MU by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.