This version of the form is not currently in use and is provided for reference only. Download this version of

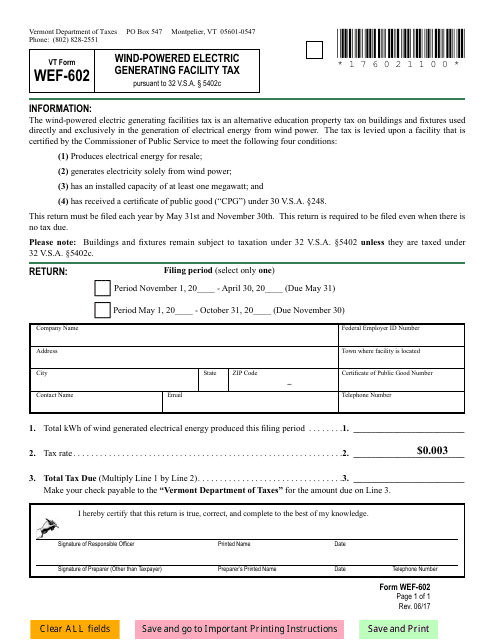

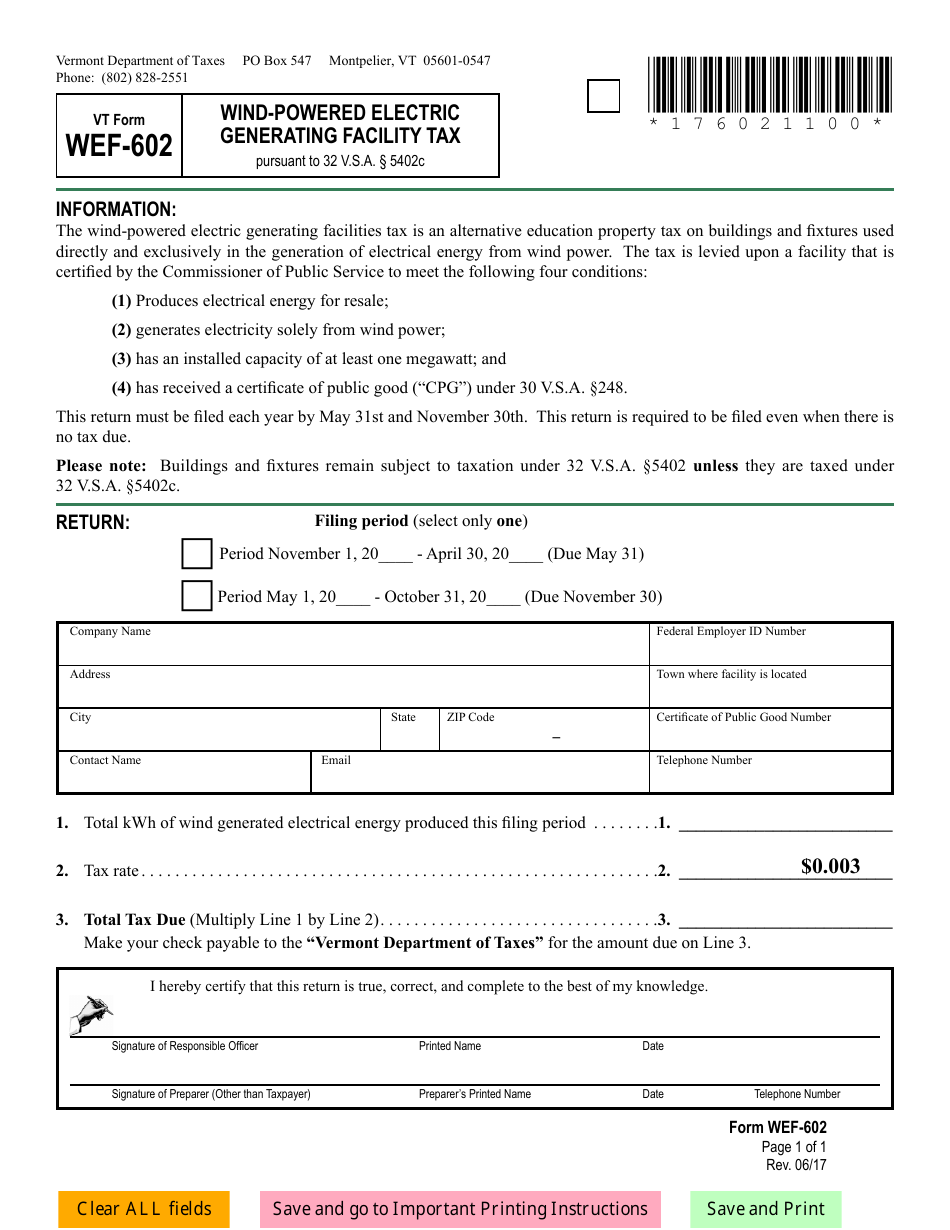

VT Form WEF-602

for the current year.

VT Form WEF-602 Wind-Powered Electric Generating Facility Tax - Vermont

What Is VT Form WEF-602?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a WEF-602 form?

A: The WEF-602 form is a tax form for wind-powered electric generating facilities in Vermont.

Q: Who needs to file the WEF-602 form?

A: Owners or operators of wind-powered electric generating facilities in Vermont need to file the WEF-602 form.

Q: What is the purpose of the WEF-602 form?

A: The WEF-602 form is used to report taxable kilowatt-hours generated by wind-powered electric generating facilities and calculate the tax owed in Vermont.

Q: How often do I need to file the WEF-602 form?

A: The WEF-602 form is filed annually.

Form Details:

- Released on June 1, 2017;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of VT Form WEF-602 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.