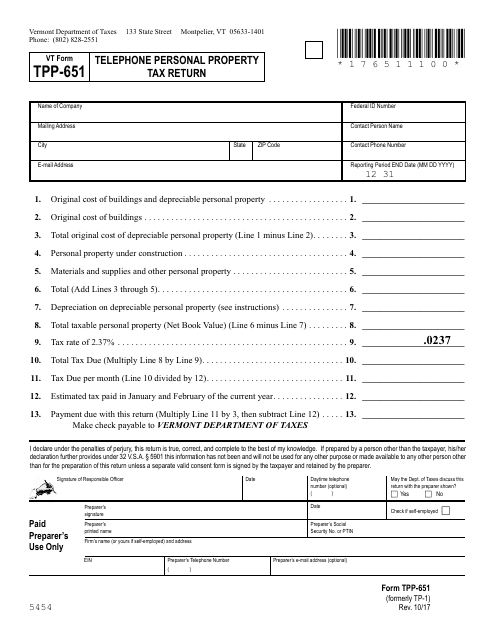

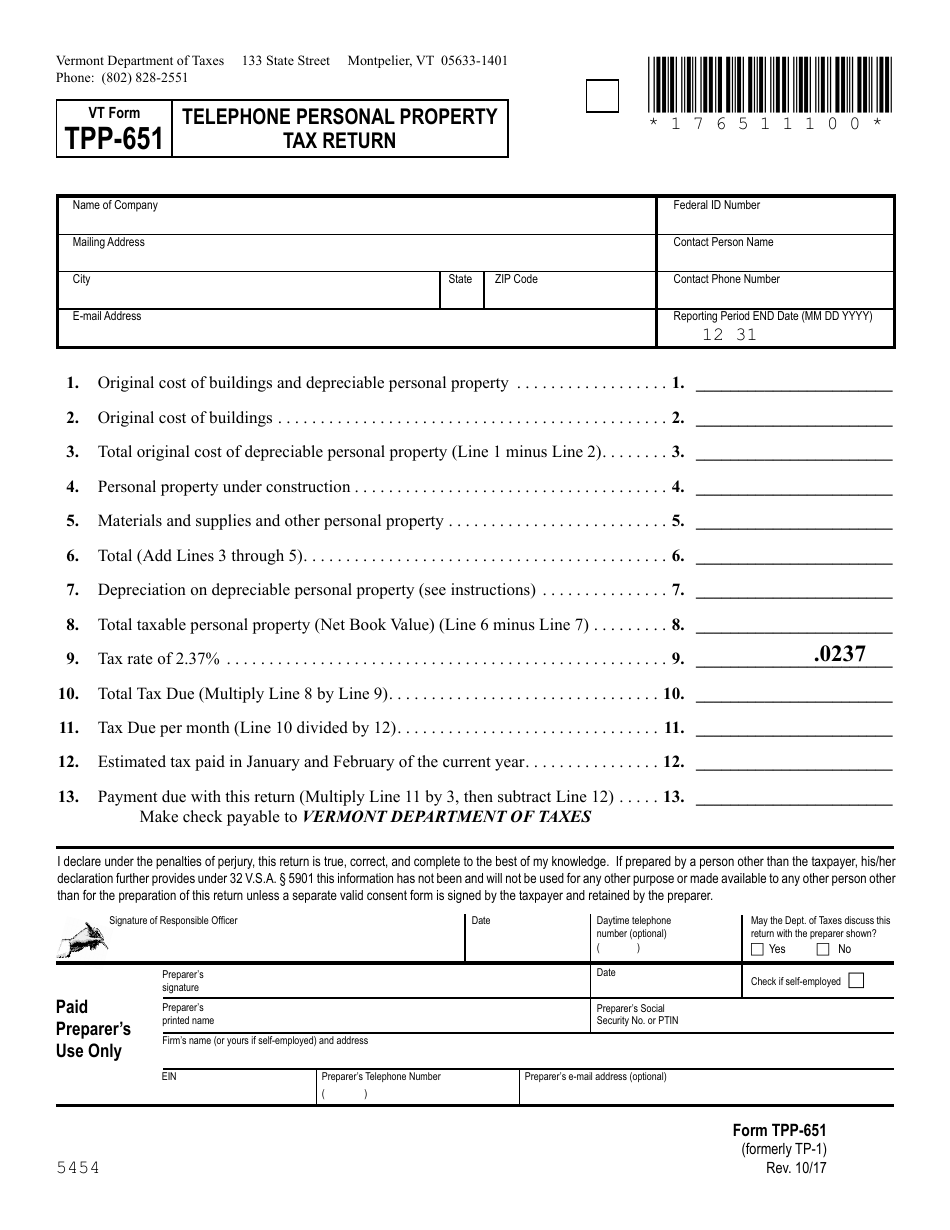

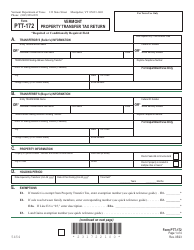

VT Form TPP-651 Telephone Personal Property Tax Return - Vermont

What Is VT Form TPP-651?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the VT Form TPP-651?

A: The VT Form TPP-651 is the Telephone Personal Property Tax Return for Vermont.

Q: What is a Telephone Personal Property Tax Return?

A: A Telephone Personal Property Tax Return is a form used to report and pay taxes on telephone equipment and infrastructure.

Q: Who needs to file the VT Form TPP-651?

A: Anyone who owns taxable telephone equipment and infrastructure in Vermont needs to file the VT Form TPP-651.

Q: What is considered taxable telephone equipment and infrastructure?

A: Taxable telephone equipment and infrastructure includes items such as telephones, telephone lines, switches, and other related equipment.

Q: When is the deadline to file the VT Form TPP-651?

A: The deadline to file the VT Form TPP-651 is determined by the Vermont Department of Taxes and is typically due annually.

Q: Are there any penalties for not filing the VT Form TPP-651?

A: Yes, there may be penalties for not filing the VT Form TPP-651, including late filing fees and potential tax assessments by the Vermont Department of Taxes.

Form Details:

- Released on October 1, 2017;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of VT Form TPP-651 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.