This version of the form is not currently in use and is provided for reference only. Download this version of

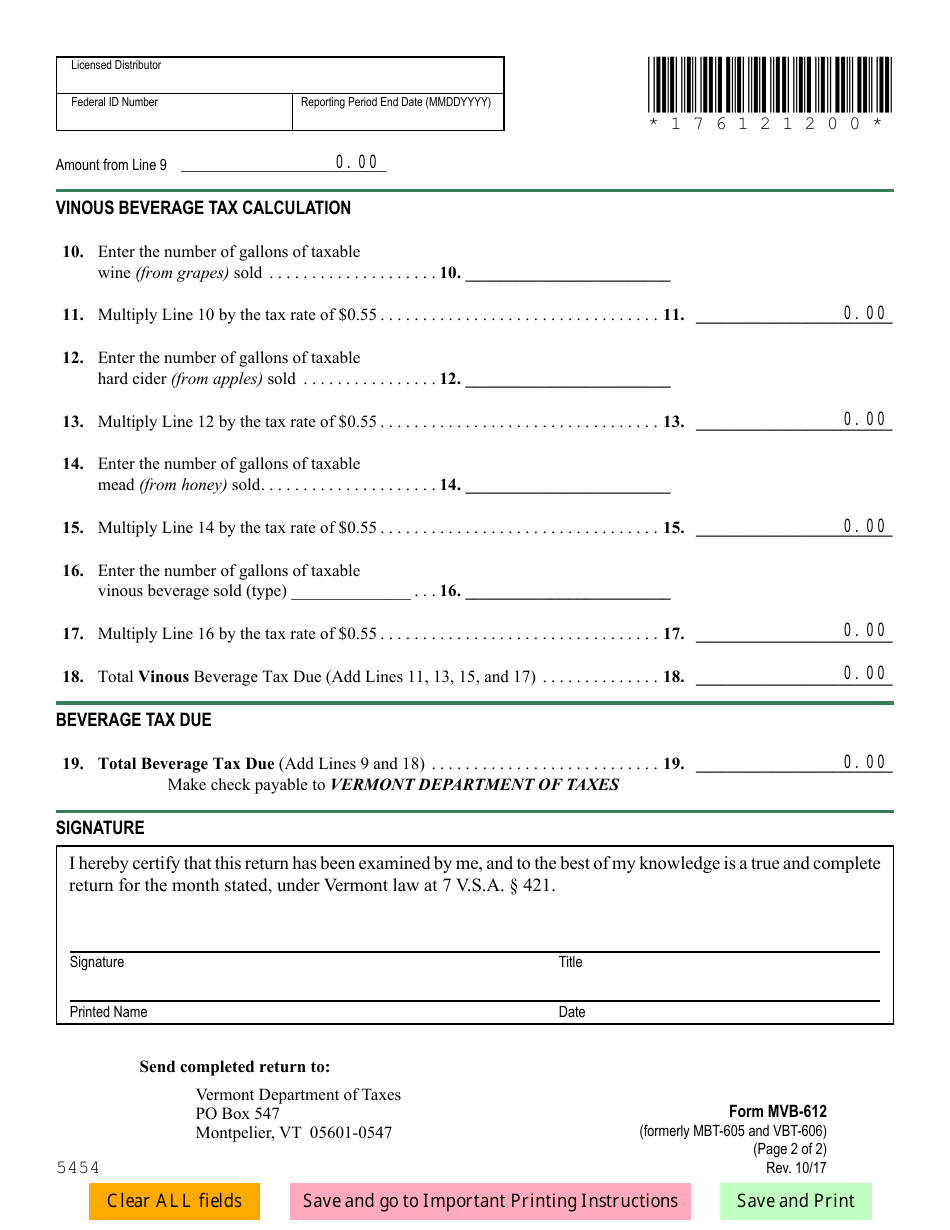

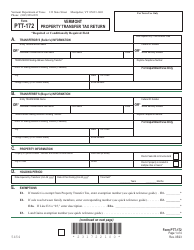

VT Form MVB-612

for the current year.

VT Form MVB-612 Malt and Vinous Beverage Tax Return - Vermont

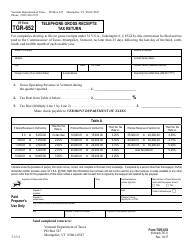

What Is VT Form MVB-612?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

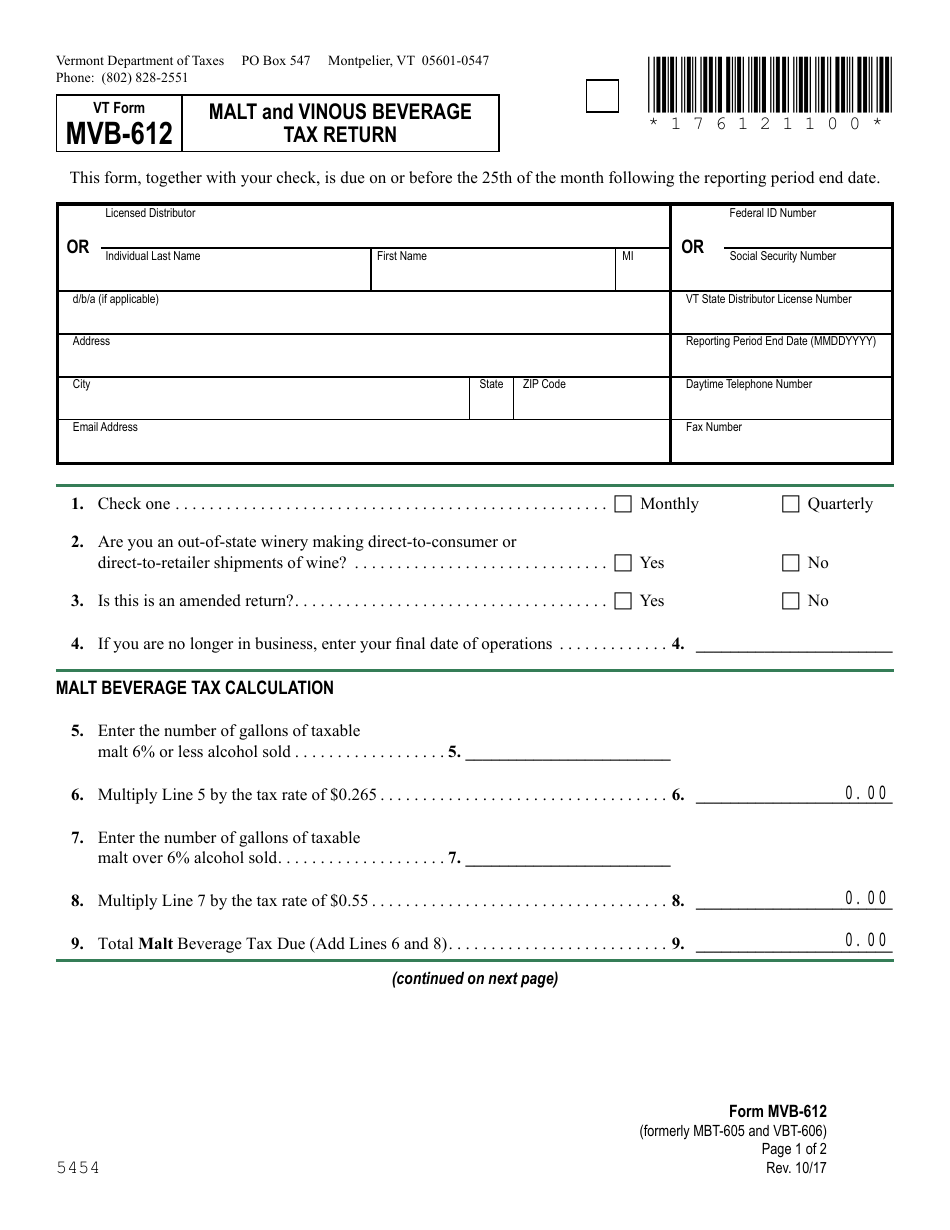

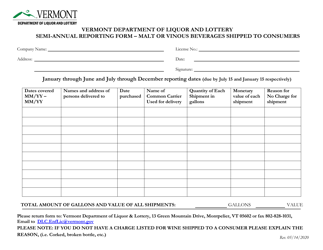

Q: What is Form MVB-612?

A: Form MVB-612 is the Malt and Vinous Beverage Tax Return form used in Vermont.

Q: Who needs to file Form MVB-612?

A: Any business in Vermont that sells malt or vinous beverages needs to file Form MVB-612.

Q: When is Form MVB-612 due?

A: Form MVB-612 is due on a quarterly basis, with the due dates falling on the 20th day of the month following the end of each quarter.

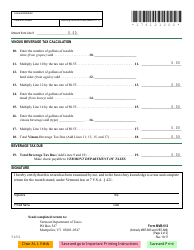

Q: What information is required on Form MVB-612?

A: Form MVB-612 requires the business to provide details about the sales of malt and vinous beverages, including quantities sold, sales amounts, and taxes due.

Q: Is there a penalty for late filing of Form MVB-612?

A: Yes, there are penalties for late filing of Form MVB-612, including interest charges and possible loss of license for non-compliance.

Q: Are there any exemptions or deductions available on Form MVB-612?

A: Yes, there are certain exemptions and deductions available on Form MVB-612, such as sales to out-of-state consumers and sales to government entities.

Q: What should I do if I have questions or need assistance with Form MVB-612?

A: If you have questions or need assistance with Form MVB-612, you can contact the Vermont Department of Taxes for guidance.

Form Details:

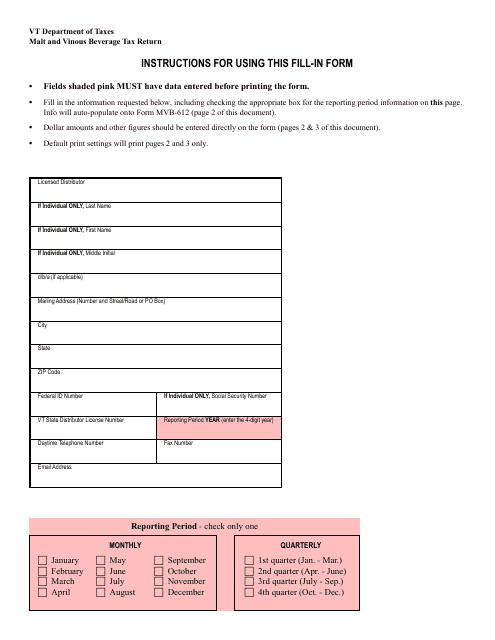

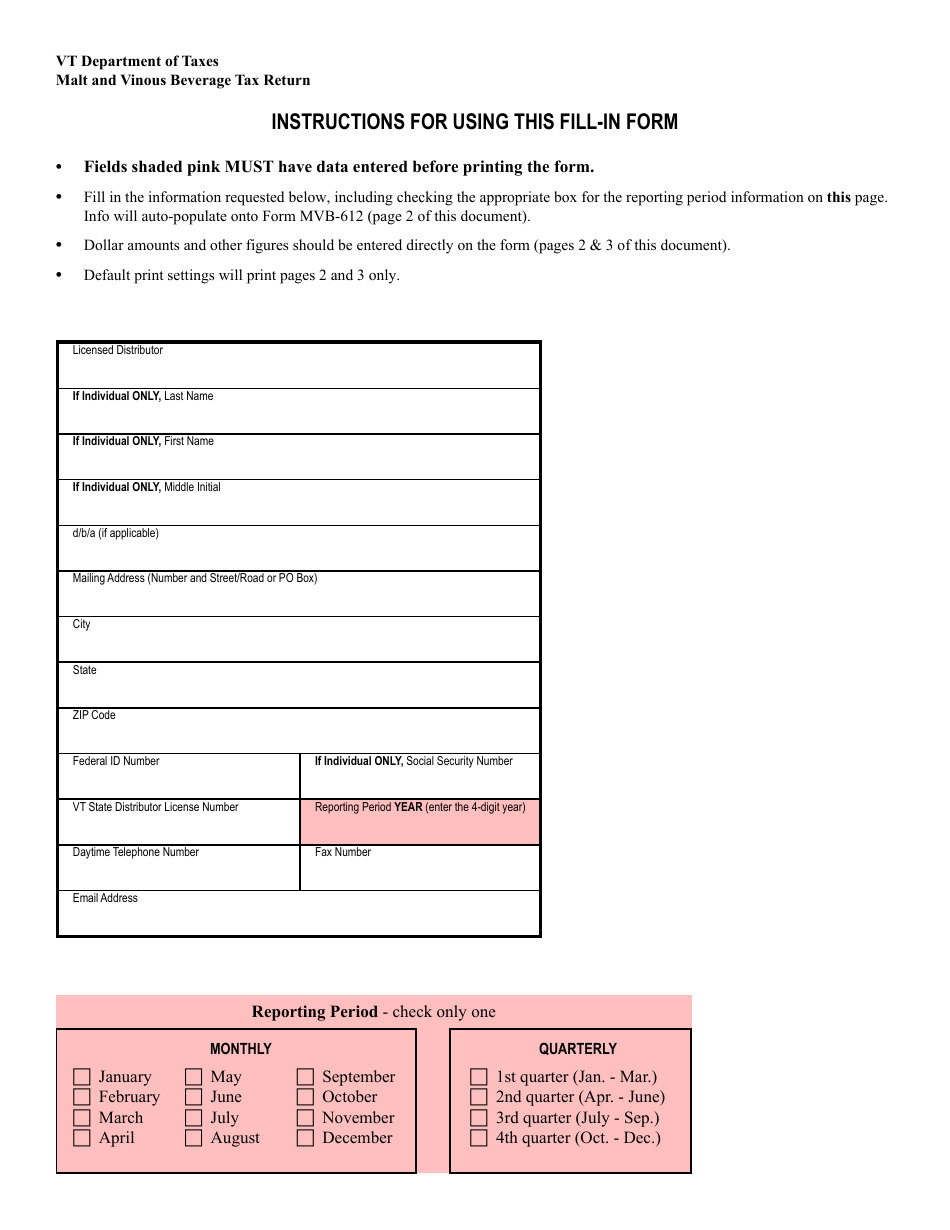

- Released on October 1, 2017;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of VT Form MVB-612 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.