This version of the form is not currently in use and is provided for reference only. Download this version of

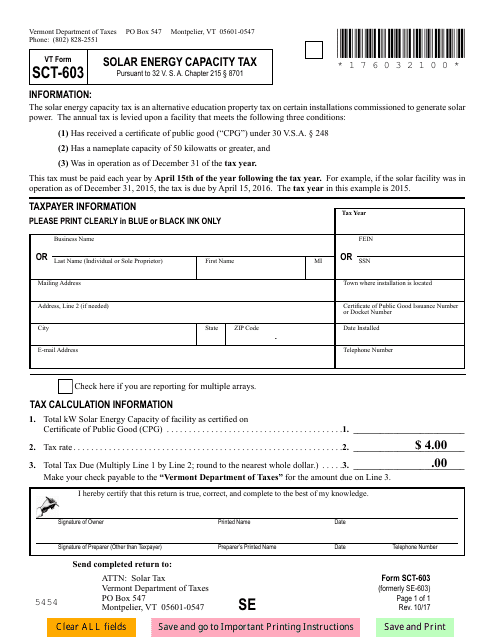

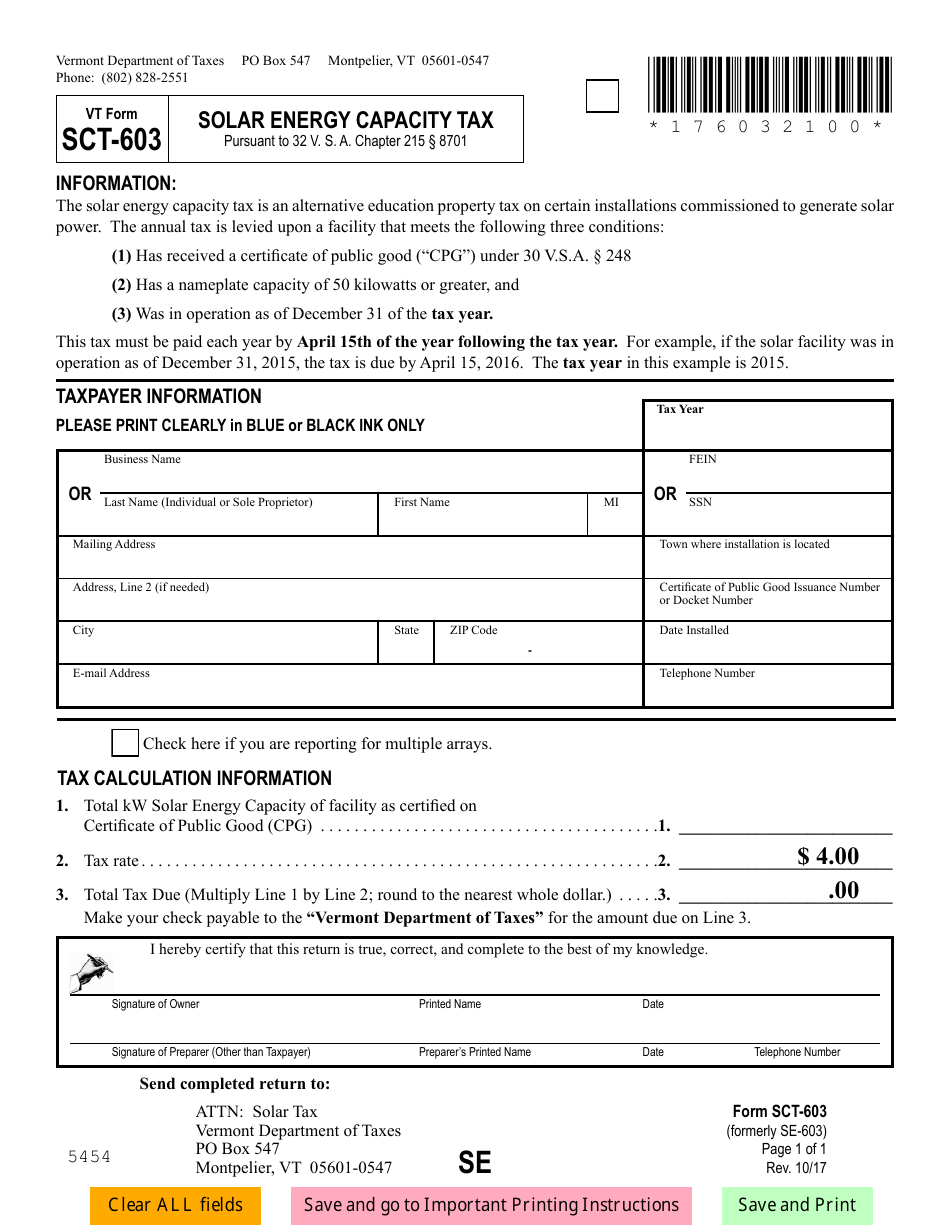

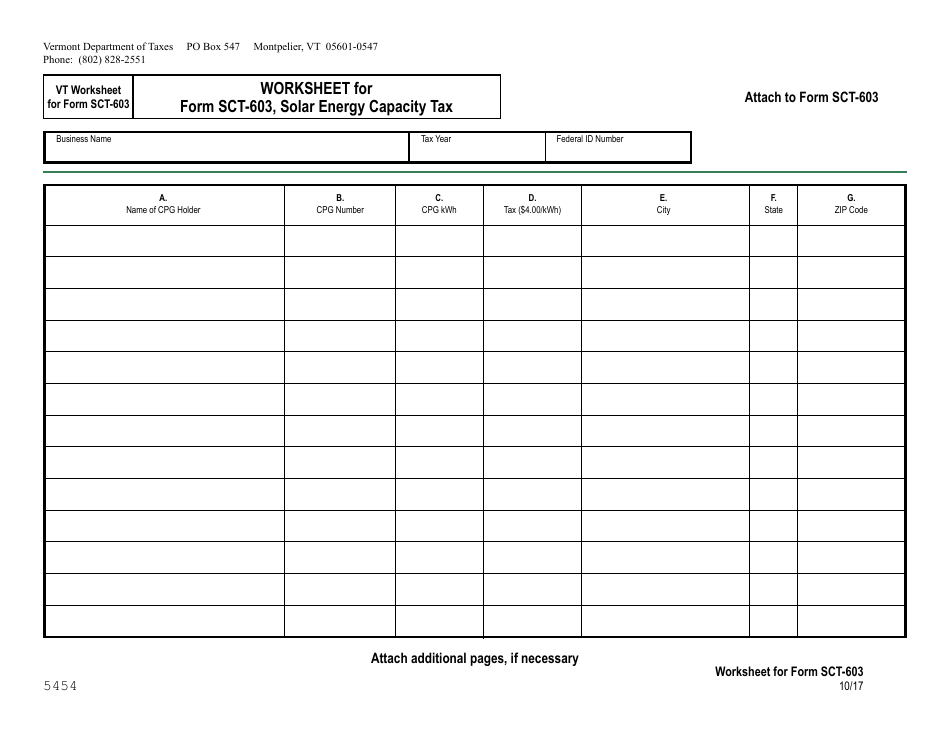

VT Form SCT-603

for the current year.

VT Form SCT-603 Solar Energy Capacity Tax - Vermont

What Is VT Form SCT-603?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the VT Form SCT-603?

A: The VT Form SCT-603 is the Solar Energy Capacity Tax form in Vermont.

Q: What is the purpose of VT Form SCT-603?

A: The purpose of VT Form SCT-603 is to report the solar energy capacity and calculate the associated tax.

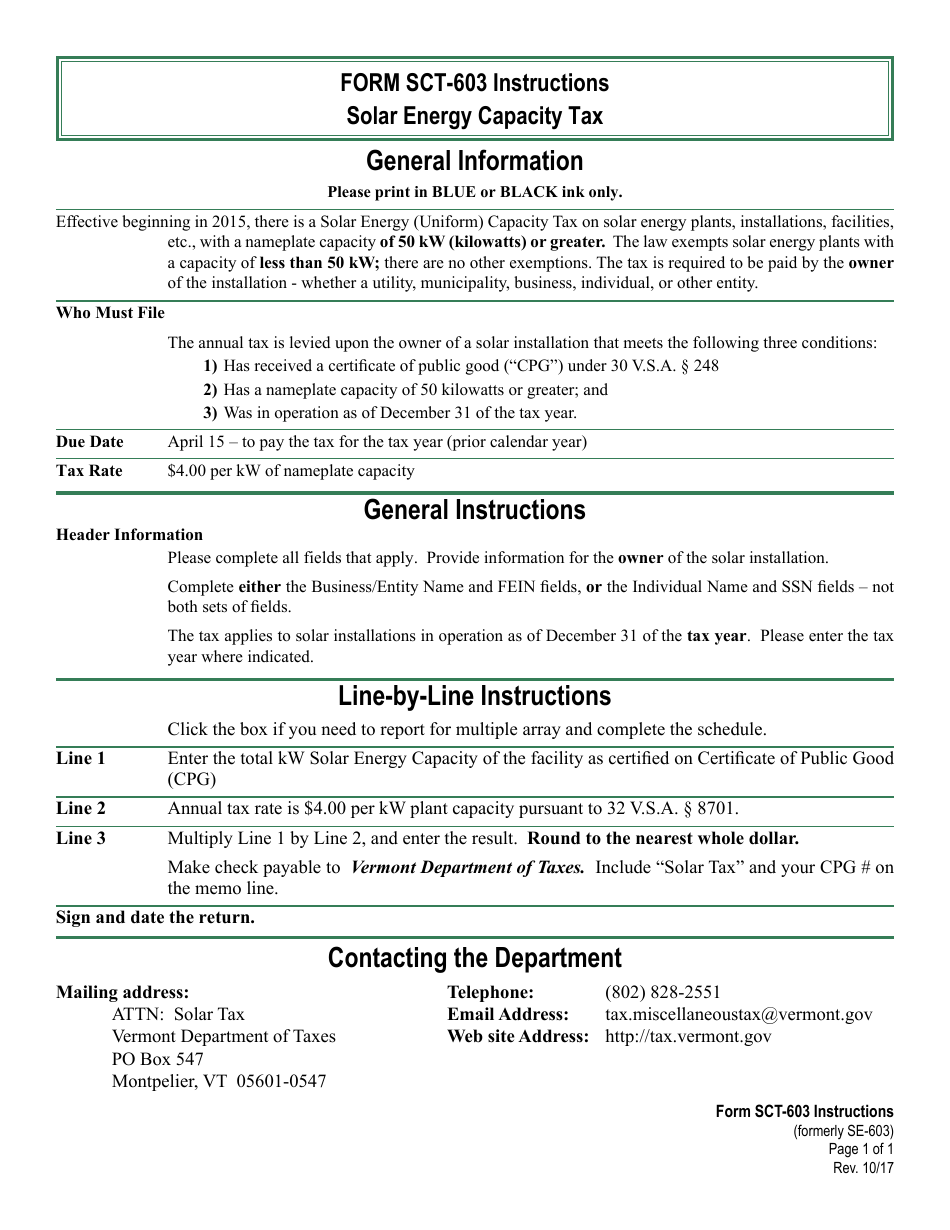

Q: Who needs to file VT Form SCT-603?

A: Anyone who owns or operates a solar energy system in Vermont and meets certain capacity thresholds is required to file VT Form SCT-603.

Q: When is the deadline for filing VT Form SCT-603?

A: The deadline for filing VT Form SCT-603 is typically April 15th of each year.

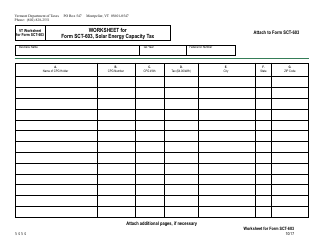

Q: What information is required to complete VT Form SCT-603?

A: To complete VT Form SCT-603, you will need to provide information about your solar energy system, including capacity, installation date, and any applicable incentives or credits.

Q: Is there a fee for filing VT Form SCT-603?

A: Yes, there is a fee associated with filing VT Form SCT-603. The fee amount depends on the capacity of your solar energy system.

Q: Are there any exemptions or credits available for the solar energy capacity tax?

A: Yes, there are exemptions and credits available for the solar energy capacity tax in Vermont. These exemptions and credits vary depending on the specific circumstances of your solar energy system.

Q: What happens if I fail to file VT Form SCT-603?

A: Failure to file VT Form SCT-603 or pay the associated tax can result in penalties and interest charges.

Form Details:

- Released on October 1, 2017;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of VT Form SCT-603 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.