This version of the form is not currently in use and is provided for reference only. Download this version of

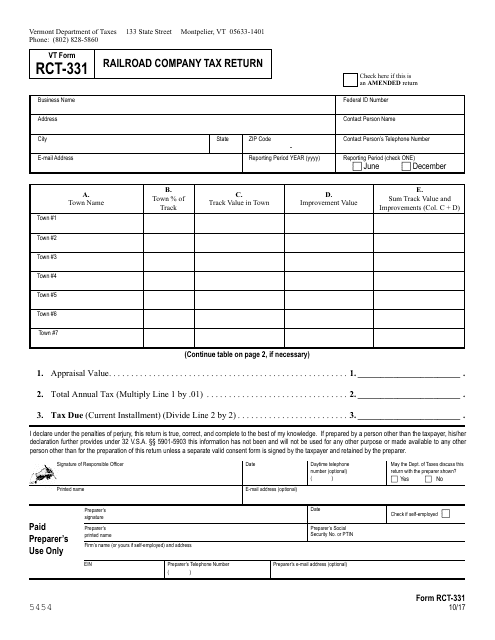

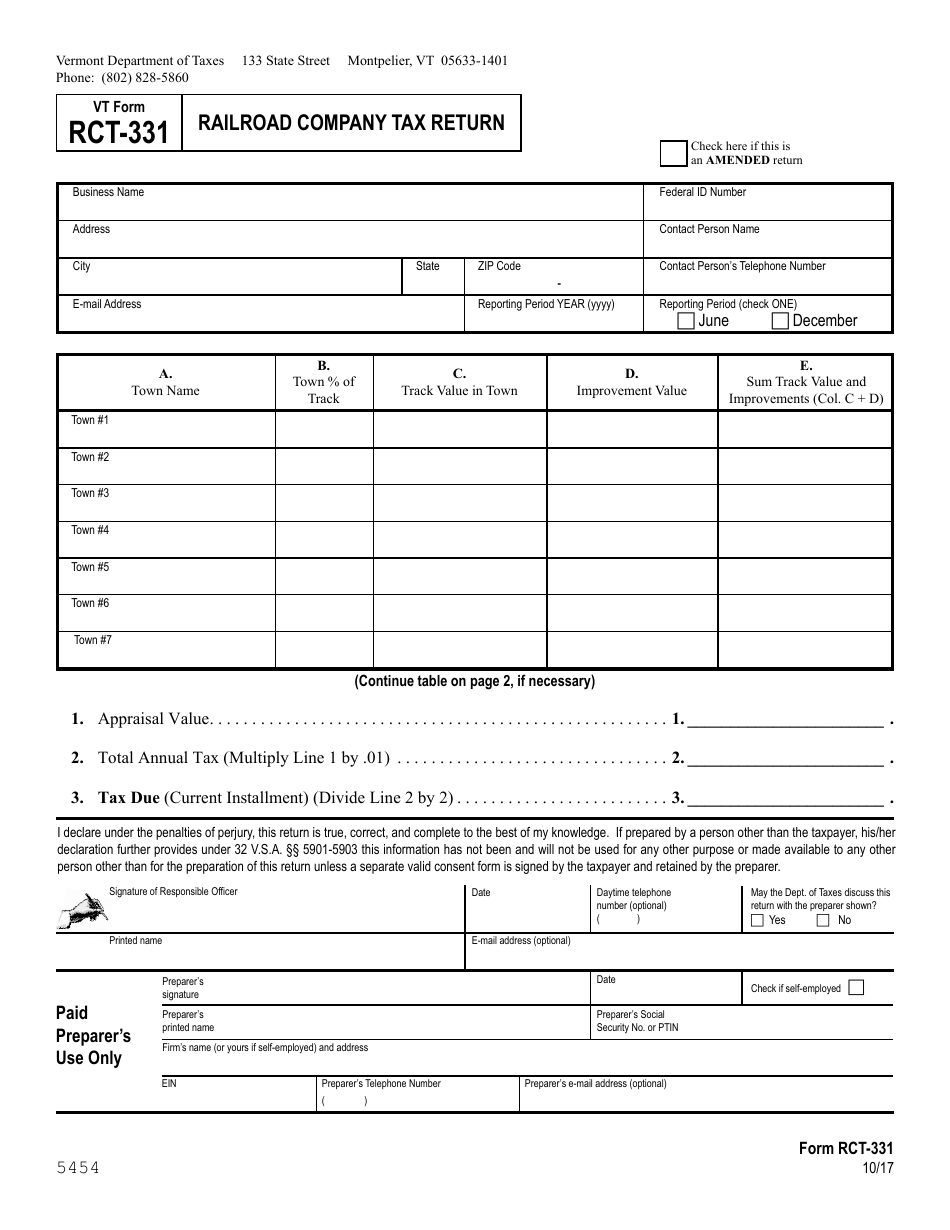

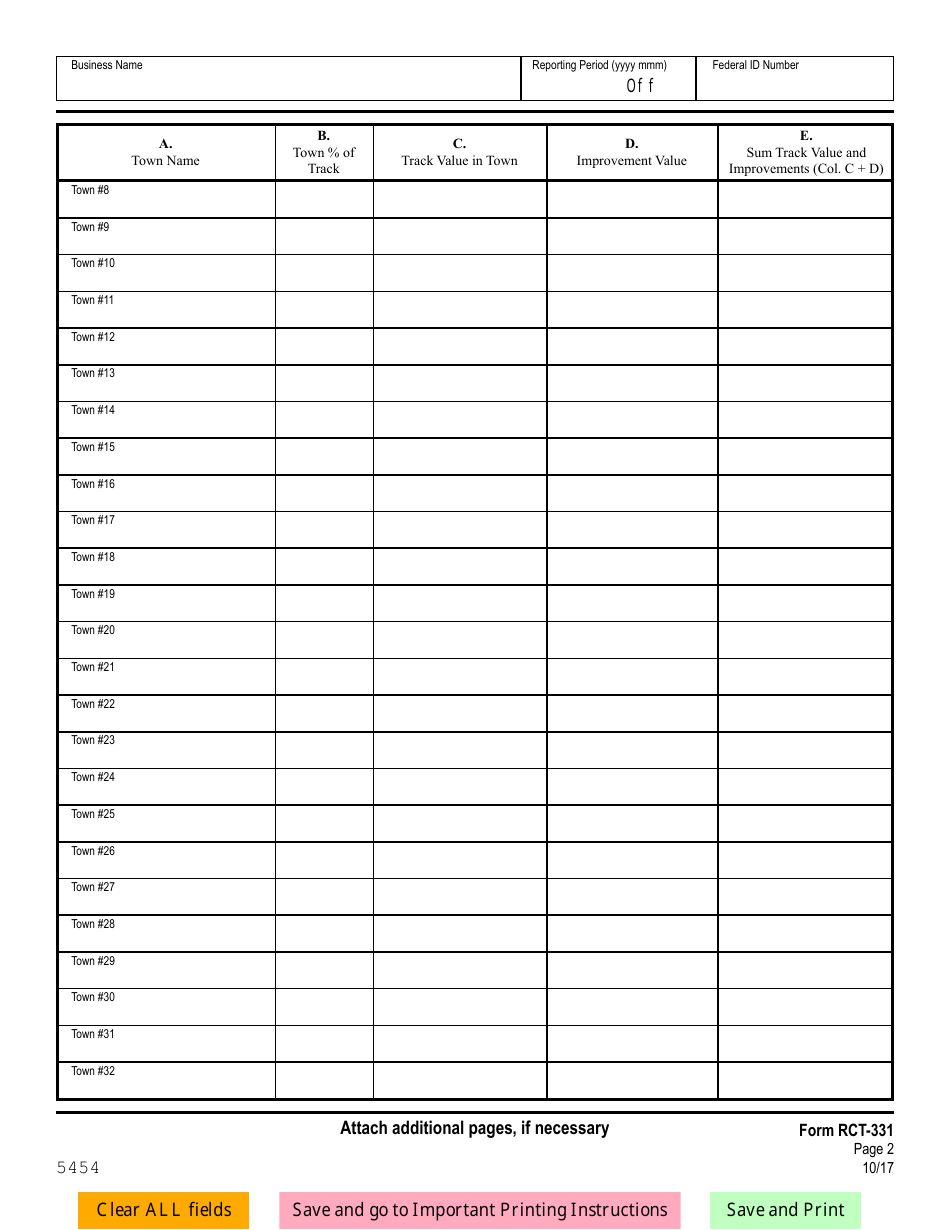

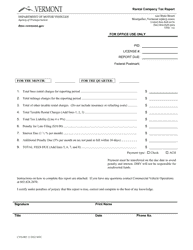

VT Form RCT-331

for the current year.

VT Form RCT-331 Railroad Company Tax Return - Vermont

What Is VT Form RCT-331?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RCT-331?

A: Form RCT-331 is the Railroad Company Tax Return specifically designed for filing taxes in the state of Vermont.

Q: Who needs to file Form RCT-331?

A: Railroad companies operating in Vermont are required to file Form RCT-331.

Q: What is the purpose of Form RCT-331?

A: The purpose of Form RCT-331 is to report and pay the applicable taxes owed by railroad companies in Vermont.

Q: What information is required to complete Form RCT-331?

A: Form RCT-331 requires information such as gross receipts, property valuation, and deductions related to the operation of railroad services in Vermont.

Q: When is the deadline for filing Form RCT-331?

A: The deadline for filing Form RCT-331 is typically on or before April 15th of each year, or the following business day if it falls on a weekend or holiday.

Q: Are there any penalties for late filing of Form RCT-331?

A: Yes, there may be penalties for late filing or failure to file Form RCT-331, including potential interest charges on the unpaid taxes.

Form Details:

- Released on October 1, 2017;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of VT Form RCT-331 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.