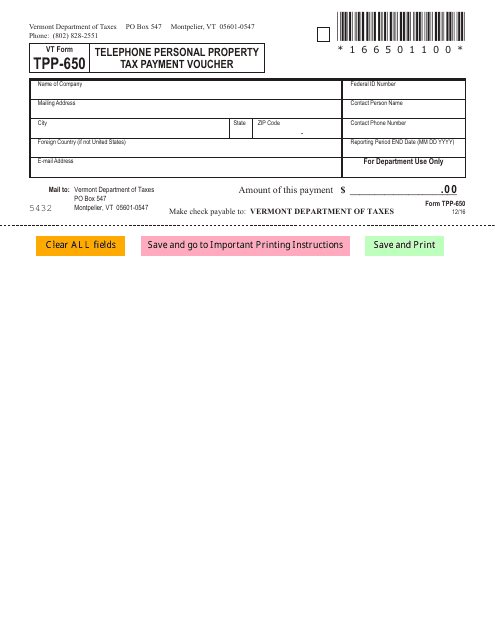

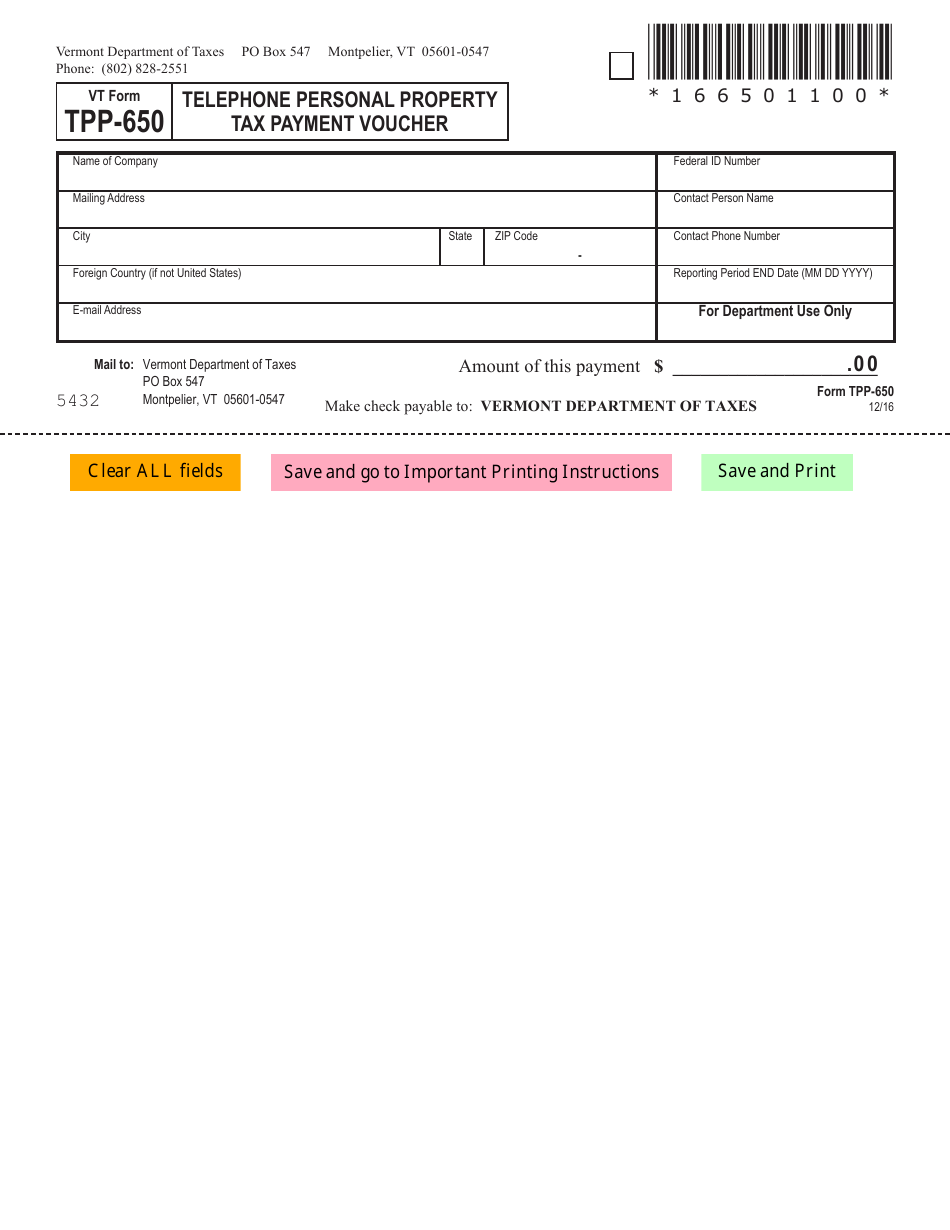

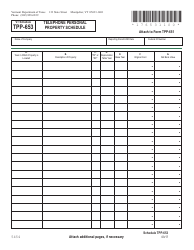

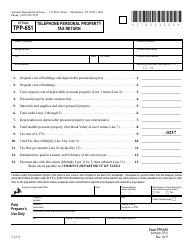

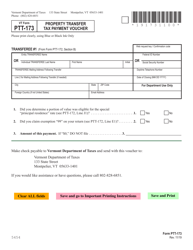

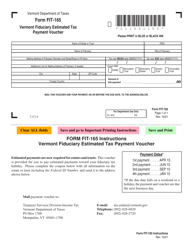

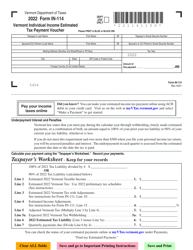

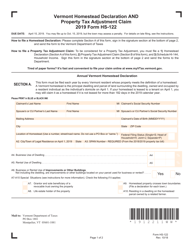

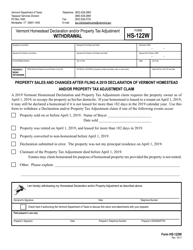

VT Form TPP-650 Telephone Personal Property Tax Payment Voucher - Vermont

What Is VT Form TPP-650?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is VT Form TPP-650?

A: VT Form TPP-650 is the Telephone Personal Property Tax Payment Voucher for Vermont.

Q: What is the purpose of VT Form TPP-650?

A: The purpose of VT Form TPP-650 is to facilitate the payment of telephone personal property taxes in Vermont.

Q: Who needs to use VT Form TPP-650?

A: Anyone who is liable for telephone personal property taxes in Vermont needs to use VT Form TPP-650.

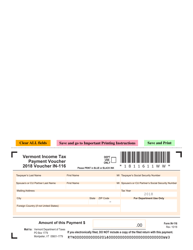

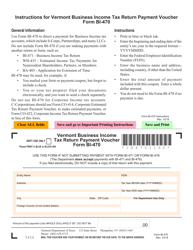

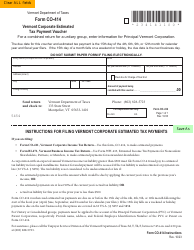

Q: How do I fill out VT Form TPP-650?

A: You need to provide your taxpayer information, calculate the amount of tax owed, and indicate the payment method.

Q: When is the deadline for filing VT Form TPP-650?

A: The deadline for filing VT Form TPP-650 varies, so you should check the instructions or contact the Vermont Department of Taxes for the specific due date.

Q: What should I do if I have questions about VT Form TPP-650 or telephone personal property taxes in Vermont?

A: If you have questions, you should contact the Vermont Department of Taxes directly for assistance.

Form Details:

- Released on December 1, 2016;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of VT Form TPP-650 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.