This version of the form is not currently in use and is provided for reference only. Download this version of

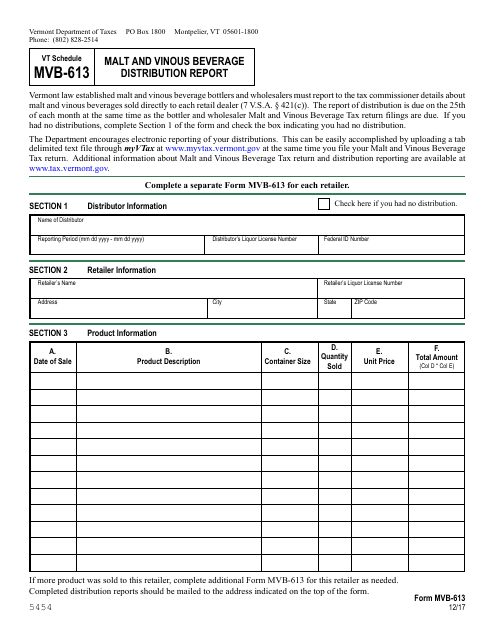

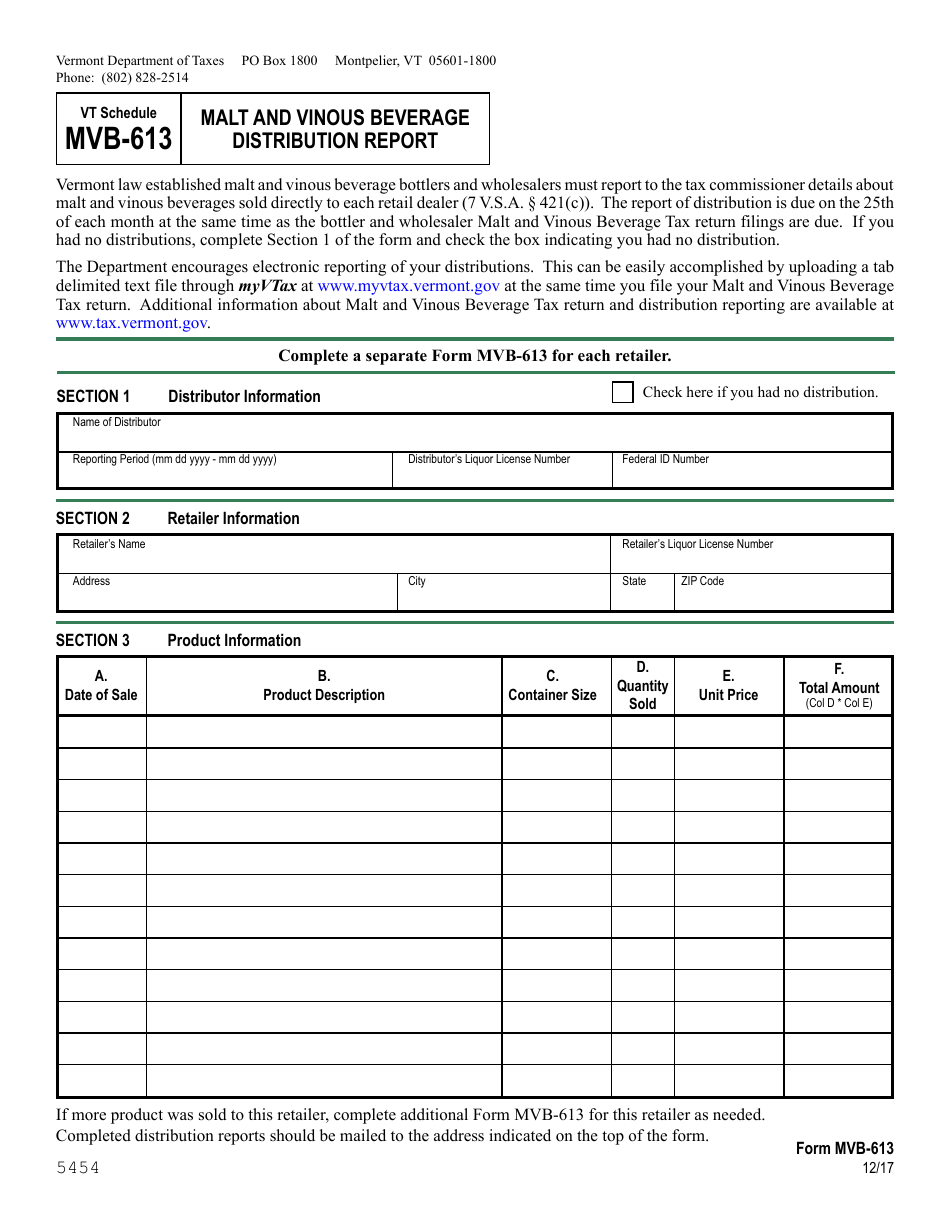

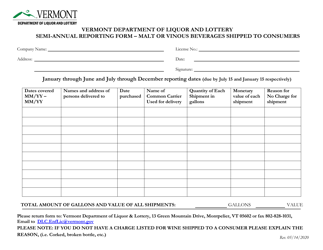

Schedule MVB-613

for the current year.

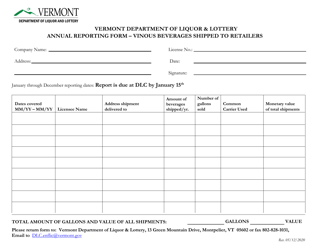

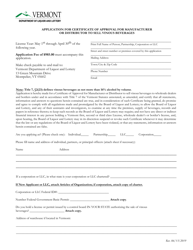

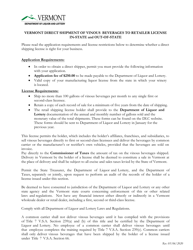

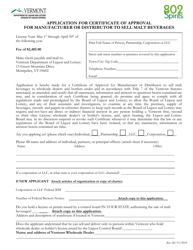

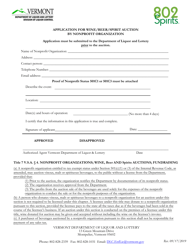

Schedule MVB-613 Malt and Vinous Beverage Distribution Report - Vermont

What Is Schedule MVB-613?

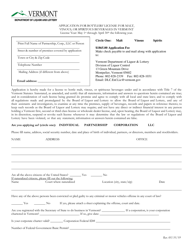

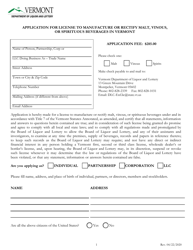

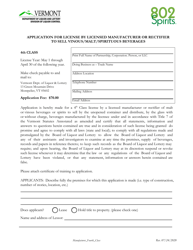

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule MVB-613?

A: Schedule MVB-613 is the Malt and Vinous Beverage Distribution Report in Vermont.

Q: What is the purpose of Schedule MVB-613?

A: The purpose of Schedule MVB-613 is to report the distribution of malt and vinous beverages in Vermont.

Q: Who needs to file Schedule MVB-613?

A: Any entity engaged in the distribution of malt and vinous beverages in Vermont needs to file Schedule MVB-613.

Q: When is Schedule MVB-613 due?

A: The due date for filing Schedule MVB-613 in Vermont varies and is determined by the Vermont Department of Taxes.

Q: Are there any penalties for not filing Schedule MVB-613?

A: Yes, there may be penalties for not filing Schedule MVB-613 in Vermont, such as late fees or other sanctions.

Q: How often do I need to file Schedule MVB-613?

A: The frequency of filing Schedule MVB-613 in Vermont depends on the specific requirements set by the Vermont Department of Taxes.

Q: What information do I need to include in Schedule MVB-613?

A: Schedule MVB-613 requires information about the quantity and distribution of malt and vinous beverages in Vermont, as well as other related details.

Q: Is Schedule MVB-613 specific to Vermont?

A: Yes, Schedule MVB-613 is specific to the state of Vermont and its requirements for reporting malt and vinous beverage distribution.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule MVB-613 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.