This version of the form is not currently in use and is provided for reference only. Download this version of

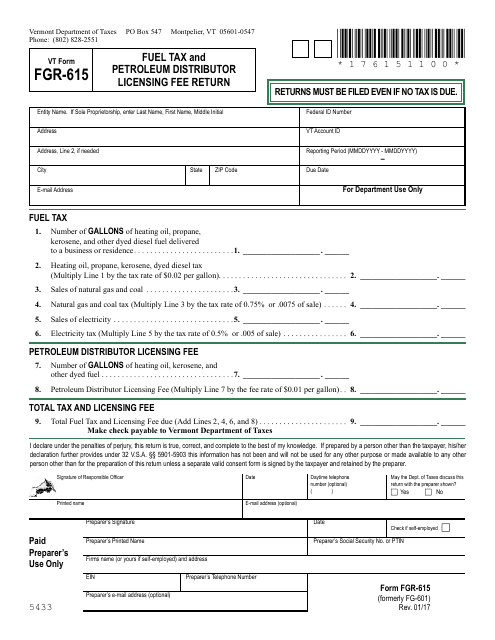

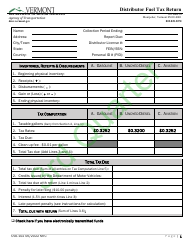

VT Form FGR-615

for the current year.

VT Form FGR-615 Fuel Tax and Petroleum Distributor Licensing Fee Return - Vermont

What Is VT Form FGR-615?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. Check the official instructions before completing and submitting the form.

FAQ

Q: What is VT Form FGR-615?

A: VT Form FGR-615 is a fuel tax and petroleum distributor licensing fee return form in Vermont.

Q: What is the purpose of VT Form FGR-615?

A: The purpose of VT Form FGR-615 is to report fuel tax and pay the petroleum distributor licensing fee in Vermont.

Q: Who needs to file VT Form FGR-615?

A: Petroleum distributors and fuel tax collectors in Vermont need to file VT Form FGR-615.

Q: What information is required on VT Form FGR-615?

A: VT Form FGR-615 requires information such as the amount of gallons of fuel sold, the amount of tax due, and the licensing fee.

Q: When is VT Form FGR-615 due?

A: VT Form FGR-615 is due on the last day of the month following the end of the calendar quarter.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of VT Form FGR-615 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.