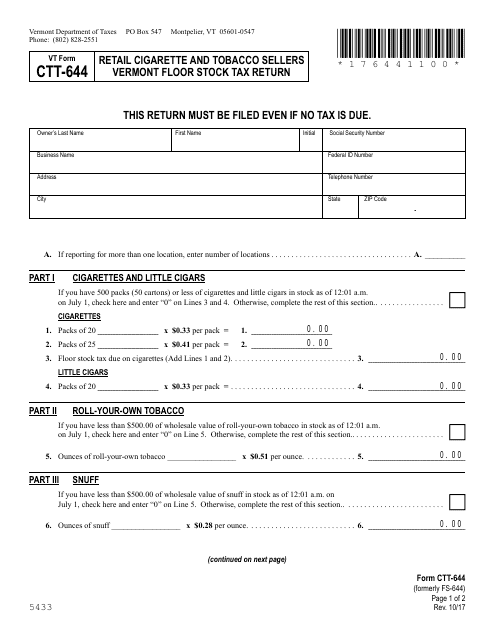

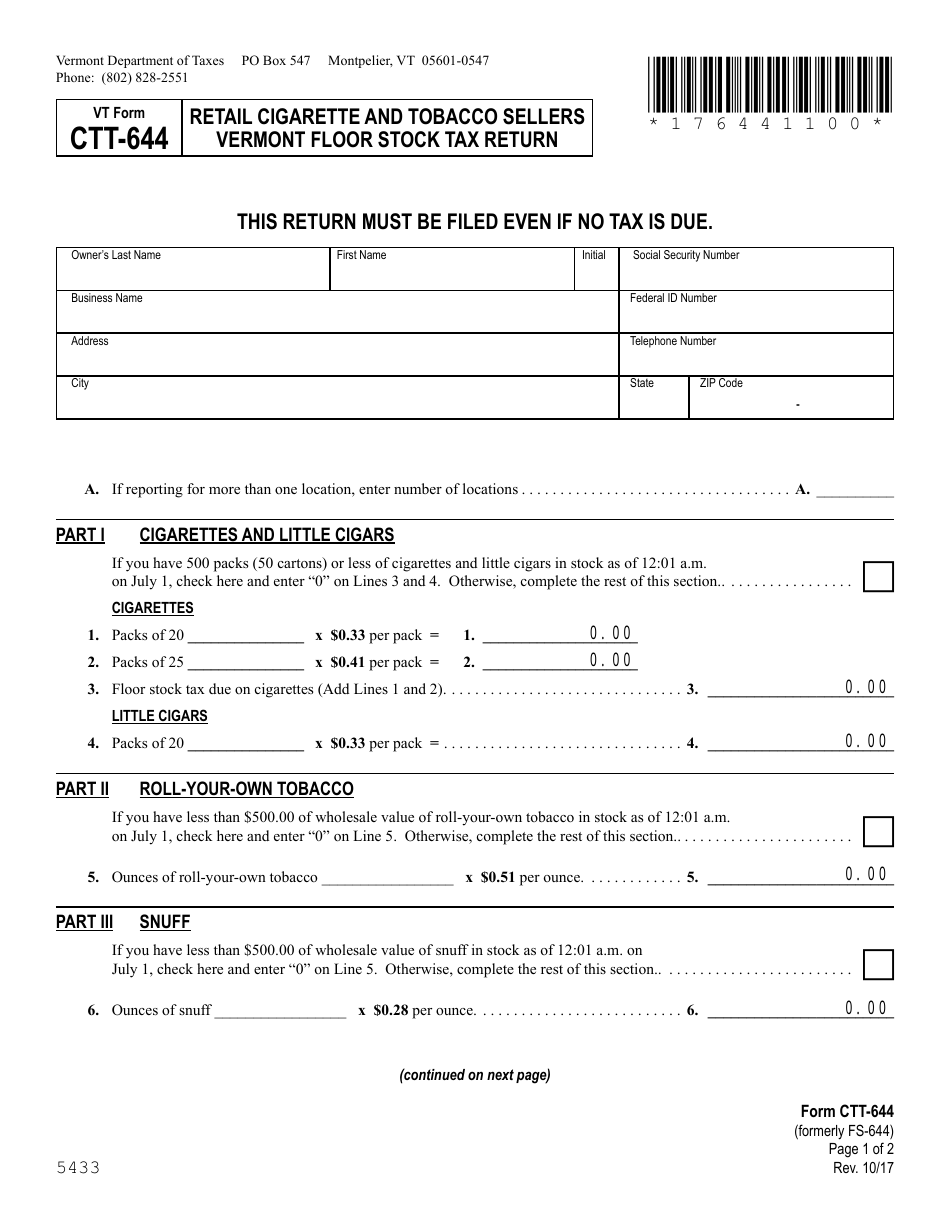

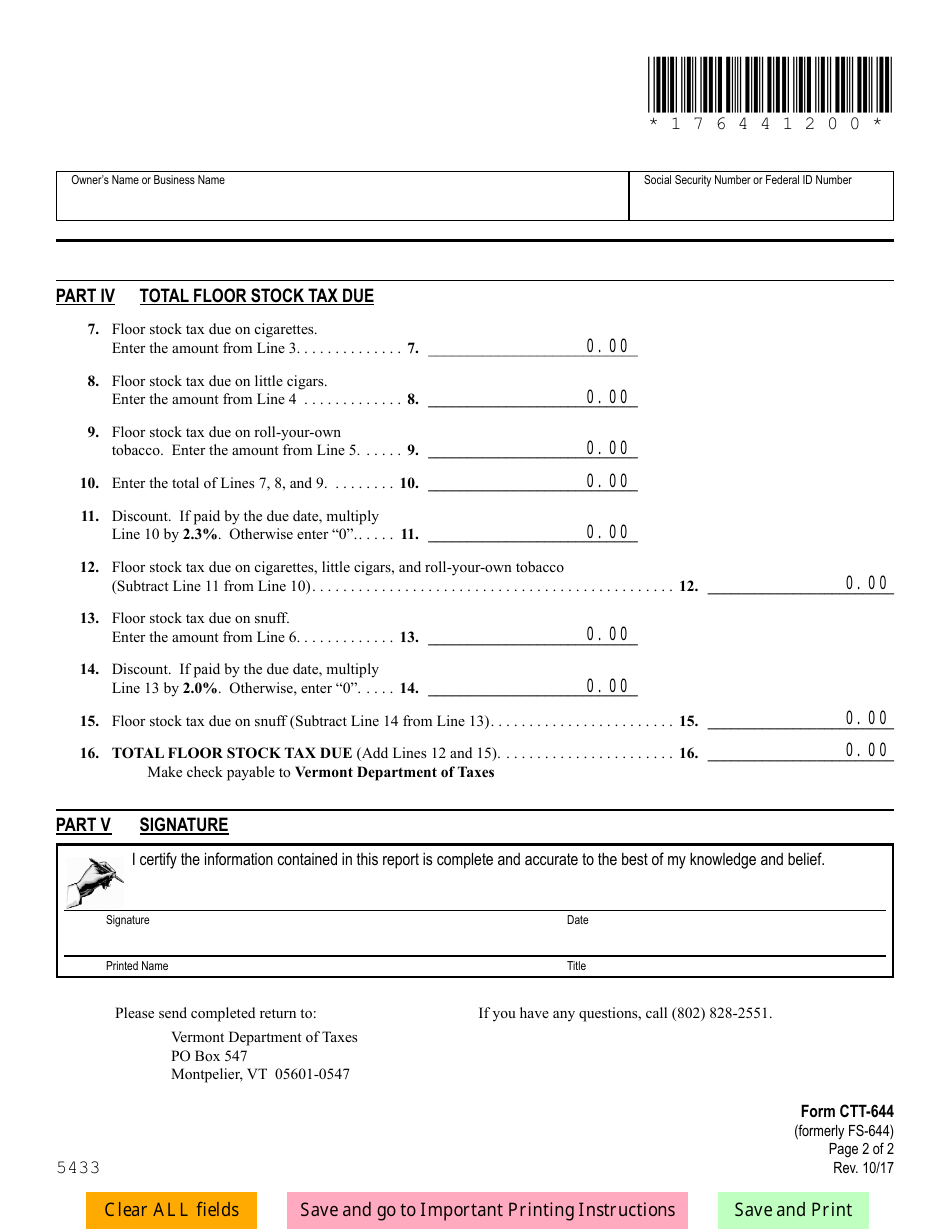

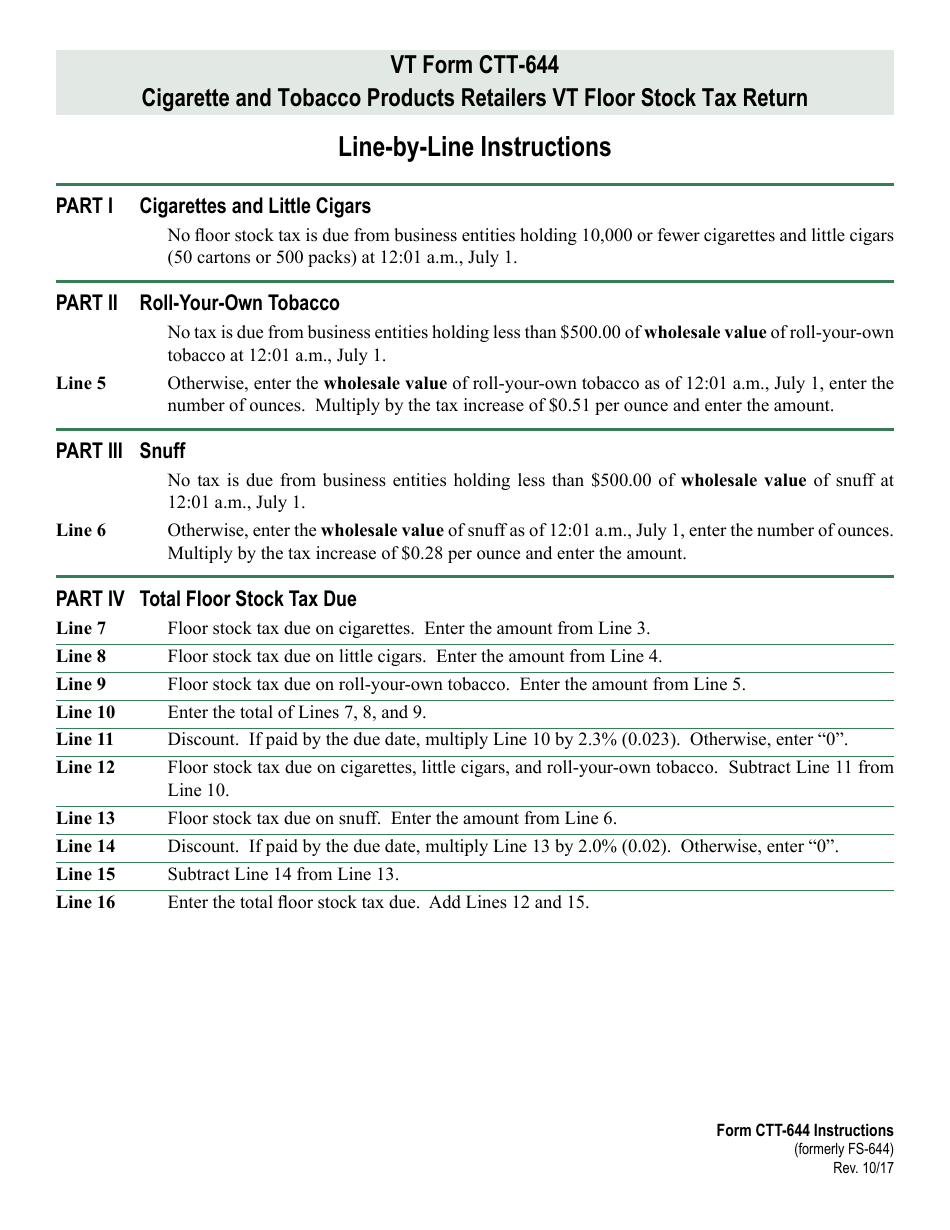

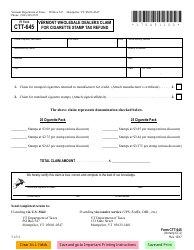

VT Form CTT-644 Retail Cigarette and Tobacco Sellers Vermont Floor Stock Tax Return - Vermont

What Is VT Form CTT-644?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is VT Form CTT-644?

A: VT Form CTT-644 is the Retail Cigarette and Tobacco Sellers Vermont Floor Stock Tax Return.

Q: Who needs to file VT Form CTT-644?

A: Retail cigarette and tobacco sellers in Vermont need to file VT Form CTT-644.

Q: What is the purpose of VT Form CTT-644?

A: The purpose of VT Form CTT-644 is to report and pay the Vermont floor stock tax on cigarettes and tobacco products.

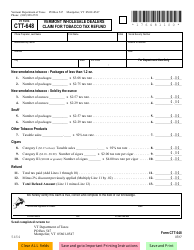

Q: What is the Vermont floor stock tax?

A: The Vermont floor stock tax is a tax on the inventory of cigarettes and tobacco products held by retailers on the effective date of the tax increase.

Q: When is VT Form CTT-644 due?

A: VT Form CTT-644 is due on or before the 25th day of the month following the effective date of the tax increase.

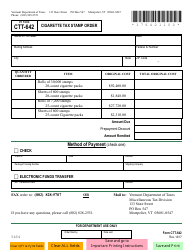

Form Details:

- Released on October 1, 2017;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of VT Form CTT-644 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.