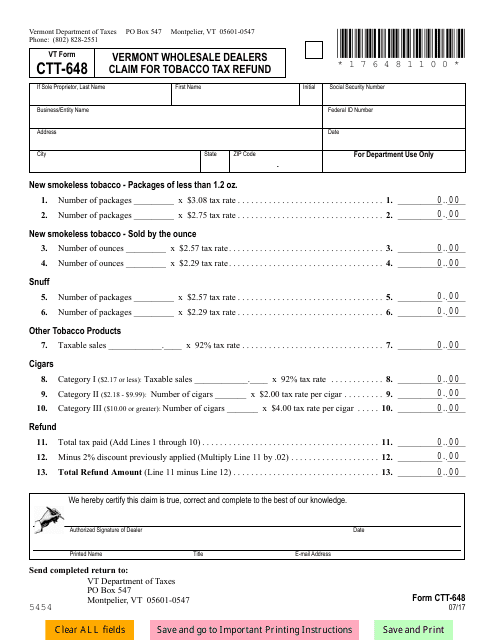

VT Form CTT-648 Vermont Wholesale Dealers Claim for Tobacco Tax Refund - Vermont

What Is VT Form CTT-648?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the VT Form CTT-648?

A: The VT Form CTT-648 is the Vermont Wholesale Dealers Claim for Tobacco Tax Refund form.

Q: Who can use the VT Form CTT-648?

A: Wholesale tobacco dealers in Vermont can use the VT Form CTT-648 to claim a refund for tobacco tax paid on unsold tobacco products.

Q: What is the purpose of the VT Form CTT-648?

A: The purpose of the VT Form CTT-648 is to allow wholesale tobacco dealers to request a refund for tobacco tax paid on products that were not sold and were returned to the manufacturer or destroyed.

Q: Are there any specific deadlines for filing the VT Form CTT-648?

A: Yes, the VT Form CTT-648 must be filed within one year from the date of the original purchase.

Q: What supporting documentation is required when filing the VT Form CTT-648?

A: When filing the VT Form CTT-648, you must attach copies of invoices that show the amount of tobacco tax paid and proof that the tobacco products were returned to the manufacturer or destroyed.

Q: How long does it take to receive a refund after filing the VT Form CTT-648?

A: The processing time for the VT Form CTT-648 varies, but it generally takes several weeks to receive a refund.

Q: Can I claim a refund for tobacco products that were sold but not consumed?

A: No, the VT Form CTT-648 only applies to tobacco products that were not sold and were either returned to the manufacturer or destroyed.

Q: Can individuals who purchased tobacco products for personal use claim a refund using the VT Form CTT-648?

A: No, the VT Form CTT-648 is specifically for wholesale tobacco dealers. Individuals cannot use this form to claim a refund for personal use.

Form Details:

- Released on July 1, 2017;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of VT Form CTT-648 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.