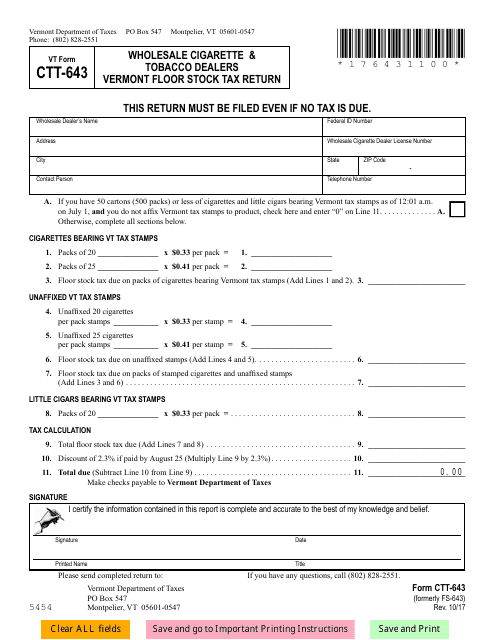

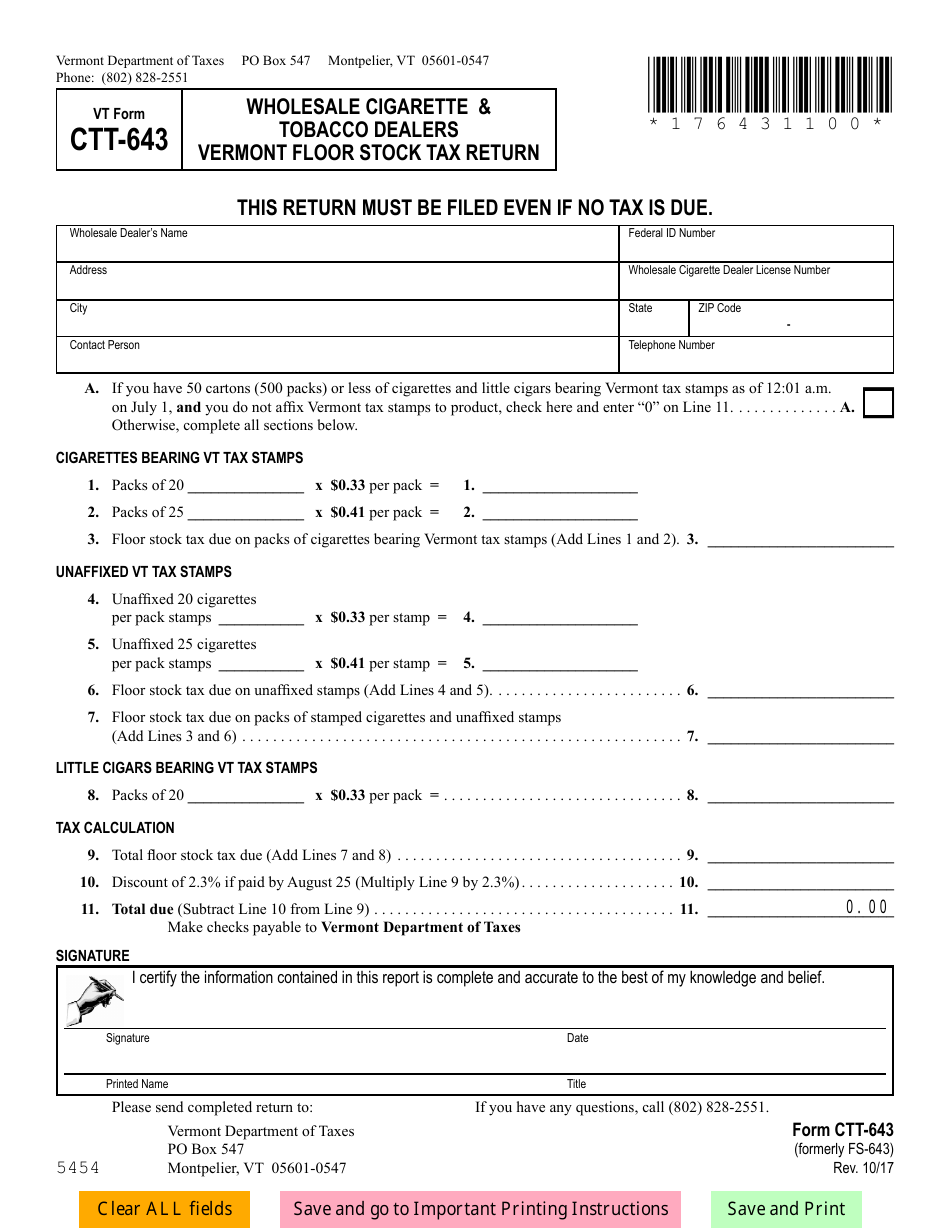

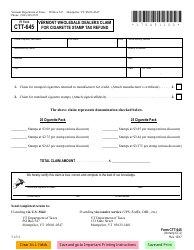

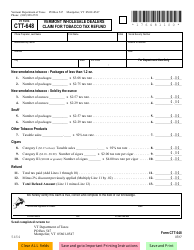

VT Form CTT-643 Wholesale Cigarette & Tobacco Dealers Vermont Floor Stock Tax Return - Vermont

What Is VT Form CTT-643?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is VT Form CTT-643?

A: VT Form CTT-643 is the Wholesale Cigarette & Tobacco Dealers Vermont Floor Stock Tax Return.

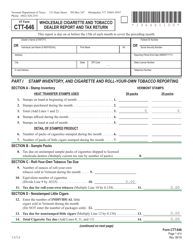

Q: Who needs to file VT Form CTT-643?

A: Wholesale Cigarette & Tobacco Dealers in Vermont need to file VT Form CTT-643.

Q: What is the purpose of VT Form CTT-643?

A: The purpose of VT Form CTT-643 is to report and pay the Vermont Floor Stock Tax on cigarettes and tobacco products.

Q: What is the Vermont Floor Stock Tax?

A: The Vermont Floor Stock Tax is a tax on the inventory of cigarettes and tobacco products held by wholesale dealers in Vermont.

Q: How often should VT Form CTT-643 be filed?

A: VT Form CTT-643 should be filed on a quarterly basis.

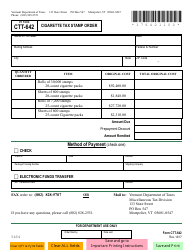

Q: Are there any penalties for late or non-filing of VT Form CTT-643?

A: Yes, there are penalties for late or non-filing of VT Form CTT-643. It is important to file on time to avoid penalties and interest charges.

Form Details:

- Released on October 1, 2017;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of VT Form CTT-643 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.