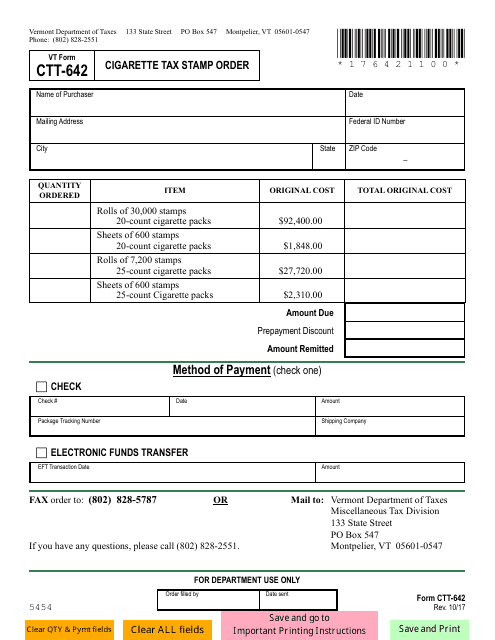

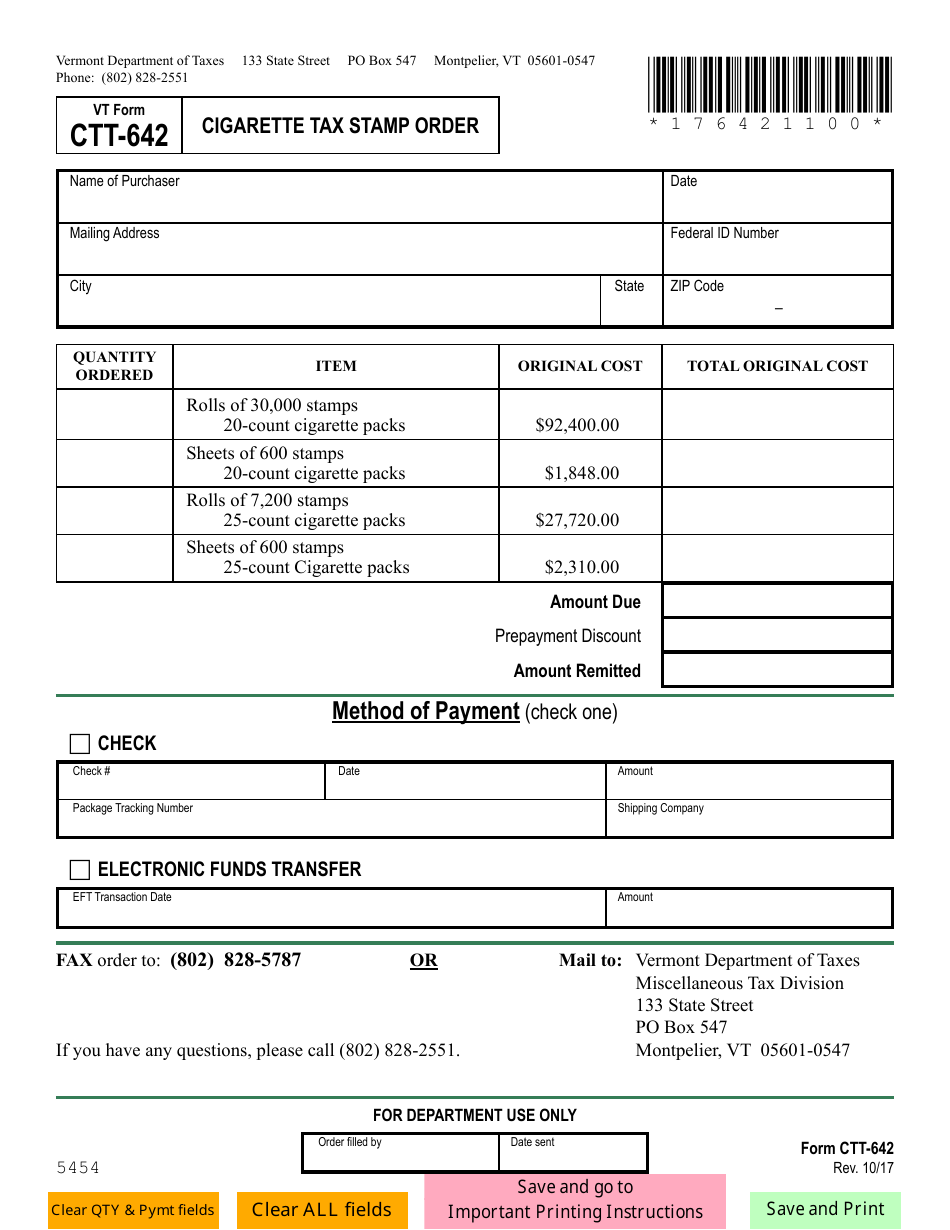

VT Form CTT-642 Cigarette Tax Stamp Order - Vermont

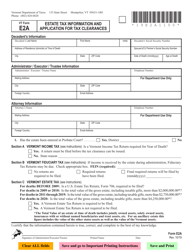

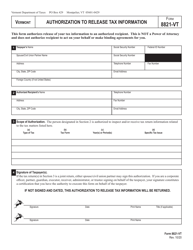

What Is VT Form CTT-642?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

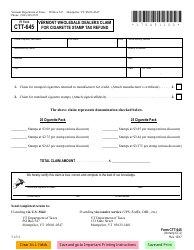

Q: What is the VT Form CTT-642?

A: The VT Form CTT-642 is a cigarette taxstamp order form used in Vermont.

Q: What is a cigarette tax stamp?

A: A cigarette tax stamp is a stamp affixed to cigarette packs to indicate that the required taxes have been paid.

Q: Who needs to use the VT Form CTT-642?

A: Cigarette distributors or wholesalers in Vermont need to use the VT Form CTT-642 to order cigarette tax stamps.

Q: Why is the VT Form CTT-642 used?

A: The VT Form CTT-642 is used to order cigarette tax stamps to ensure compliance with Vermont's cigarette tax laws.

Q: Are there any fees associated with the VT Form CTT-642?

A: Yes, there is a fee for each cigarette tax stamp ordered using the VT Form CTT-642.

Q: How often do I need to order cigarette tax stamps using the VT Form CTT-642?

A: It depends on the volume of cigarettes you distribute, but you may need to order tax stamps regularly to ensure compliance.

Q: What are the consequences of not using cigarette tax stamps?

A: Failure to use cigarette tax stamps can result in penalties and legal consequences.

Q: How long does it take to receive ordered cigarette tax stamps?

A: The processing time for ordered cigarette tax stamps may vary, so it's important to plan ahead and order in a timely manner.

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of VT Form CTT-642 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.