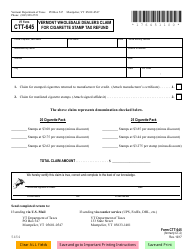

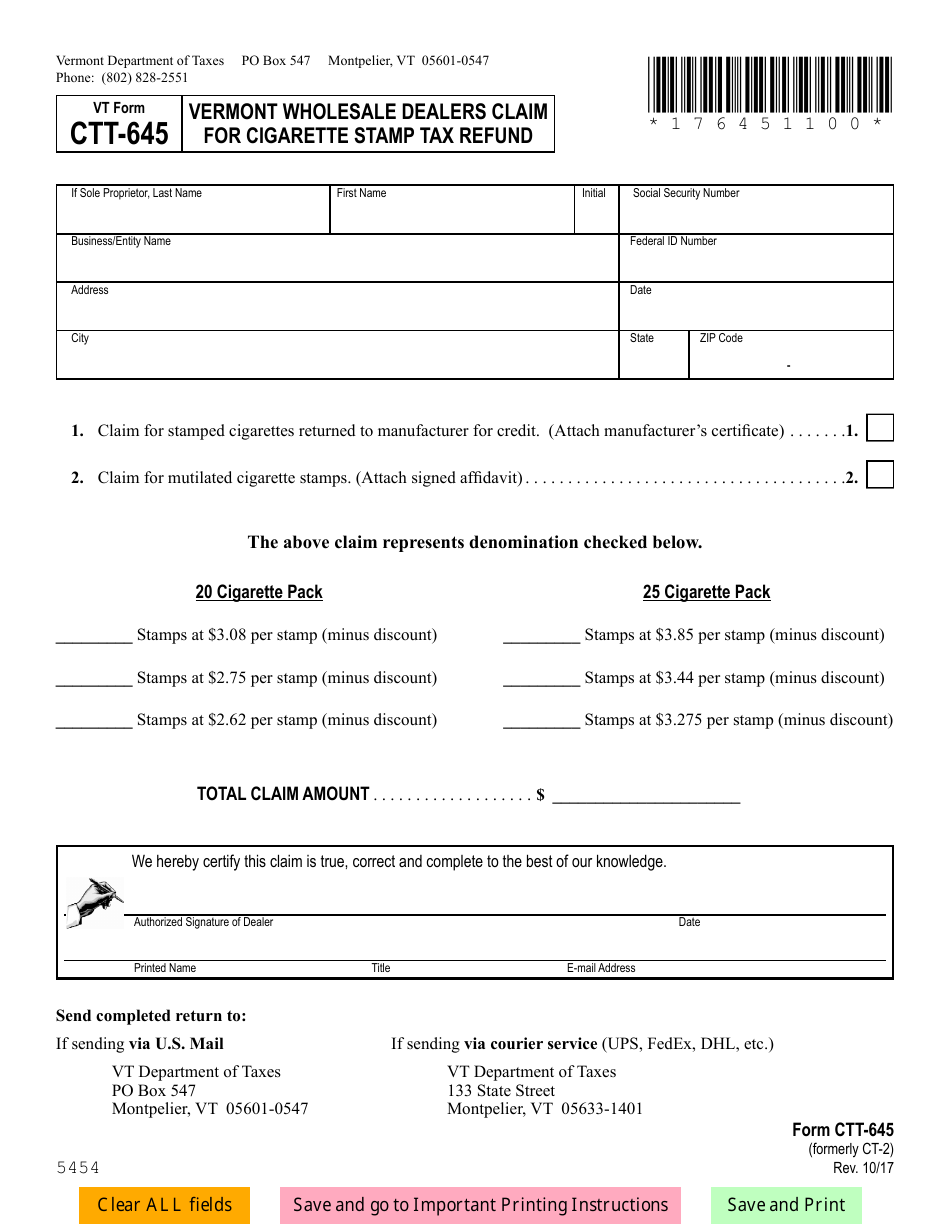

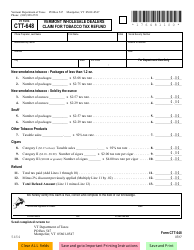

VT Form CTT-645 Vermont Wholesale Dealers Claim for Cigarette Stamp Tax Refund - Vermont

What Is VT Form CTT-645?

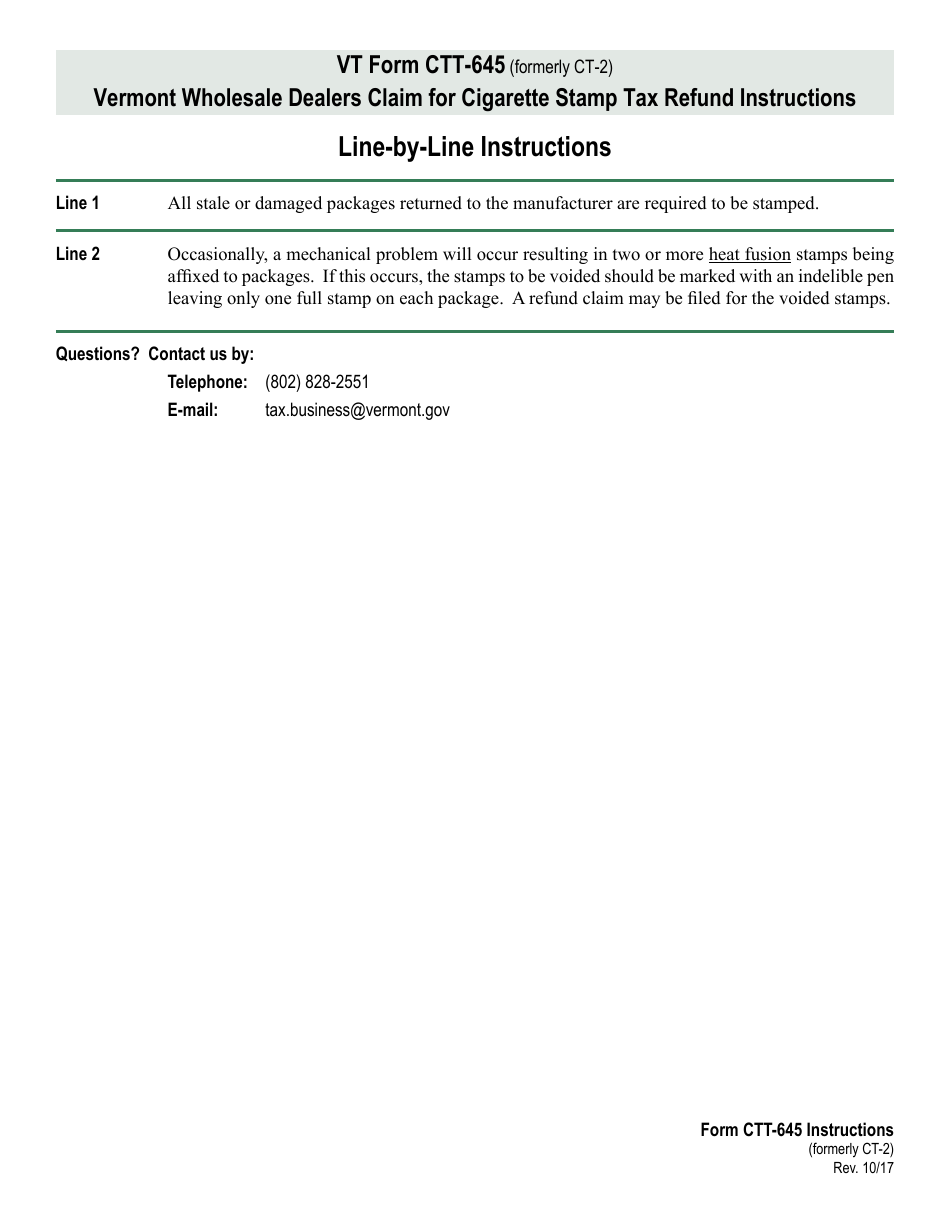

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CTT-645?

A: Form CTT-645 is the Vermont Wholesale Dealers Claim for Cigarette Stamp Tax Refund.

Q: Who can use Form CTT-645?

A: Wholesale dealers in Vermont can use Form CTT-645 to claim a refund for cigarette stamp tax.

Q: What is the purpose of Form CTT-645?

A: The purpose of Form CTT-645 is to facilitate the refund process for wholesale dealers who have overpaid cigarette stamp tax in Vermont.

Q: Are there any eligibility requirements to use Form CTT-645?

A: Yes, only wholesale dealers in Vermont who have overpaid cigarette stamp tax are eligible to use Form CTT-645.

Q: What information do I need to provide on Form CTT-645?

A: You will need to provide your wholesale dealer information, details of overpayment, and any supporting documentation required by the Vermont Department of Taxes.

Q: Is there a deadline for submitting Form CTT-645?

A: Yes, the deadline for submitting Form CTT-645 is specified by the Vermont Department of Taxes and may vary.

Q: Will I receive a refund if my claim is approved?

A: If your claim is approved, you will receive a refund for the overpaid cigarette stamp tax amount.

Q: What should I do if I have any questions or need assistance with Form CTT-645?

A: If you have any questions or need assistance with Form CTT-645, you can contact the Vermont Department of Taxes for guidance.

Form Details:

- Released on October 1, 2017;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of VT Form CTT-645 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.