This version of the form is not currently in use and is provided for reference only. Download this version of

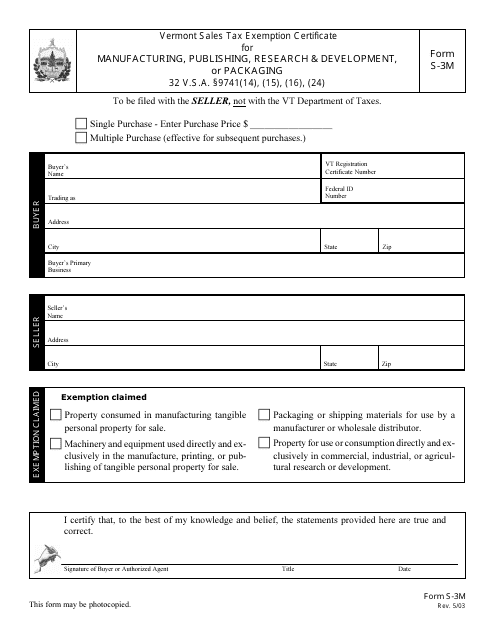

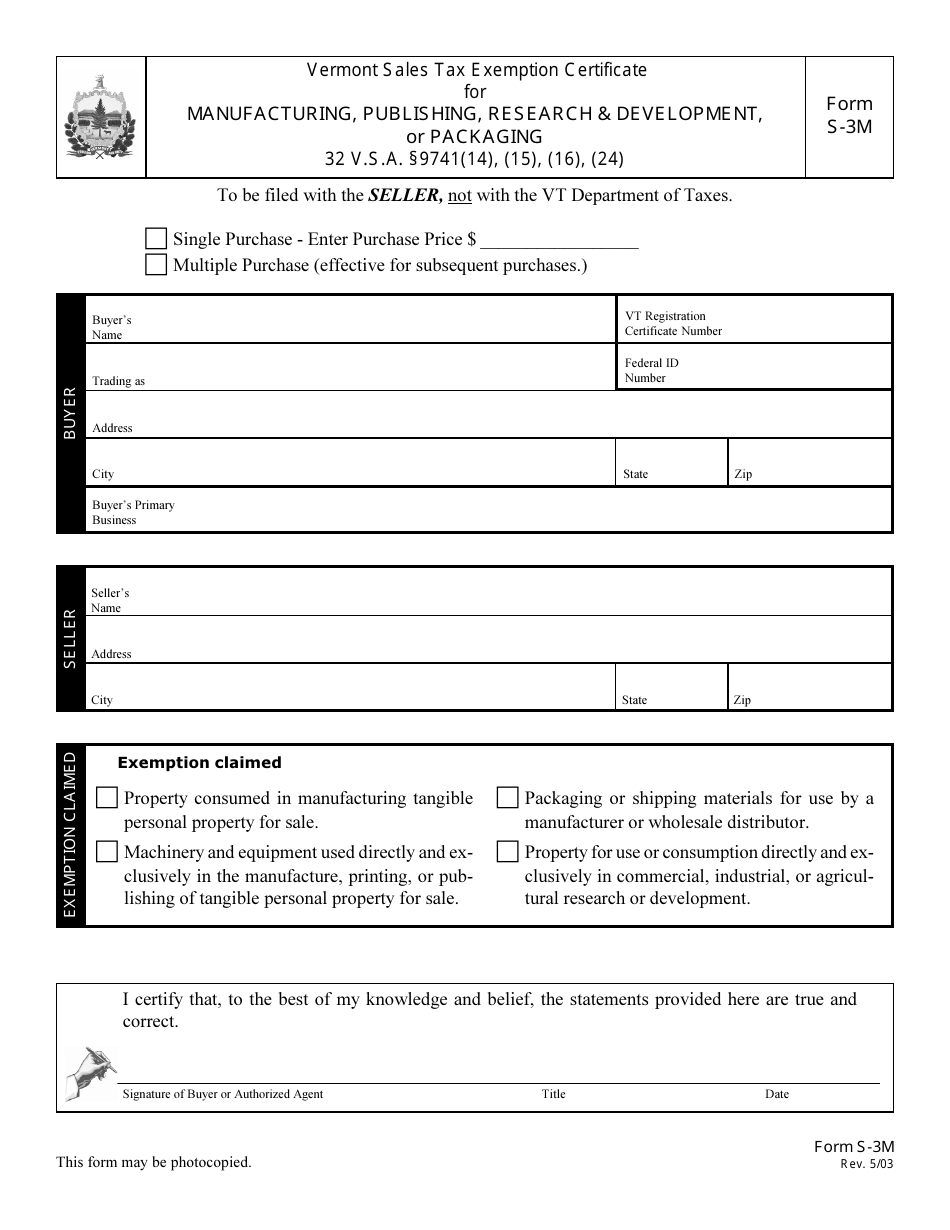

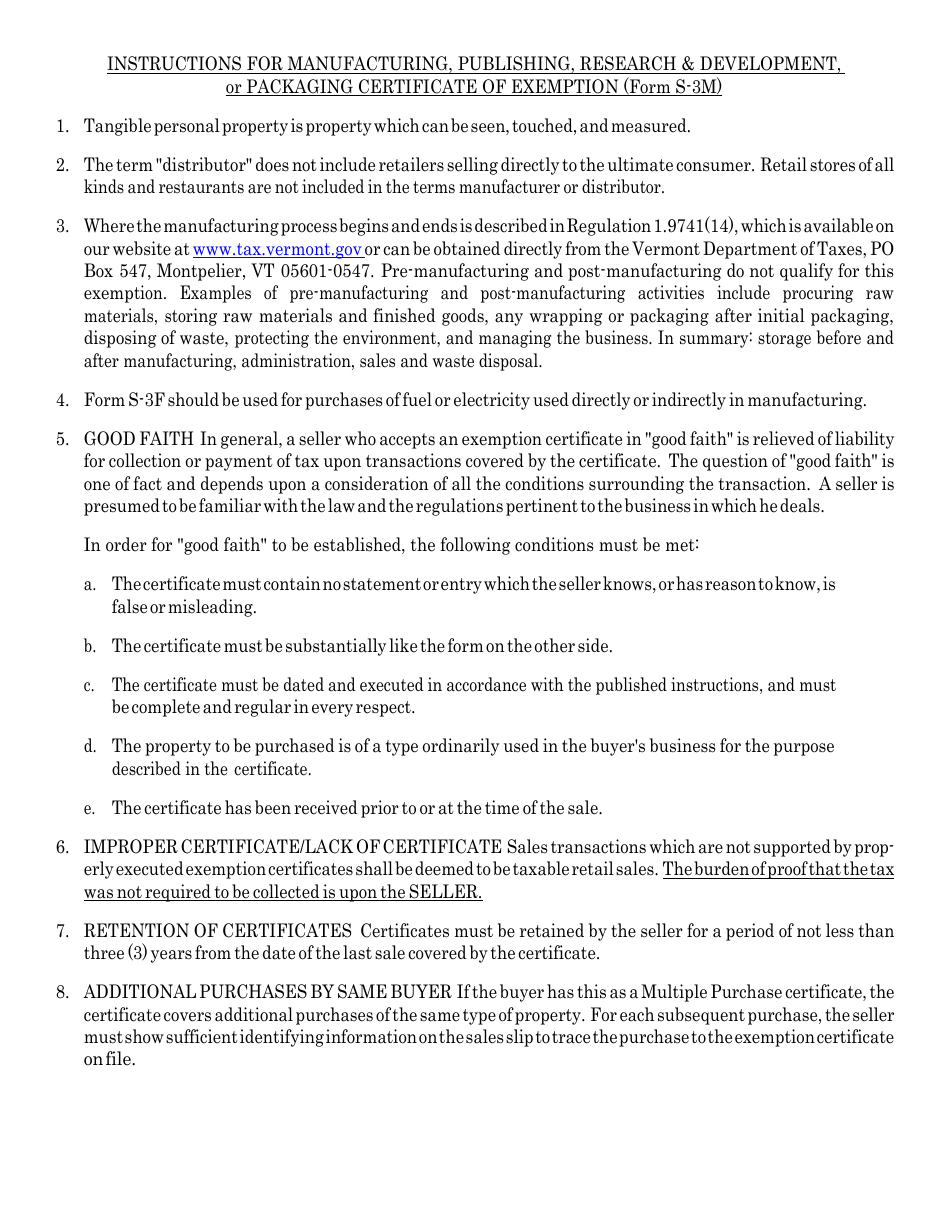

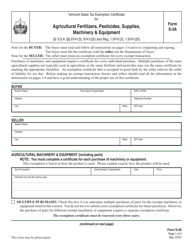

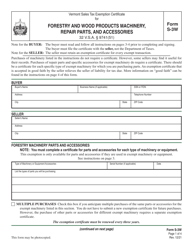

VT Form S-3M

for the current year.

VT Form S-3M Vermont Sales Tax Exemption Certificate for Manufacturing, Publishing, Research & Development, or Packaging - Vermont

What Is VT Form S-3M?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is VT Form S-3M?

A: VT Form S-3M is the Vermont Sales Tax Exemption Certificate specifically for manufacturing, publishing, research & development, or packaging.

Q: Who can use VT Form S-3M?

A: Businesses engaged in manufacturing, publishing, research & development, or packaging in Vermont can use VT Form S-3M.

Q: What is the purpose of VT Form S-3M?

A: The purpose of VT Form S-3M is to apply for sales tax exemption for qualifying activities related to manufacturing, publishing, research & development, or packaging.

Q: What are the qualifying activities for VT Form S-3M?

A: Qualifying activities for VT Form S-3M include manufacturing, publishing, research & development, or packaging conducted in Vermont.

Q: How do I apply for sales tax exemption using VT Form S-3M?

A: To apply for sales tax exemption, businesses need to complete and submit VT Form S-3M to the Vermont Department of Taxes.

Q: Are there any specific requirements for using VT Form S-3M?

A: Yes, businesses must meet the specific eligibility requirements outlined in the instructions of VT Form S-3M to qualify for sales tax exemption.

Form Details:

- Released on May 1, 2003;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of VT Form S-3M by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.