This version of the form is not currently in use and is provided for reference only. Download this version of

VT Form S-3E

for the current year.

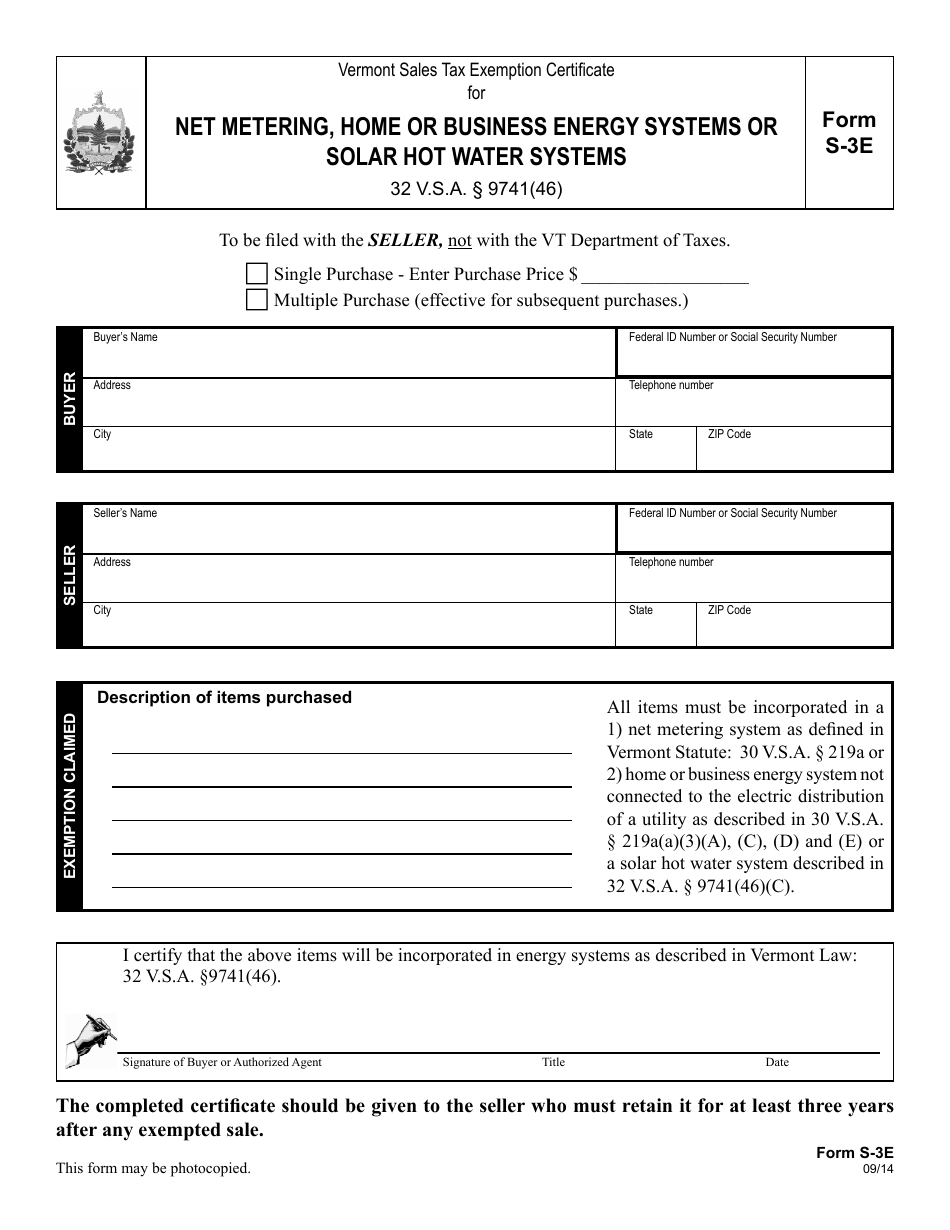

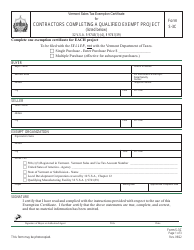

VT Form S-3E Vermont Sales Tax Exemption Certificate for Net Metering, Home or Business Energy Systems or Solar Hot Water Systems - Vermont

What Is VT Form S-3E?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the VT Form S-3E?

A: The VT Form S-3E is the Sales Tax Exemption Certificate for Net Metering, Home or Business Energy Systems or Solar Hot Water Systems in Vermont.

Q: Who can use the VT Form S-3E?

A: The VT Form S-3E can be used by individuals or businesses installing net metering, home or business energy systems, or solar hot water systems in Vermont.

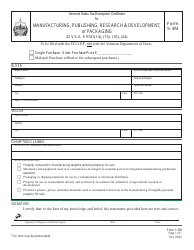

Q: What does the VT Form S-3E exempt from?

A: The VT Form S-3E exempts these systems from sales tax in Vermont.

Q: When should I use the VT Form S-3E?

A: You should use the VT Form S-3E at the time of purchase to claim the sales tax exemption.

Q: Do I need to renew the VT Form S-3E?

A: No, the VT Form S-3E does not need to be renewed. Once you have it, you can use it for eligible purchases indefinitely.

Q: What are the eligible systems covered by the VT Form S-3E?

A: The eligible systems include net metering systems, home or business energy systems, and solar hot water systems in Vermont.

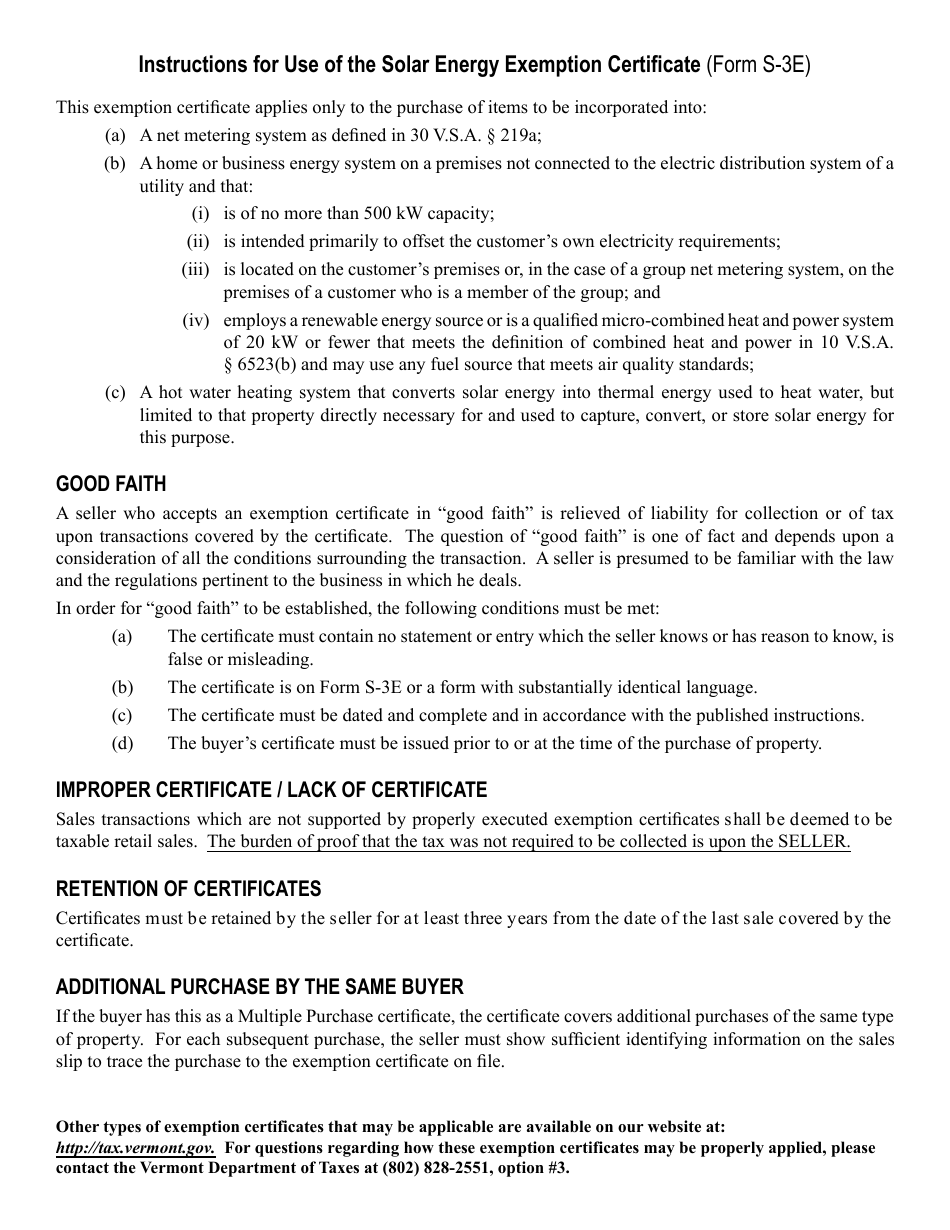

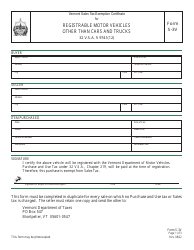

Q: Are there any restrictions or limitations for using the VT Form S-3E?

A: There may be certain conditions or requirements that need to be met in order to qualify for the sales tax exemption. It is recommended to review the instructions provided with the form or consult with the Vermont Department of Taxes for specific details.

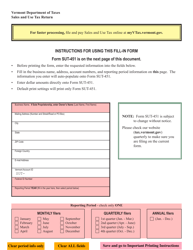

Form Details:

- Released on September 1, 2014;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of VT Form S-3E by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.