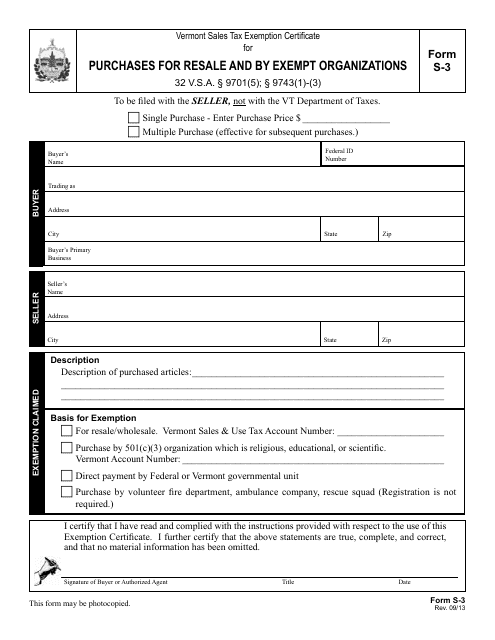

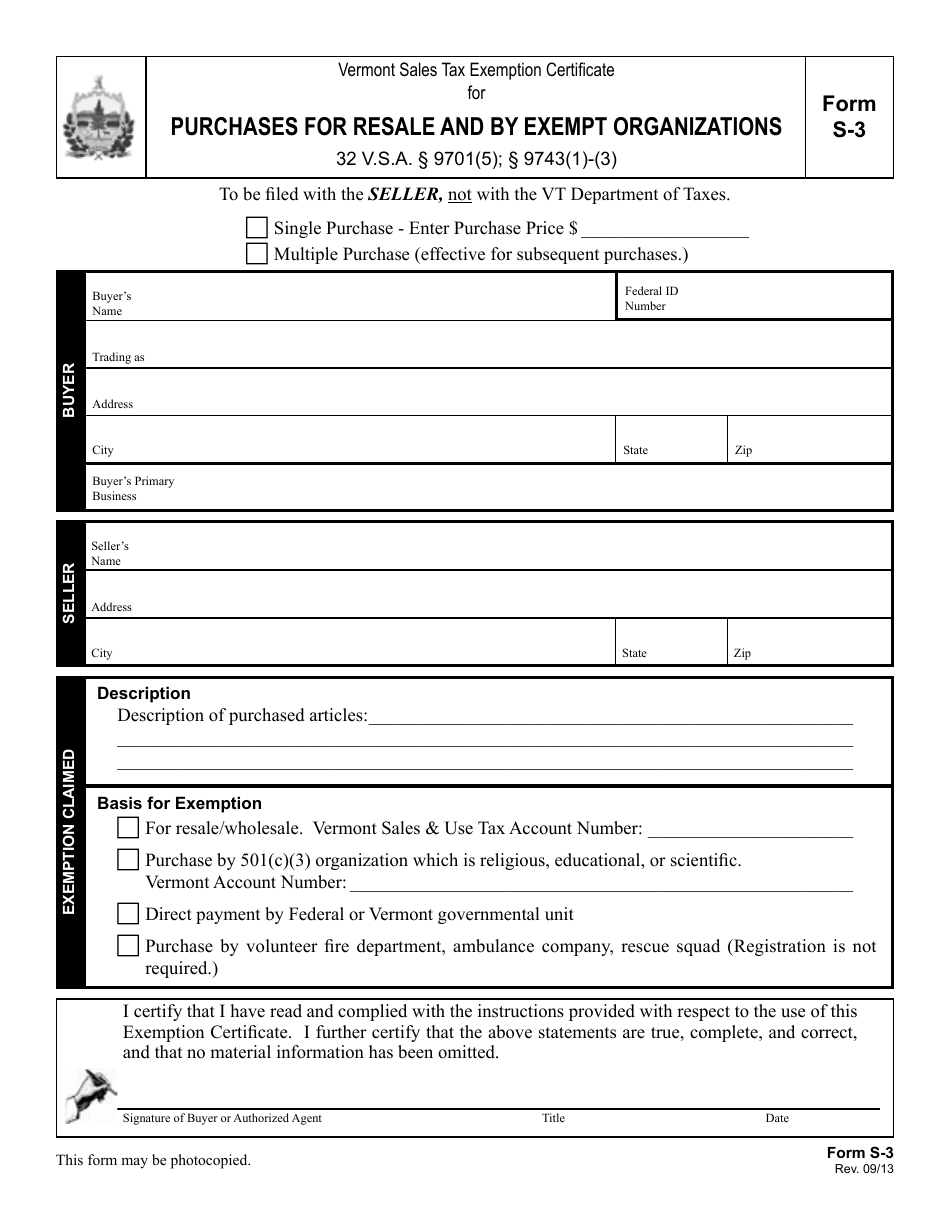

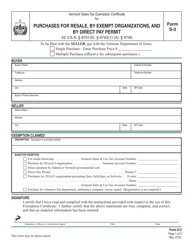

VT Form S-3 Purchases for Resale and by Exempt Organizations - Vermont

What Is VT Form S-3?

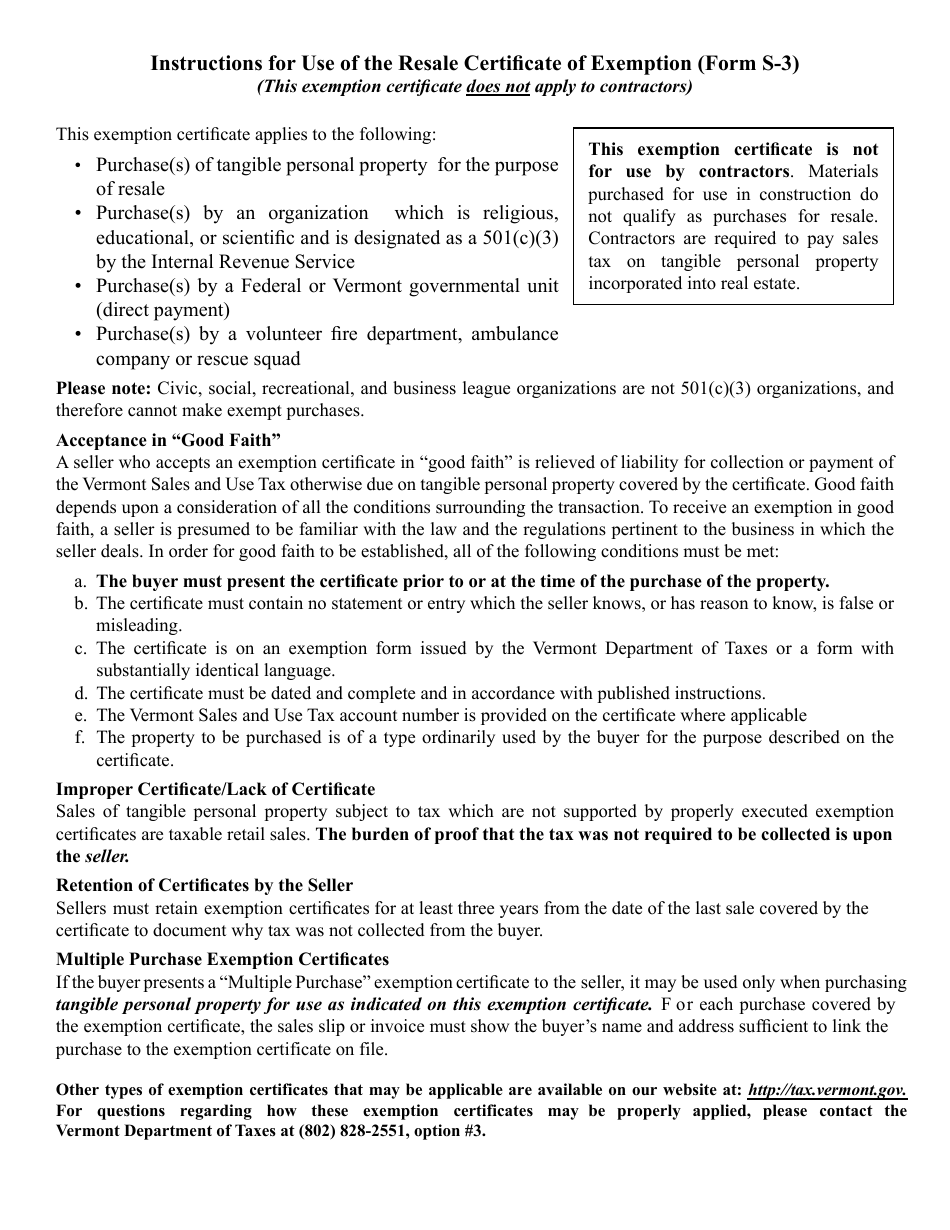

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is VT Form S-3?

A: VT Form S-3 is a tax form used in Vermont.

Q: Who is required to file VT Form S-3?

A: VT Form S-3 is used by businesses that make purchases for resale or by exempt organizations.

Q: What is the purpose of VT Form S-3?

A: VT Form S-3 is used to report purchases made for resale or by exempt organizations in order to claim an exemption from sales tax.

Q: When is VT Form S-3 due?

A: VT Form S-3 is typically due on the 25th day of the month following the end of the reporting period.

Form Details:

- Released on September 1, 2013;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of VT Form S-3 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.