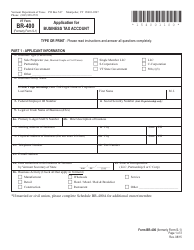

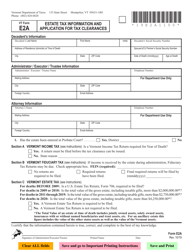

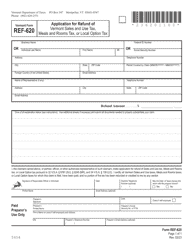

VT Form REF-619 Application for Refund of Miscellaneous Taxes - Vermont

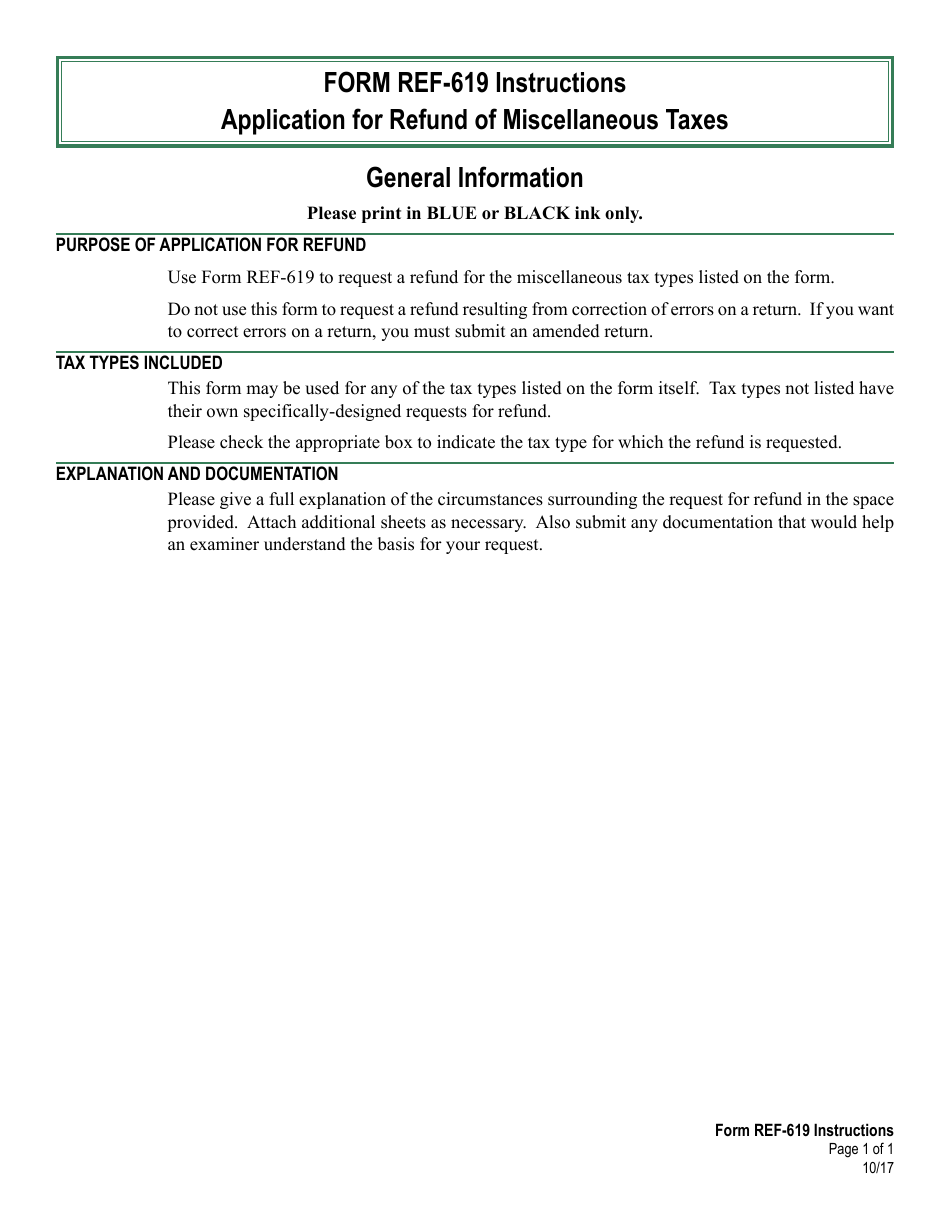

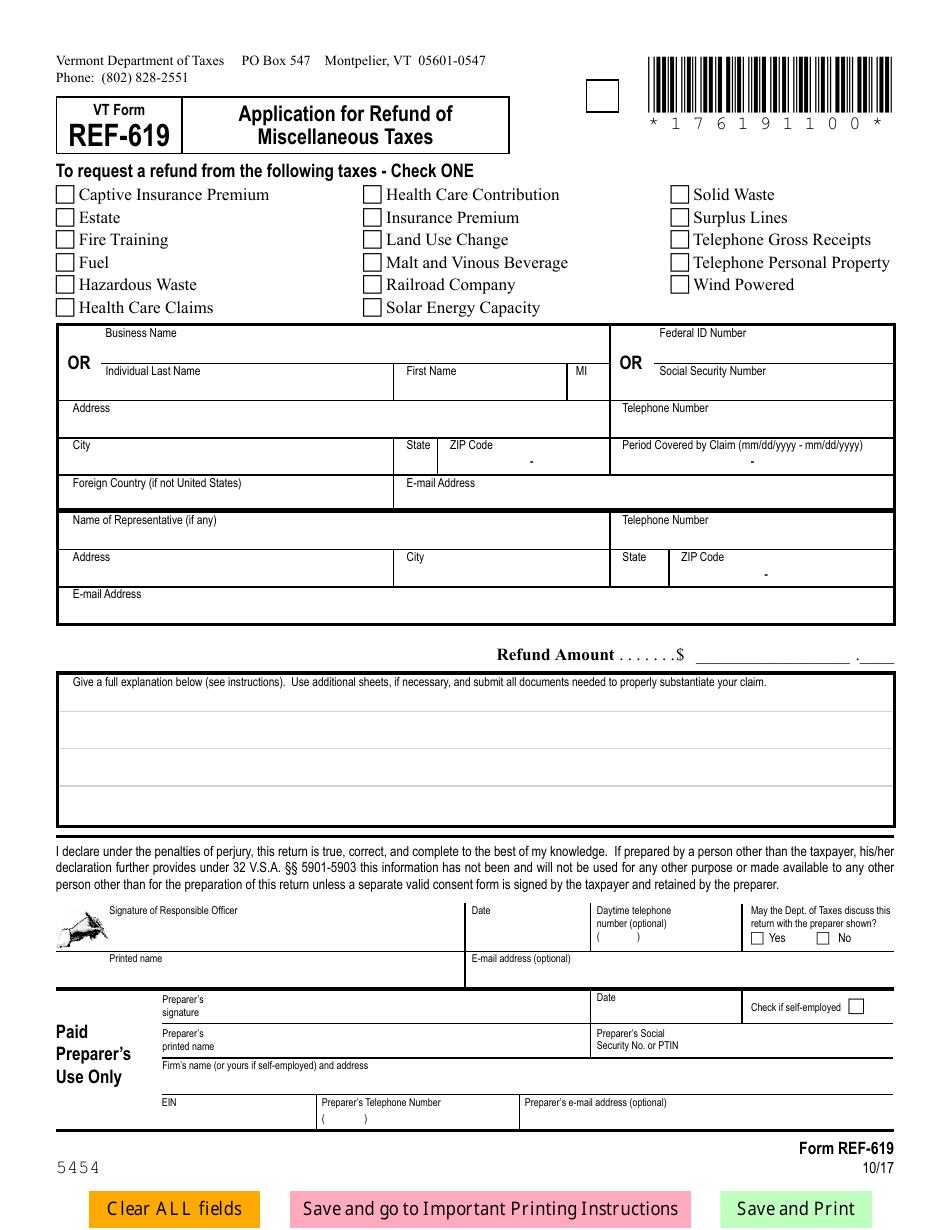

What Is VT Form REF-619?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is VT Form REF-619?

A: VT Form REF-619 is the Application for Refund of Miscellaneous Taxes in Vermont.

Q: Who can use VT Form REF-619?

A: Anyone who has paid miscellaneous taxes in Vermont and wants to apply for a refund can use VT Form REF-619.

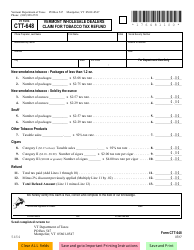

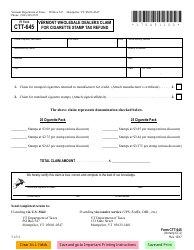

Q: What taxes can be refunded using VT Form REF-619?

A: VT Form REF-619 can be used to claim refunds for various miscellaneous taxes paid in Vermont, such as alcoholic beverages tax, cigarette tax, and fuel tax.

Q: What information is required on VT Form REF-619?

A: VT Form REF-619 requires you to provide your personal information, details about the taxes paid, and the reason for requesting the refund.

Q: How long does it take to process a refund request using VT Form REF-619?

A: The processing time for a refund request submitted using VT Form REF-619 can vary, but it typically takes several weeks to receive a refund.

Q: Are there any fees associated with filing VT Form REF-619?

A: There are no fees associated with filing VT Form REF-619.

Q: Can I file VT Form REF-619 electronically?

A: Currently, VT Form REF-619 cannot be filed electronically. It must be mailed to the Vermont Department of Taxes.

Form Details:

- Released on October 1, 2016;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of VT Form REF-619 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.