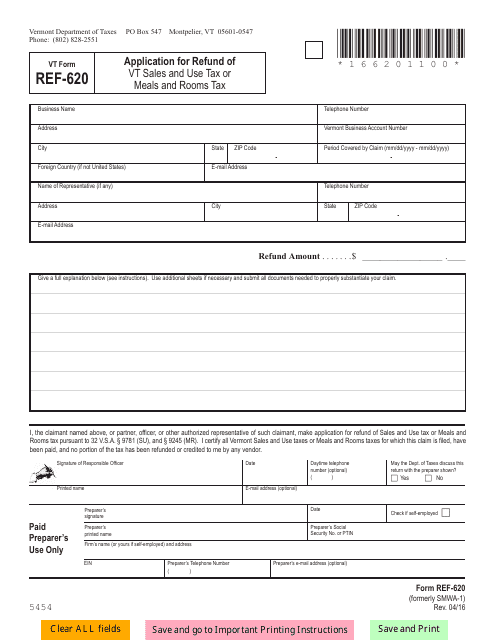

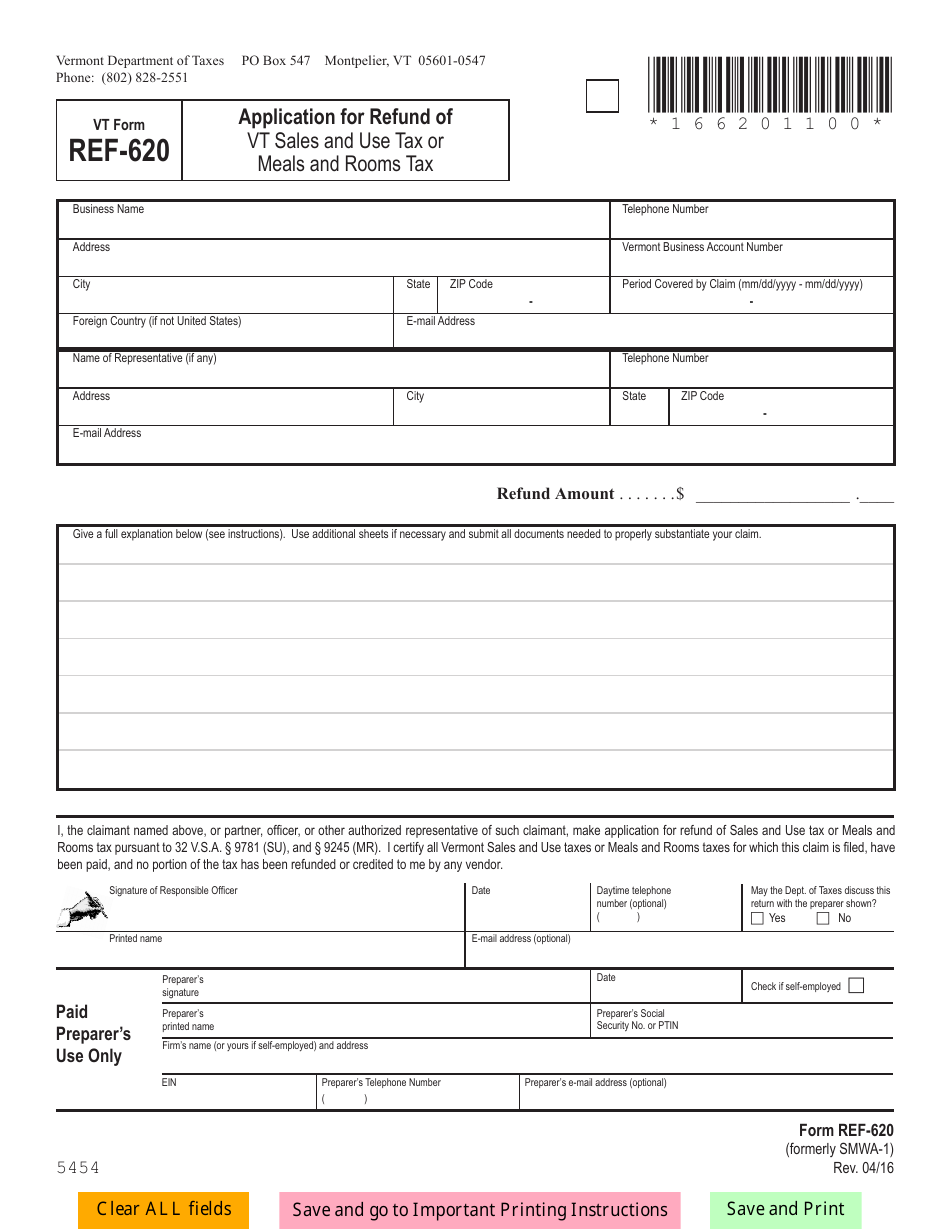

VT Form REF-620 Application for Refund of Vt Sales and Use Tax or Meals and Rooms Tax - Vermont

What Is VT Form REF-620?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. Check the official instructions before completing and submitting the form.

FAQ

Q: What is VT Form REF-620?

A: VT Form REF-620 is the Application for Refund of Vermont Sales and Use Tax or Meals and Rooms Tax.

Q: What can I use VT Form REF-620 for?

A: You can use VT Form REF-620 to apply for a refund of Vermont Sales and Use Tax or Meals and Rooms Tax.

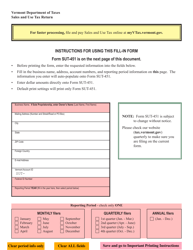

Q: What information do I need to provide on VT Form REF-620?

A: You will need to provide details such as your name, address, tax account number, the period covered by the refund, and the reason for the refund.

Q: How long does it take to process a refund application using VT Form REF-620?

A: The processing time for a refund application using VT Form REF-620 can vary, but it typically takes around 4-6 weeks.

Q: Is there a deadline for filing VT Form REF-620?

A: Yes, there is a deadline for filing VT Form REF-620. The form must be filed within three years from the date the tax was paid or the tax return was due, whichever is later.

Q: Can I file VT Form REF-620 electronically?

A: No, VT Form REF-620 cannot be filed electronically. It must be printed, signed, and mailed to the Vermont Department of Taxes.

Q: Are there any fees associated with filing VT Form REF-620?

A: No, there are no fees associated with filing VT Form REF-620. It is free to submit the form.

Form Details:

- Released on April 1, 2016;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of VT Form REF-620 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.