This version of the form is not currently in use and is provided for reference only. Download this version of

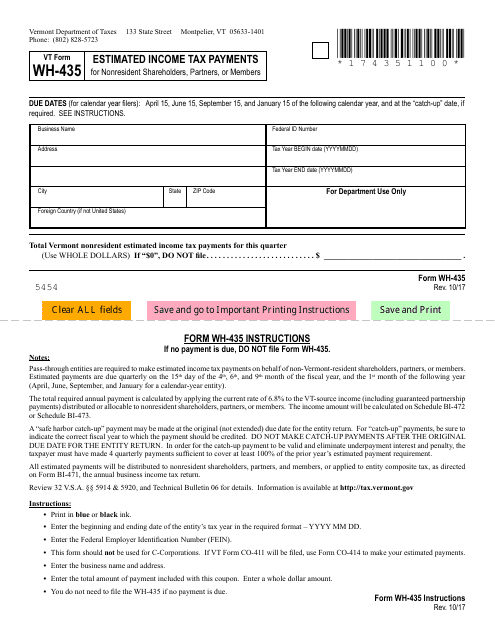

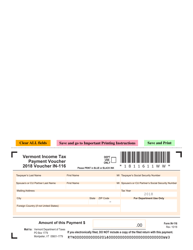

VT Form WH-435

for the current year.

VT Form WH-435 Estimated Income Tax Payments for Nonresident Shareholders, Partners, or Members - Vermont

What Is VT Form WH-435?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

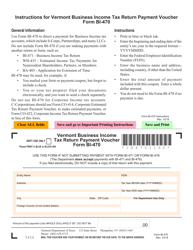

Q: What is Form WH-435?

A: Form WH-435 is the form used by nonresident shareholders, partners, or members to make estimated income tax payments in Vermont.

Q: Who needs to file Form WH-435?

A: Nonresident shareholders, partners, or members who earn income in Vermont and need to make estimated income tax payments are required to file Form WH-435.

Q: What is the purpose of Form WH-435?

A: Form WH-435 is used to calculate and report estimated income tax payments for nonresident shareholders, partners, or members in Vermont.

Q: What information is required to complete Form WH-435?

A: To complete Form WH-435, you will need to provide your personal information, income information, and tax liability details.

Q: When is Form WH-435 due?

A: Form WH-435 is due on the 15th day of the 4th month following the close of the tax year.

Form Details:

- Released on October 1, 2017;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of VT Form WH-435 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.