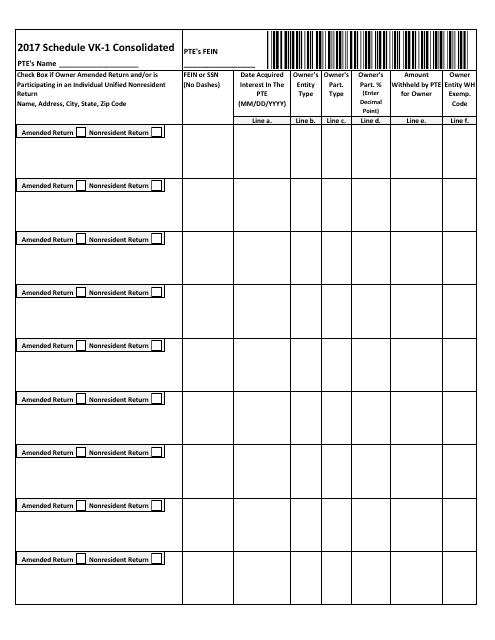

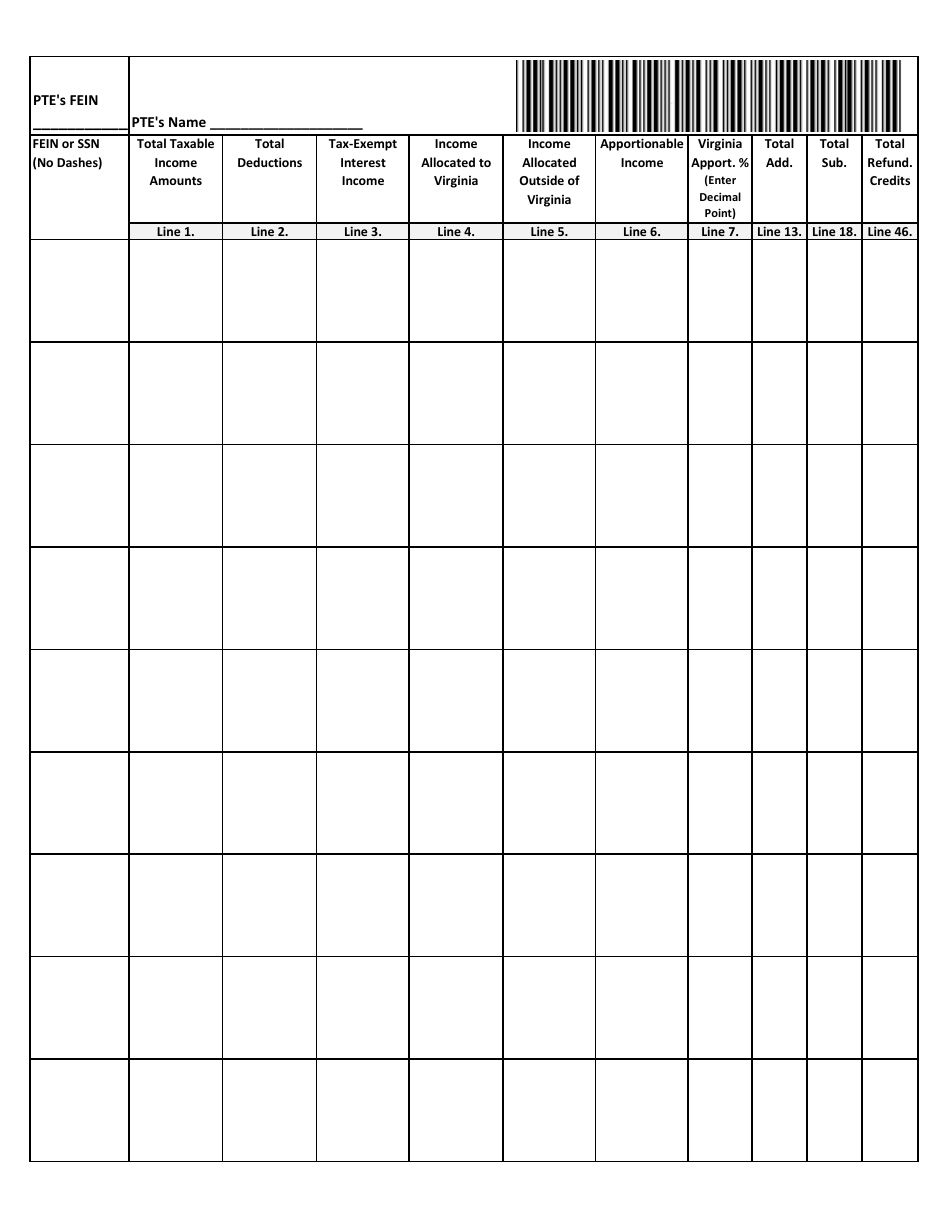

Schedule VK-1 Consolidated - Virginia

What Is Schedule VK-1?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

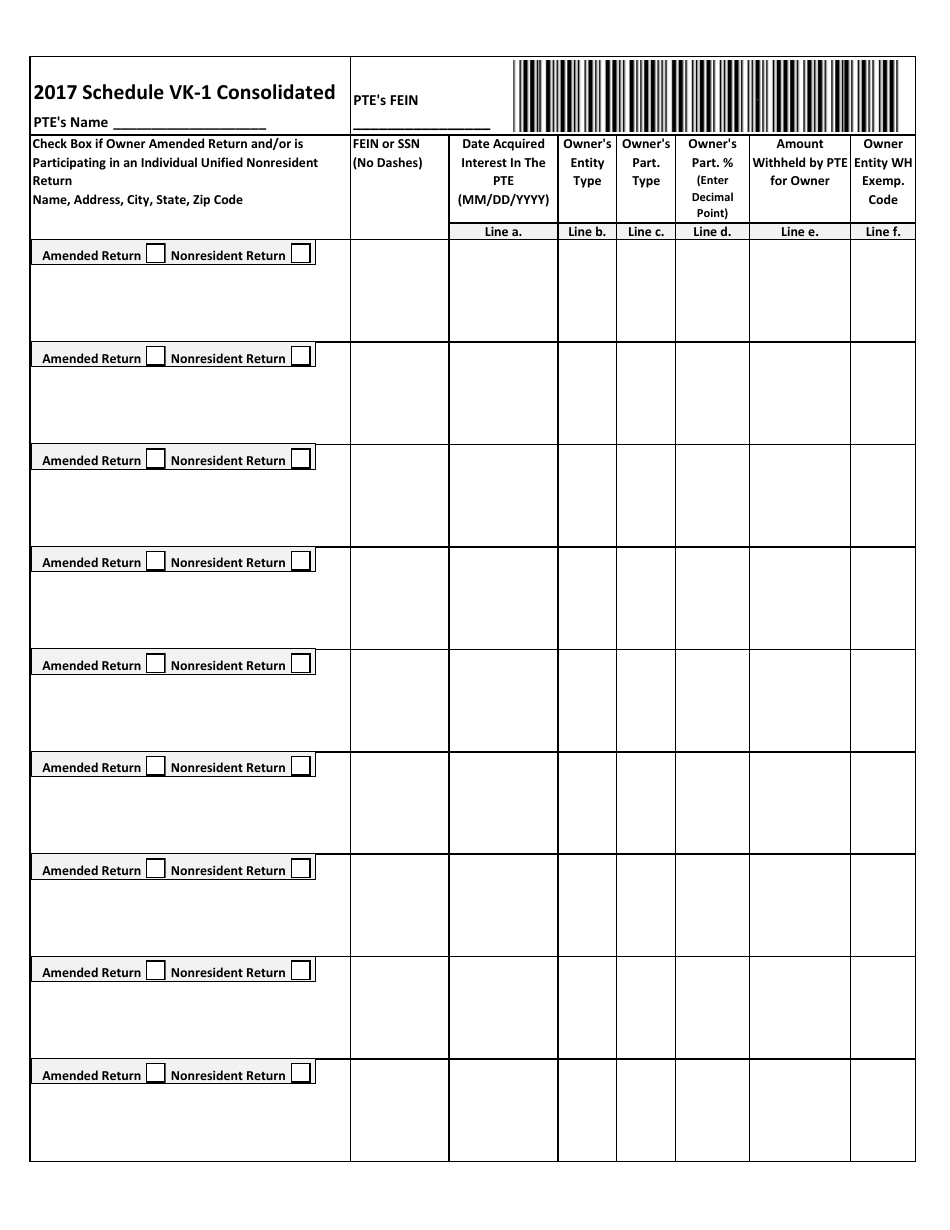

Q: What is Schedule VK-1 Consolidated?

A: Schedule VK-1 Consolidated is a form used in the state of Virginia to report consolidated information for partnerships, limited liability companies, and S corporations.

Q: Who needs to file Schedule VK-1 Consolidated?

A: Partnerships, limited liability companies, and S corporations in Virginia may need to file Schedule VK-1 Consolidated if they meet certain criteria.

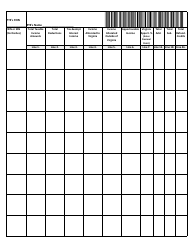

Q: What information is reported on Schedule VK-1 Consolidated?

A: Schedule VK-1 Consolidated reports information about the income, deductions, and credits of the partnership, limited liability company, or S corporation.

Q: When is the deadline to file Schedule VK-1 Consolidated?

A: The deadline to file Schedule VK-1 Consolidated in Virginia is typically the same as the deadline for filing the entity's tax return.

Q: Do I need to include copies of Schedule VK-1 Consolidated with my tax return?

A: Yes, you generally need to include copies of Schedule VK-1 Consolidated with your Virginia tax return.

Q: Are there any penalties for not filing Schedule VK-1 Consolidated?

A: Yes, there may be penalties for not filing Schedule VK-1 Consolidated or for filing it late in Virginia.

Q: Can I electronically file Schedule VK-1 Consolidated?

A: Yes, Virginia allows electronic filing of Schedule VK-1 Consolidated.

Q: Is Schedule VK-1 Consolidated the same as Schedule K-1?

A: No, Schedule VK-1 Consolidated is a consolidated version of Schedule K-1, which is used to report individual partner or shareholder information.

Form Details:

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule VK-1 by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.