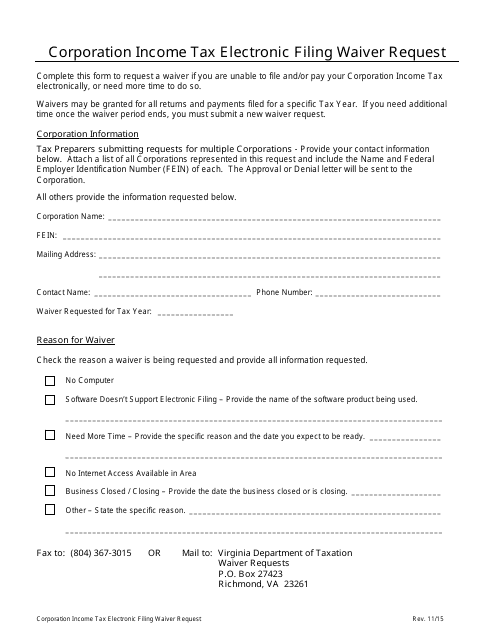

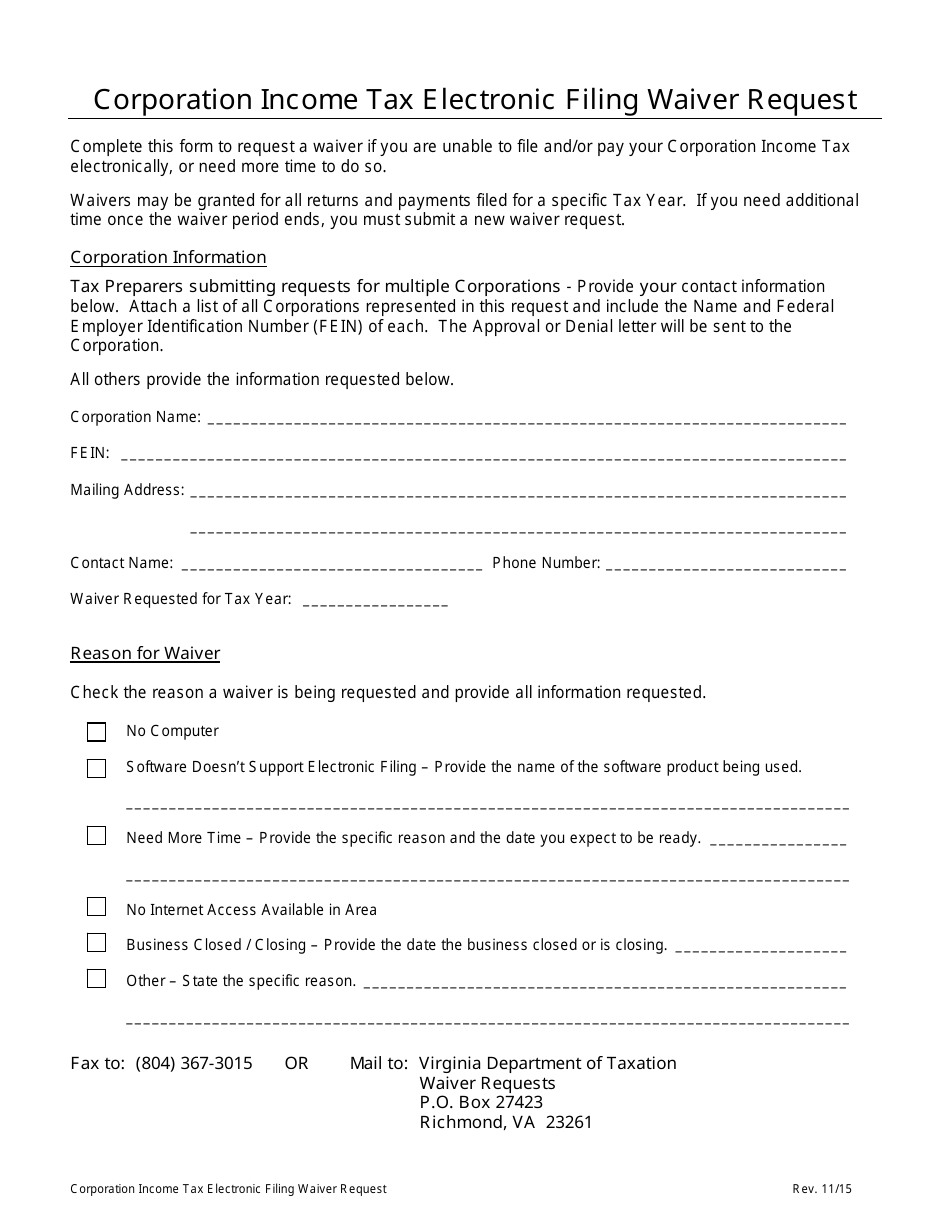

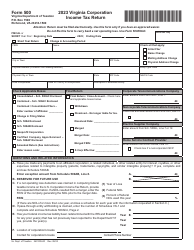

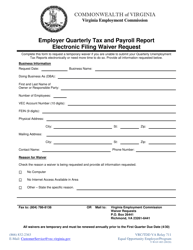

Corporation Income Tax Electronic Filing Waiver Request - Virginia

Corporation Income Tax Electronic Filing Waiver Request is a legal document that was released by the Virginia Department of Taxation - a government authority operating within Virginia.

FAQ

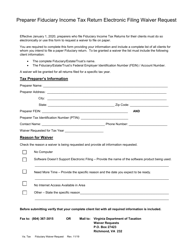

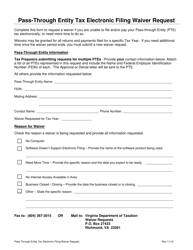

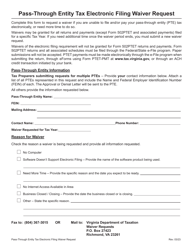

Q: What is the Corporation Income Tax Electronic Filing Waiver Request?

A: The Corporation Income Tax Electronic Filing Waiver Request is a form used in Virginia to request a waiver from filing corporate income tax electronically.

Q: Who needs to use the Corporation Income Tax Electronic Filing Waiver Request?

A: Any corporation in Virginia that is unable to file their income tax electronically needs to use this form to request a waiver.

Q: Why would a corporation need a waiver from electronic filing?

A: A corporation may need a waiver if they are unable to meet the electronic filing requirements due to technical difficulties or other valid reasons.

Q: How can a corporation request a waiver from electronic filing?

A: A corporation can request a waiver by submitting the Corporation Income Tax Electronic Filing Waiver Request form to the Virginia Department of Taxation.

Q: Is there a deadline for submitting the Corporation Income Tax Electronic Filing Waiver Request?

A: Yes, the waiver request should be submitted before the original due date of the corporation's income tax return.

Form Details:

- Released on November 1, 2015;

- The latest edition currently provided by the Virginia Department of Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.