This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form 500T

for the current year.

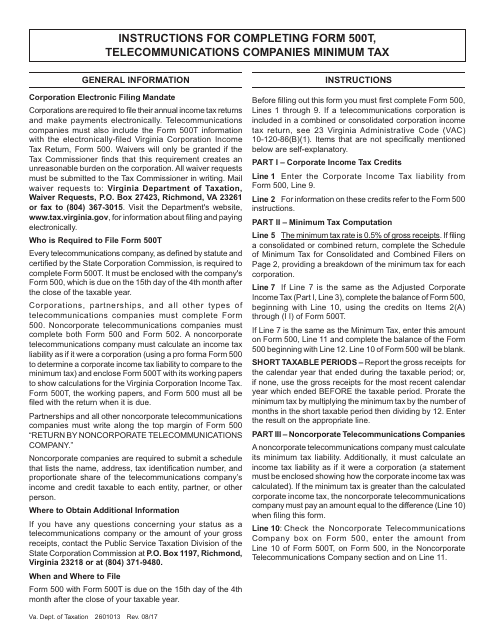

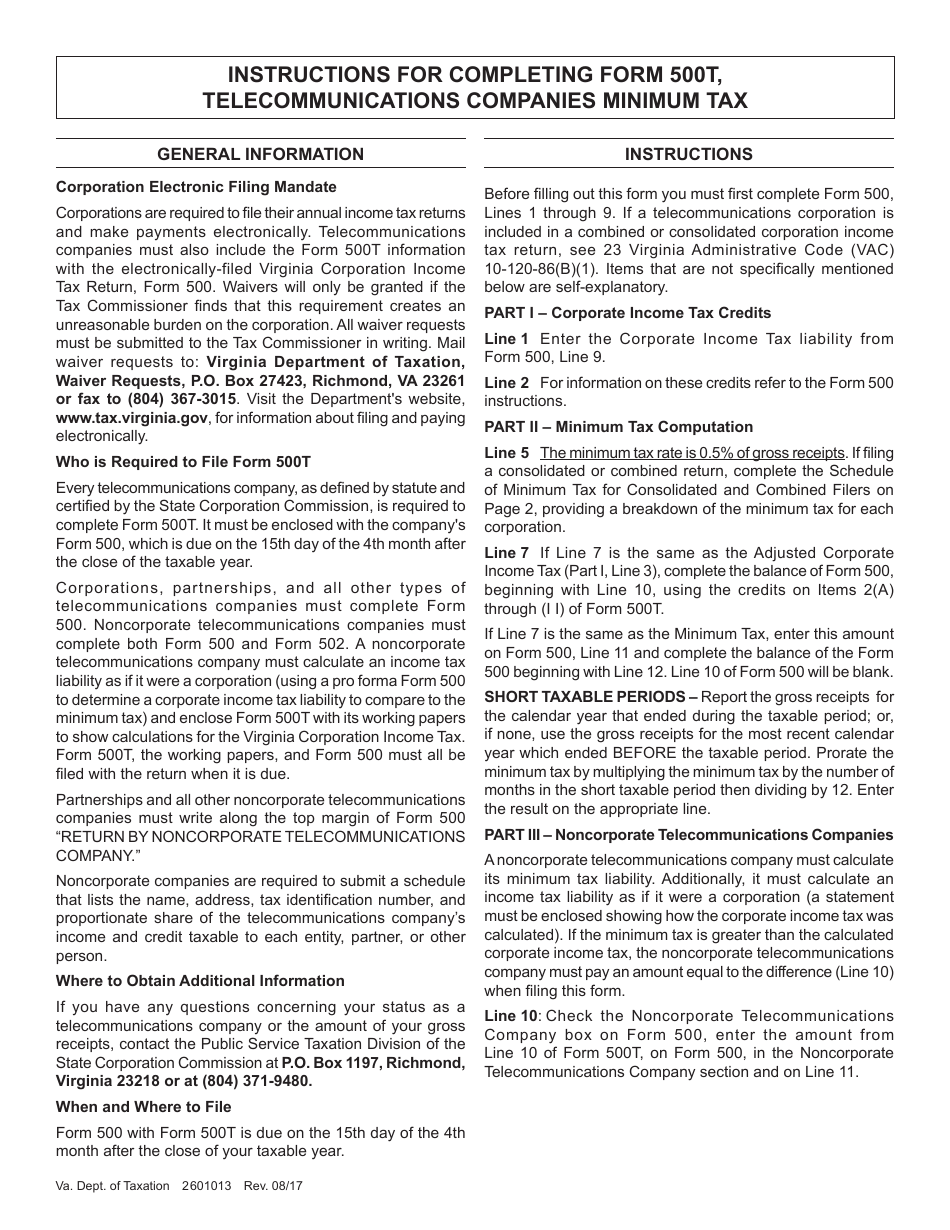

Instructions for Form 500T Telecommunications Companies Minimum Tax - Virginia

This document contains official instructions for Form 500T , Telecommunications Companies Minimum Tax - a form released and collected by the Virginia Department of Taxation.

FAQ

Q: What is Form 500T?

A: Form 500T is a tax form for telecommunications companies in Virginia.

Q: Who needs to file Form 500T?

A: Telecommunications companies in Virginia need to file Form 500T.

Q: What is the purpose of Form 500T?

A: Form 500T is used to calculate and pay the minimum tax for telecommunications companies in Virginia.

Q: When is the due date for Form 500T?

A: The due date for Form 500T varies, but it is generally due by May 1st of each year.

Q: Are there any penalties for late filing of Form 500T?

A: Yes, there may be penalties for late filing of Form 500T, so it's important to file on time.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Virginia Department of Taxation.