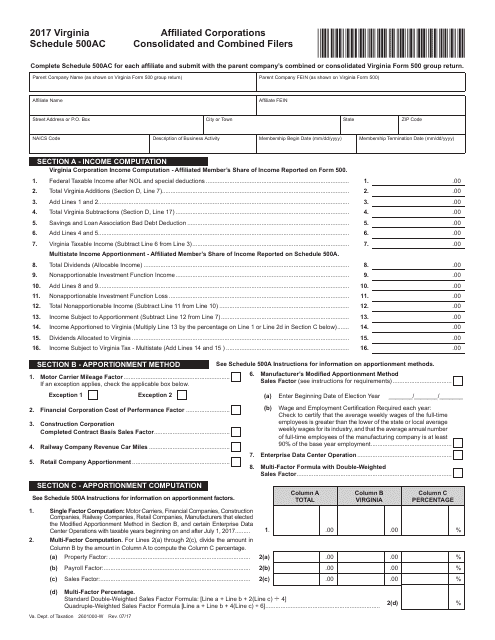

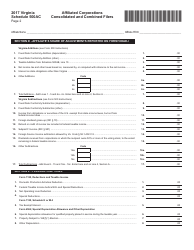

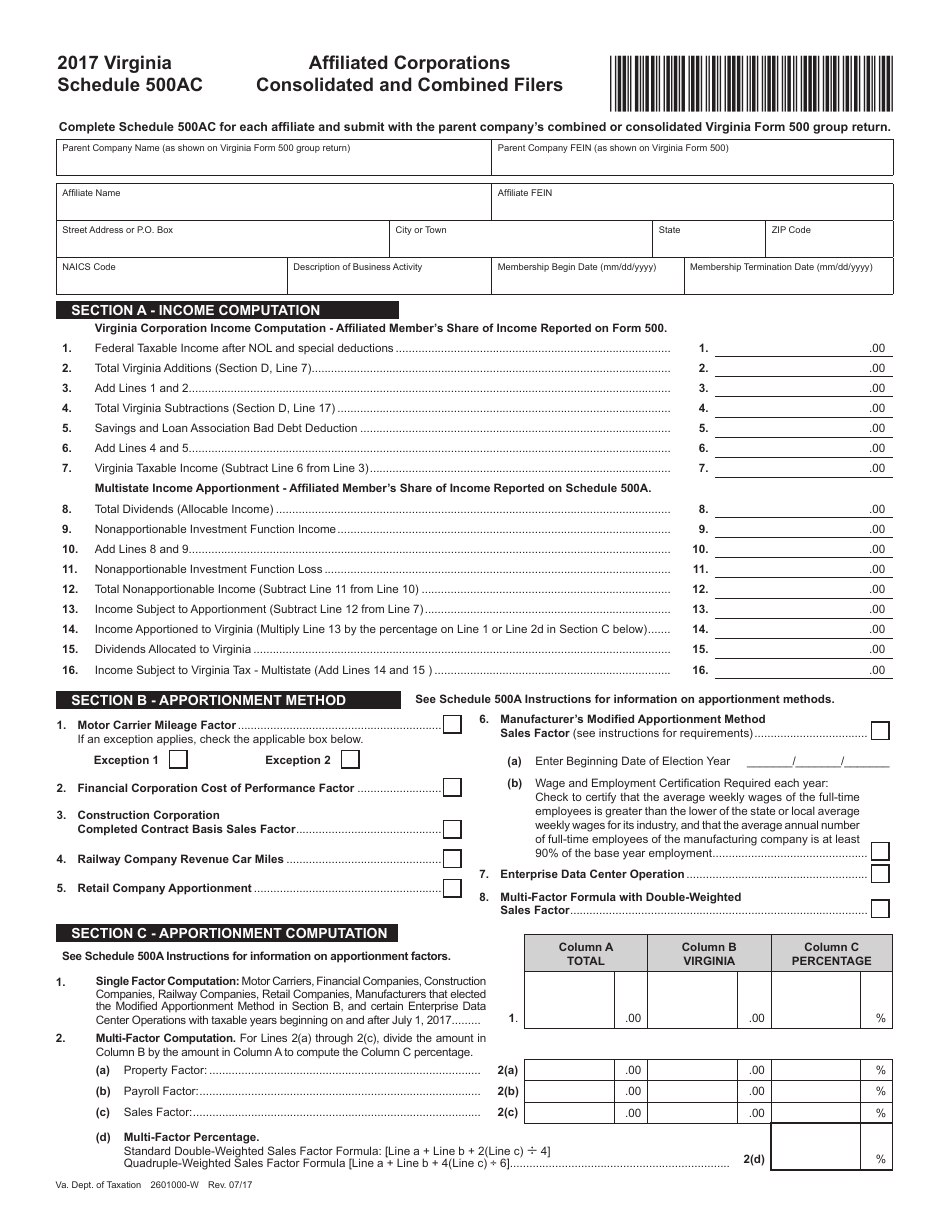

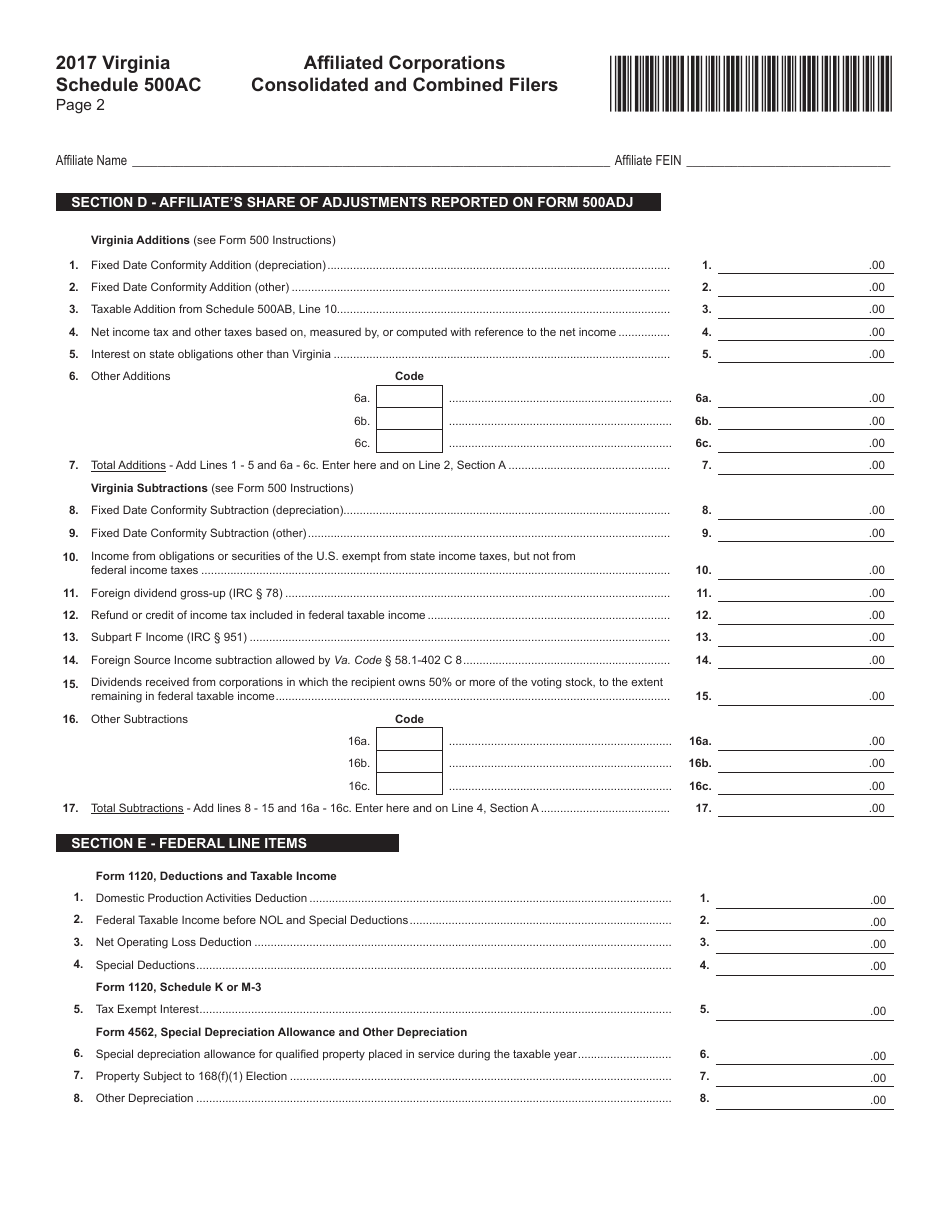

Form 2601000-W Schedule 500AC Affiliated Corporations Consolidated and Combined Filers - Virginia

What Is Form 2601000-W Schedule 500AC?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 2601000-W Schedule 500AC?

A: Form 2601000-W Schedule 500AC is a form used by affiliated corporations as part of their consolidated and combined filers in Virginia.

Q: Who uses Form 2601000-W Schedule 500AC?

A: Affiliated corporations that are required to file consolidated and combined returns in Virginia use Form 2601000-W Schedule 500AC.

Q: What is the purpose of Form 2601000-W Schedule 500AC?

A: The purpose of Form 2601000-W Schedule 500AC is to provide information on the affiliated corporations that are part of a consolidated and combined filing in the state of Virginia.

Q: Is Form 2601000-W Schedule 500AC specific to Virginia?

A: Yes, Form 2601000-W Schedule 500AC is specific to filing consolidated and combined returns in the state of Virginia.

Form Details:

- Released on July 1, 2017;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 2601000-W Schedule 500AC by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.