This version of the form is not currently in use and is provided for reference only. Download this version of

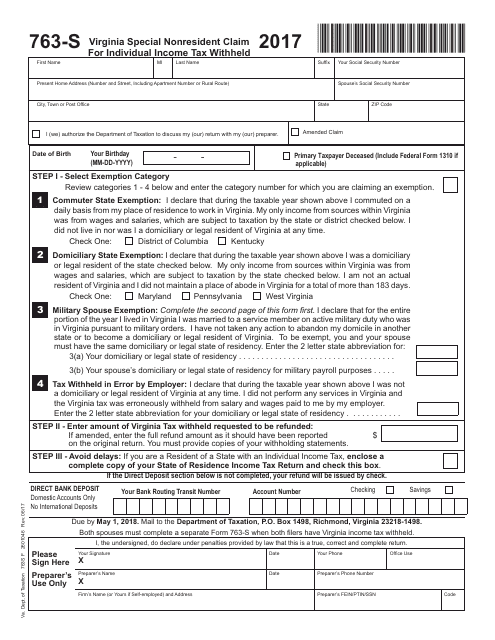

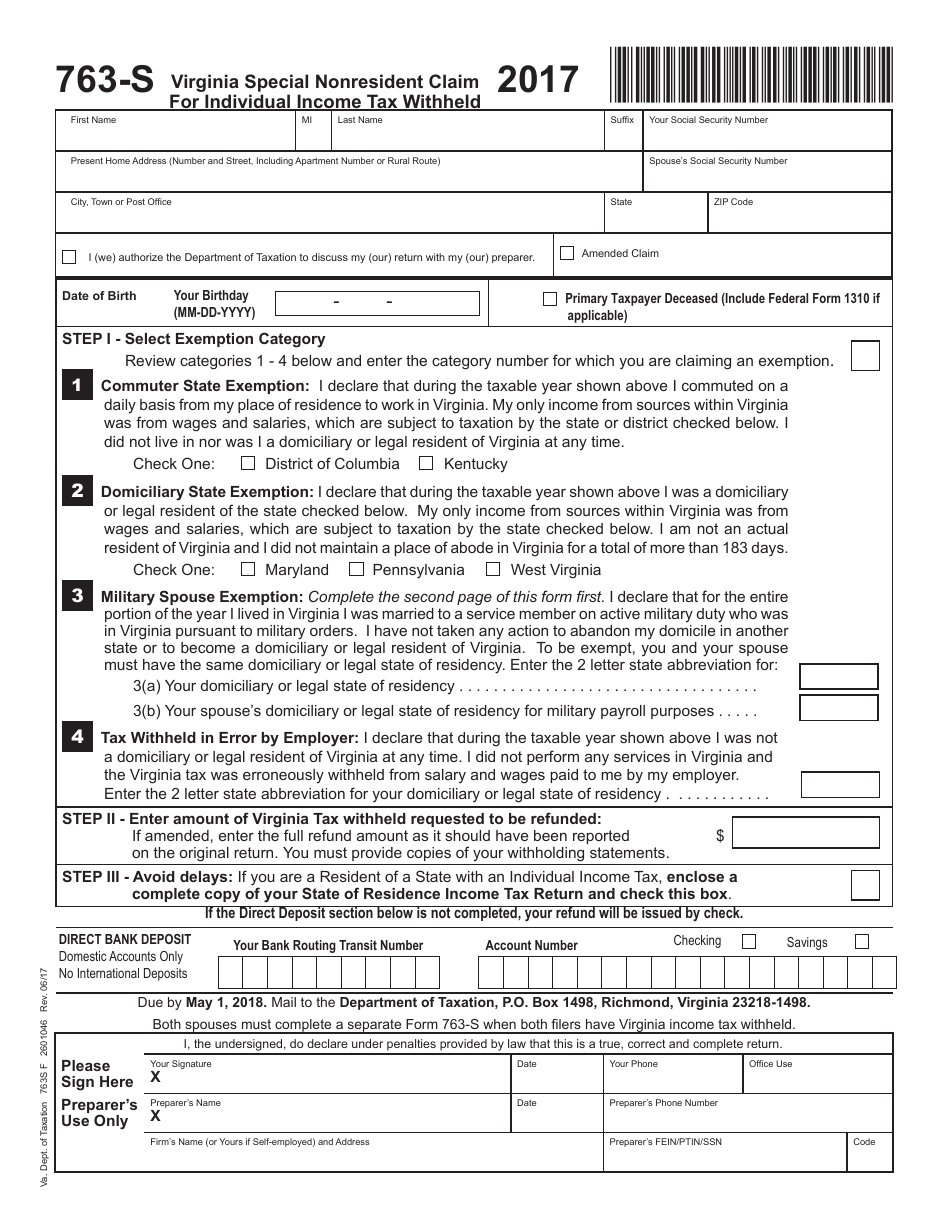

Form 763-S

for the current year.

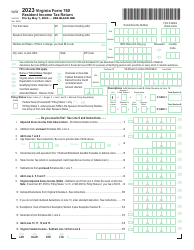

Form 763-S Special Nonresident Claim for Individual Income Tax Withheld - Virginia

What Is Form 763-S?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 763-S?

A: Form 763-S is the Special Nonresident Claim for Individual Income Tax Withheld in Virginia.

Q: Who should use Form 763-S?

A: Form 763-S should be used by nonresident individuals who have had income tax withheld in Virginia.

Q: When should I use Form 763-S?

A: You should use Form 763-S if you are a nonresident individual and you had income tax withheld in Virginia.

Q: What is the purpose of Form 763-S?

A: The purpose of Form 763-S is to claim a refund of Virginia income tax that was withheld from your wages or other income.

Q: Is there a deadline for filing Form 763-S?

A: Yes, Form 763-S must be filed within 3 years from the original due date of the tax return for the tax year in question.

Q: Do I have to include any supporting documentation with Form 763-S?

A: Yes, you must include copies of your federal income tax return and any other supporting documentation that verifies the amount of Virginia income tax withheld.

Q: What do I do with Form 763-S once completed?

A: Once completed, you should mail Form 763-S and any supporting documentation to the Virginia Department of Taxation.

Q: How long will it take to receive a refund from Form 763-S?

A: Typically, it takes about 8-10 weeks for the Virginia Department of Taxation to process and issue a refund.

Q: Can I file Form 763-S electronically?

A: No, currently Form 763-S cannot be filed electronically and must be submitted by mail.

Form Details:

- Released on June 1, 2017;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 763-S by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.