This version of the form is not currently in use and is provided for reference only. Download this version of

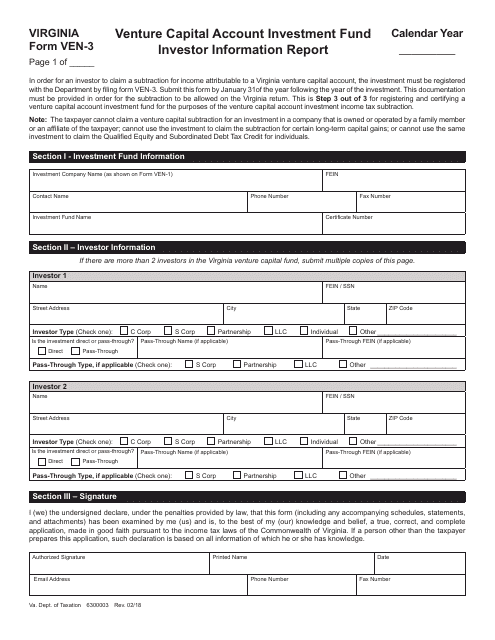

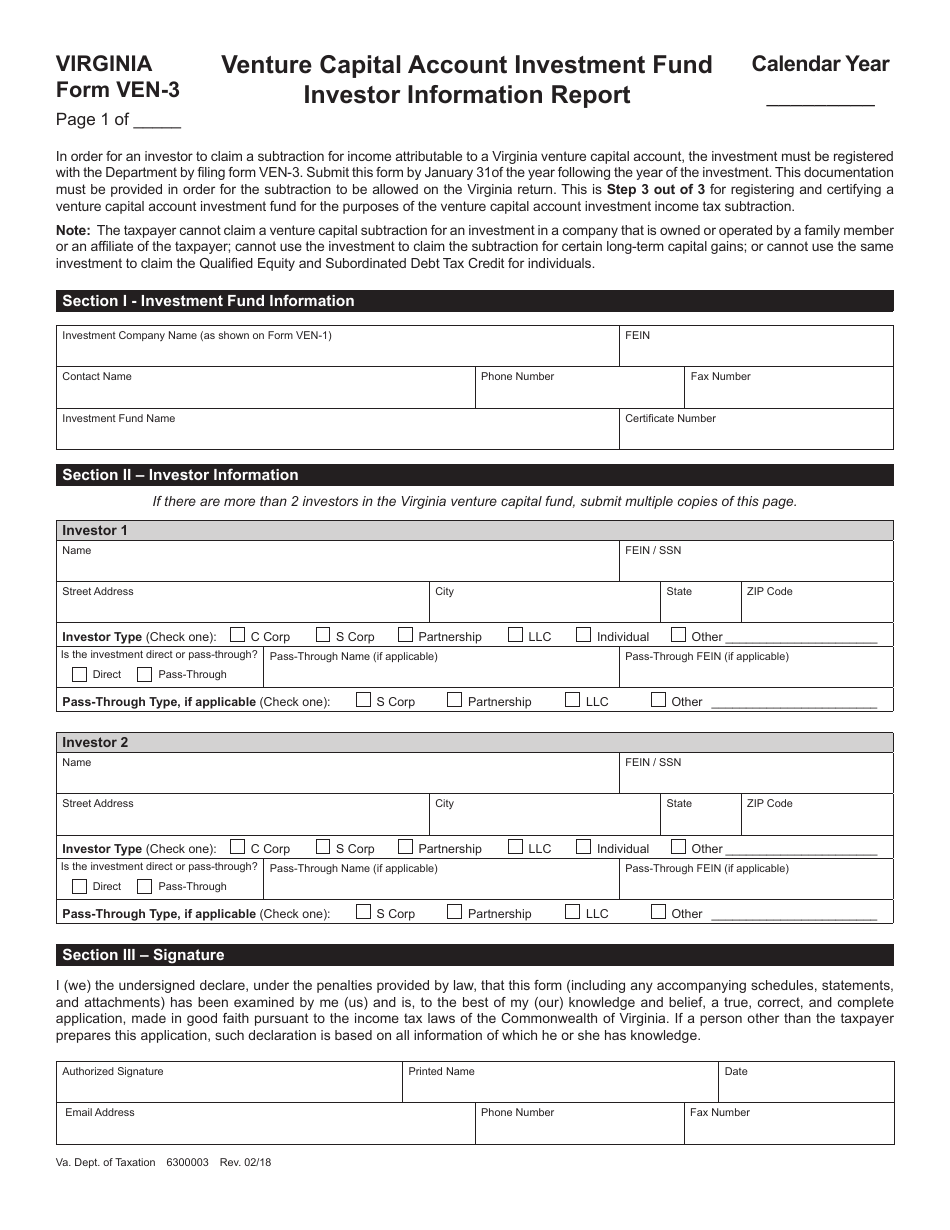

Form VEN-3

for the current year.

Form VEN-3 Venture Capital Account Investment Fund Investor Information Report - Virginia

What Is Form VEN-3?

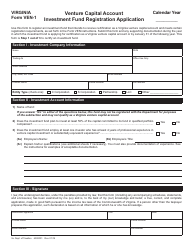

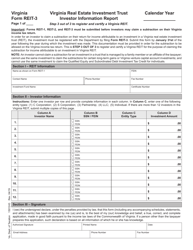

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form VEN-3?

A: Form VEN-3 is the Venture Capital Account Investment Fund Investor Information Report.

Q: What is the purpose of Form VEN-3?

A: The purpose of Form VEN-3 is to provide information about an investor's venture capital account investment fund.

Q: Who needs to file Form VEN-3?

A: Investors in a venture capital account investment fund in Virginia need to file Form VEN-3.

Q: What information is required on Form VEN-3?

A: Form VEN-3 requires information such as the investor's name, contact information, investment amount, and other details about the venture capital account investment fund.

Q: Is there a deadline for filing Form VEN-3?

A: Yes, Form VEN-3 must be filed on or before the 15th day of the fourth month following the close of the taxable year.

Q: Are there any penalties for late filing of Form VEN-3?

A: Yes, late filing of Form VEN-3 may result in penalties and interest.

Q: Is Form VEN-3 specific to Virginia?

A: Yes, Form VEN-3 is specific to venture capital account investment funds in Virginia.

Q: Is there a fee for filing Form VEN-3?

A: No, there is no fee for filing Form VEN-3.

Form Details:

- Released on February 1, 2018;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form VEN-3 by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.