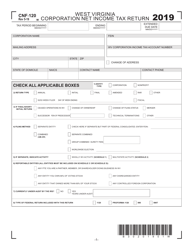

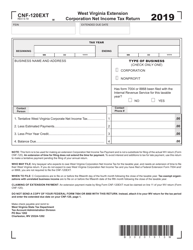

This version of the form is not currently in use and is provided for reference only. Download this version of

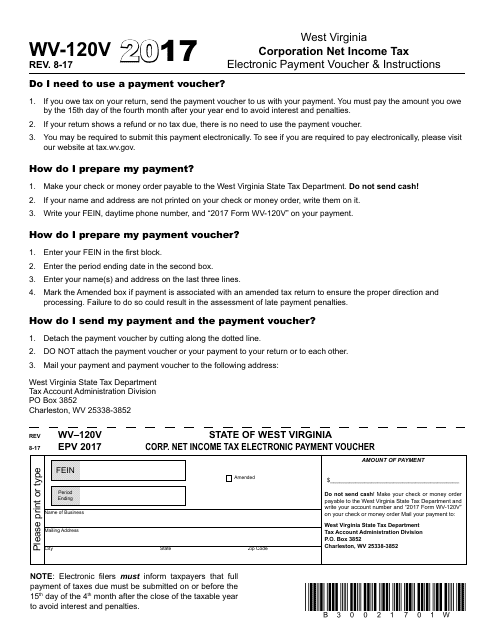

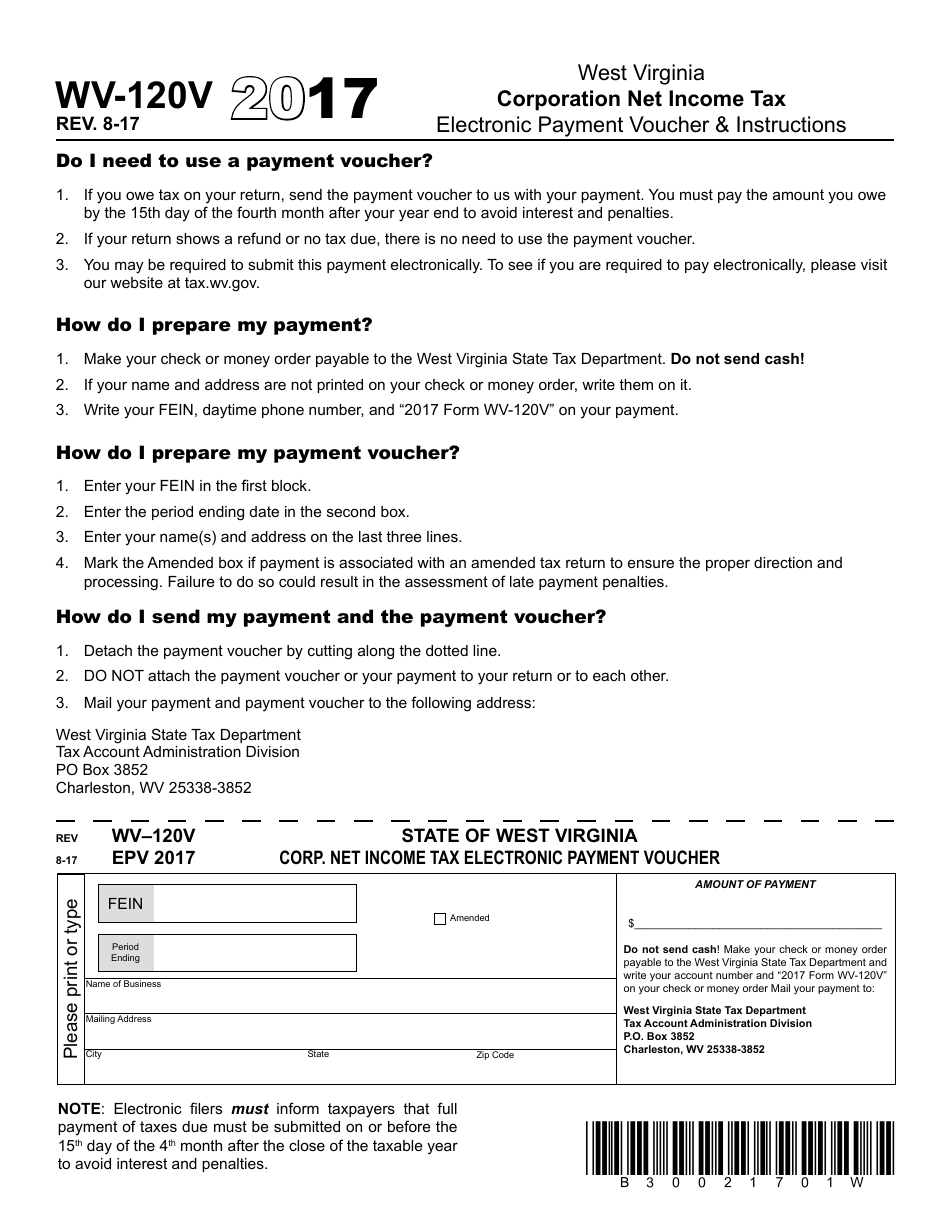

Form WV-120v

for the current year.

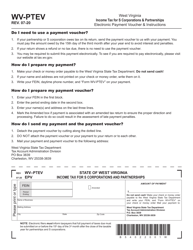

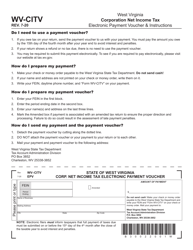

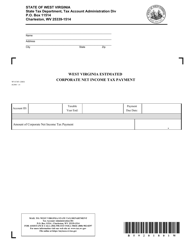

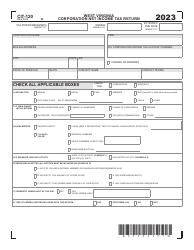

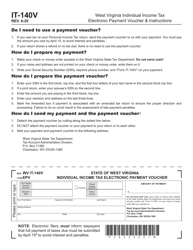

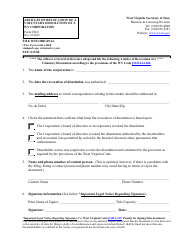

Form WV-120v West Virginia Corporation Net Income Tax Electronic Payment Voucher - West Virginia

What Is Form WV-120v?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

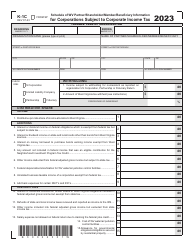

Q: What is Form WV-120v?

A: Form WV-120v is the West Virginia Corporation Net Income TaxElectronic Payment Voucher.

Q: What is the purpose of Form WV-120v?

A: The purpose of Form WV-120v is to make electronic payments for West Virginia Corporation Net Income Tax.

Q: Who needs to file Form WV-120v?

A: Corporations in West Virginia who are required to pay Net Income Tax electronically need to file Form WV-120v.

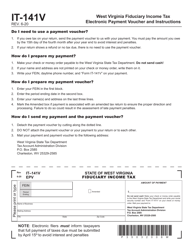

Q: Is Form WV-120v available in paper format?

A: No, Form WV-120v is only available for electronic filing and payment.

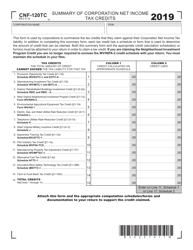

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form WV-120v by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.