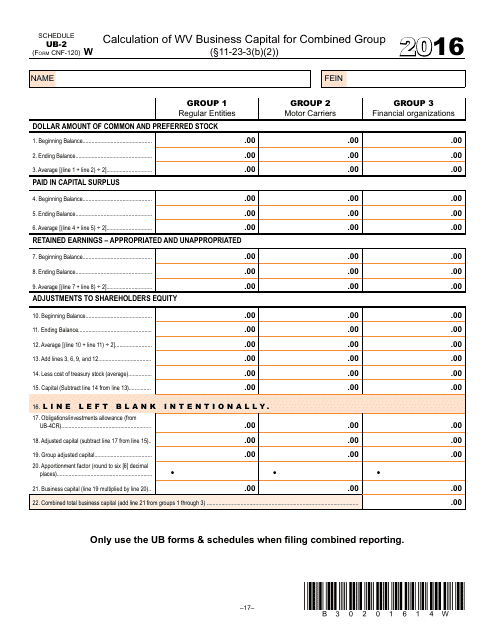

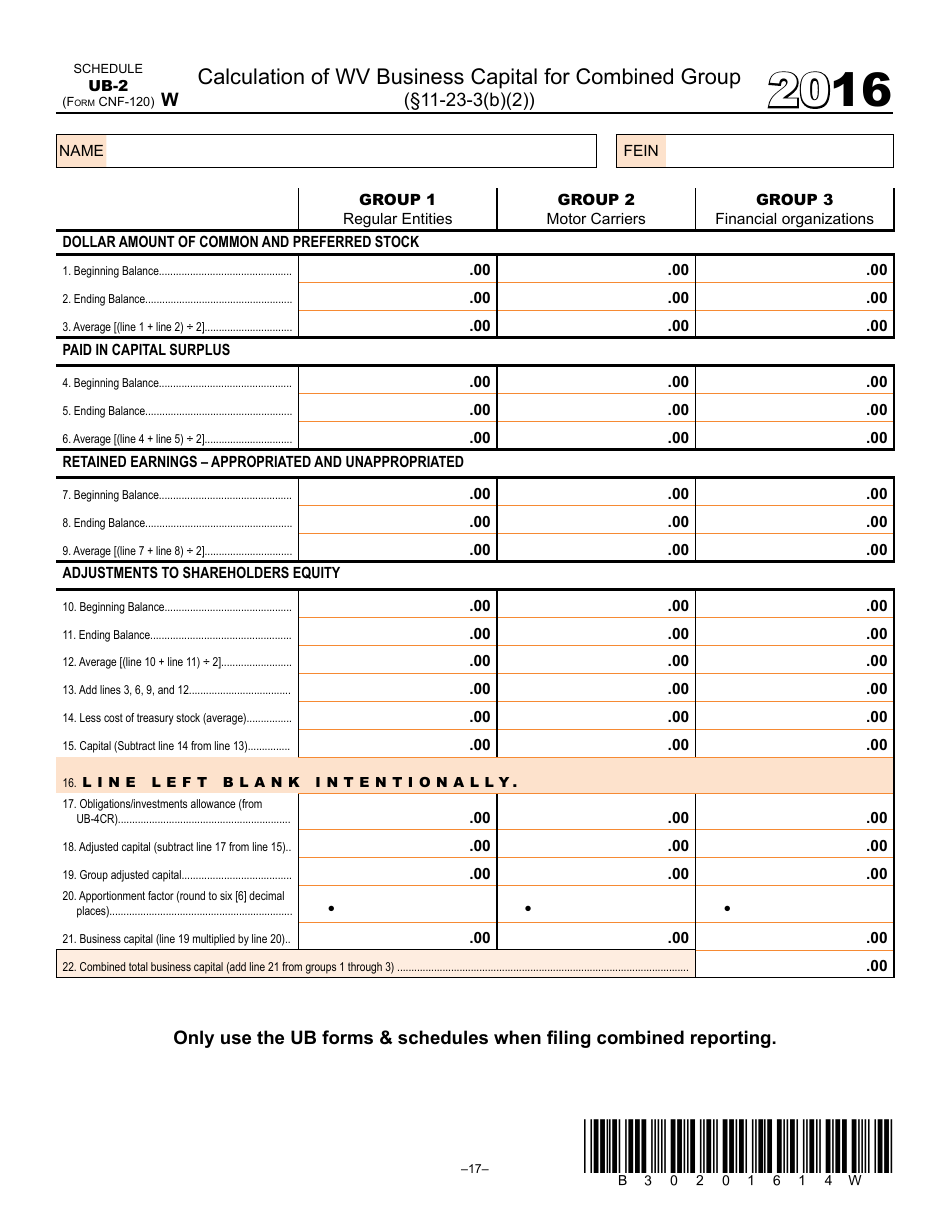

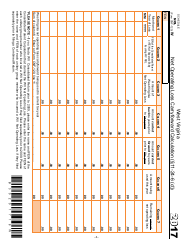

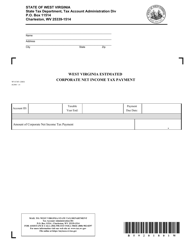

Form WV / CNF-120 Schedule UB-2 Calculation of Wv Business Capital for Combined Group - West Virginia

What Is Form WV/CNF-120 Schedule UB-2?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form WV/CNF-120?

A: Form WV/CNF-120 is a form used in West Virginia to calculate the business capital for a combined group.

Q: What is Schedule UB-2?

A: Schedule UB-2 is a specific schedule on Form WV/CNF-120 used to calculate the business capital specifically for the group's West Virginia operations.

Q: What does 'WV Business Capital' mean?

A: 'WV Business Capital' refers to the capital invested by a group of businesses specifically in their West Virginia operations.

Q: What is a 'Combined Group'?

A: A 'Combined Group' refers to a collection of businesses that have elected to file a combined tax return in West Virginia.

Q: Why is it important to calculate WV Business Capital?

A: Calculating WV Business Capital is important as it determines the group's apportionment factor for West Virginia tax purposes.

Q: Who should use Form WV/CNF-120 Schedule UB-2?

A: Form WV/CNF-120 Schedule UB-2 should be used by businesses that are part of a combined group and have operations in West Virginia.

Q: Are there any specific instructions for completing Schedule UB-2?

A: Yes, there are specific instructions provided on the form itself to assist in completing Schedule UB-2.

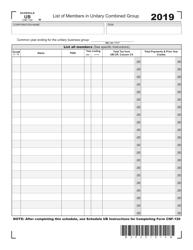

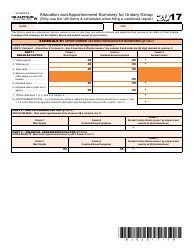

Q: What other forms are required to be filed along with Form WV/CNF-120 Schedule UB-2?

A: The form may require additional schedules or forms depending on the specific circumstances of the combined group's operations.

Q: Is Form WV/CNF-120 Schedule UB-2 only applicable to businesses in West Virginia?

A: Yes, Form WV/CNF-120 Schedule UB-2 is specifically used for businesses operating in West Virginia.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form WV/CNF-120 Schedule UB-2 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.