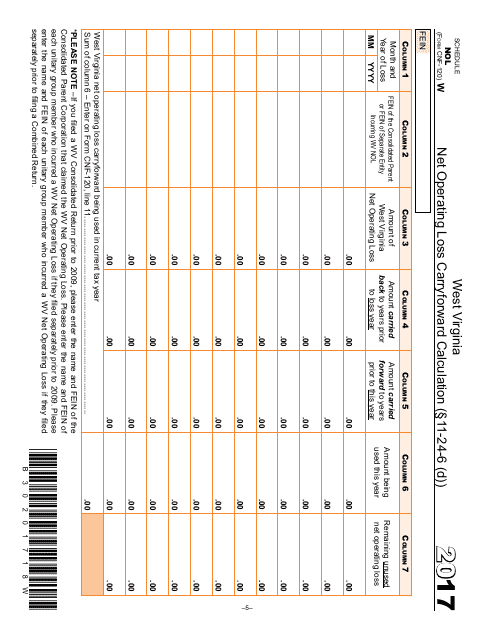

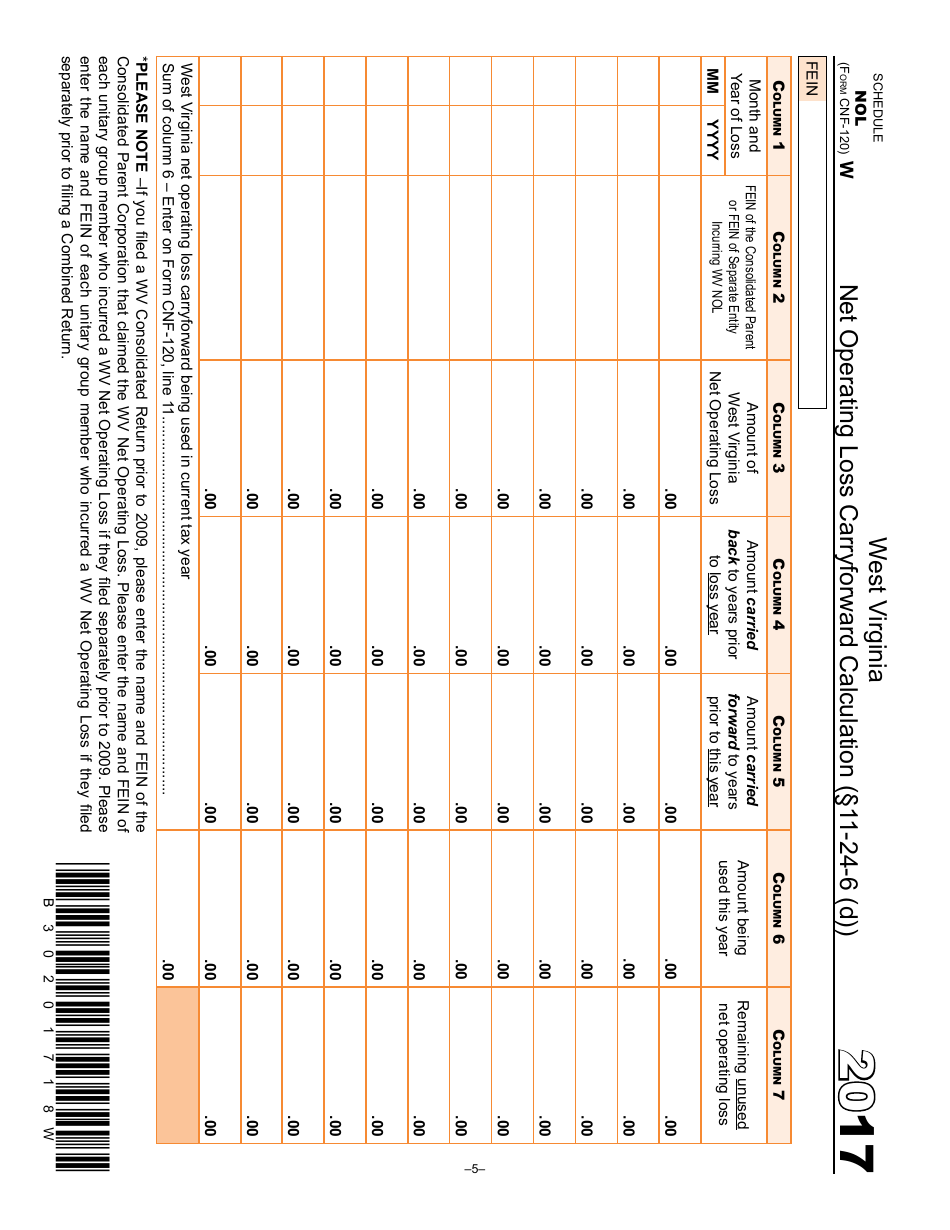

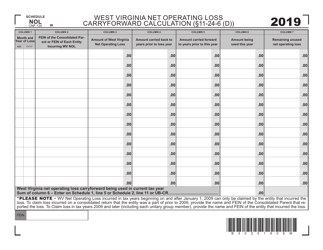

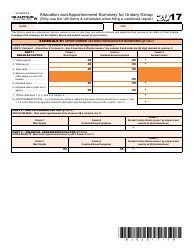

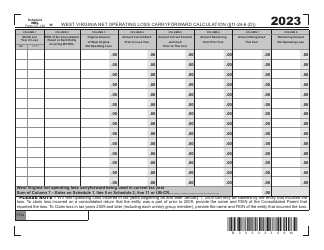

Form WV / CNF-120 Schedule NOL West Virginia Net Operating Loss Carryforward Calculation - West Virginia

What Is Form WV/CNF-120 Schedule NOL?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form WV/CNF-120?

A: Form WV/CNF-120 is a tax form used in West Virginia for calculating the Net Operating Loss (NOL) Carryforward.

Q: What is a Net Operating Loss (NOL) Carryforward?

A: A Net Operating Loss (NOL) Carryforward is a tax provision that allows businesses to use losses from previous years to offset future taxable income.

Q: What is Schedule NOL?

A: Schedule NOL is a part of Form WV/CNF-120 that specifically calculates the Net Operating Loss (NOL) Carryforward.

Q: Why would a business use the Net Operating Loss (NOL) Carryforward?

A: Businesses may use the NOL Carryforward to reduce their tax liability in future years when they have taxable income.

Q: Who needs to file Form WV/CNF-120 Schedule NOL?

A: Businesses in West Virginia that have a Net Operating Loss (NOL) and want to carry it forward to future tax years need to file Form WV/CNF-120 Schedule NOL.

Q: What information is required on the Schedule NOL?

A: The Schedule NOL requires information about the business's net operating loss for the tax year, any Section 179 expense deduction, and any other state NOL used in the calculation.

Q: When is the deadline to file Form WV/CNF-120 Schedule NOL?

A: The deadline to file Form WV/CNF-120 Schedule NOL is the same as the deadline for filing your West Virginia state income tax return.

Q: Are there any fees associated with filing Form WV/CNF-120 Schedule NOL?

A: There are no fees to file Form WV/CNF-120 Schedule NOL with the West Virginia State Tax Department.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form WV/CNF-120 Schedule NOL by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.