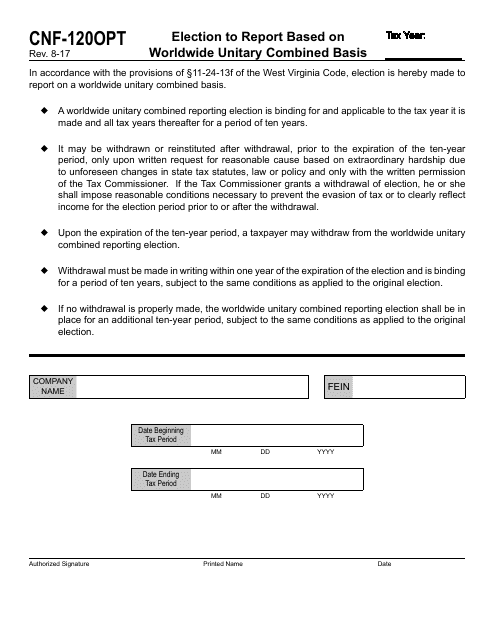

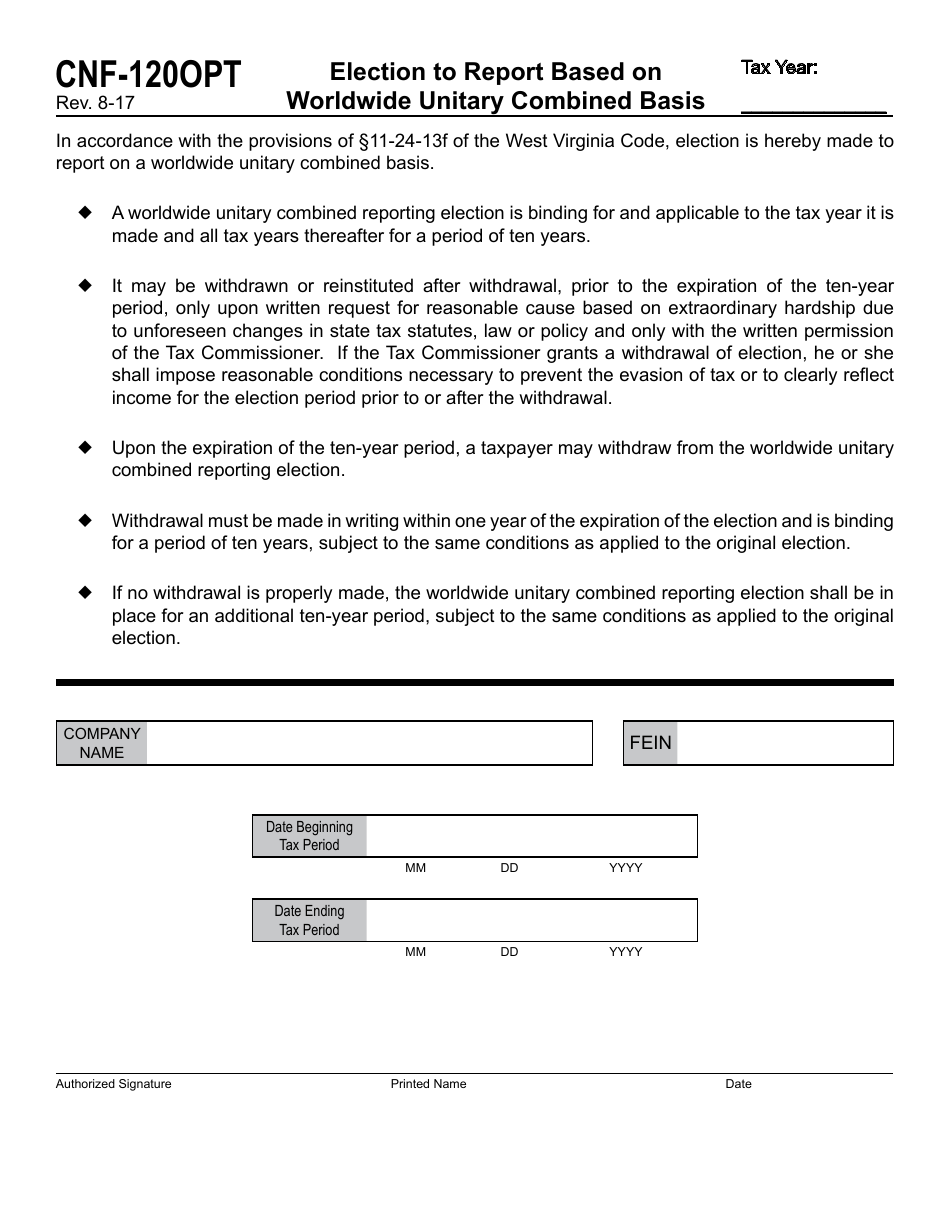

Form CNF-120opt Election to Report Based on Worldwide Unitary Combined Basis - West Virginia

What Is Form CNF-120opt?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CNF-120opt?

A: Form CNF-120opt is the Election to Report Based on Worldwide Unitary Combined Basis form in West Virginia.

Q: What does the form CNF-120opt allow?

A: The form CNF-120opt allows corporations to report their income based on a worldwide unitary combined basis.

Q: Who can use Form CNF-120opt?

A: Corporations in West Virginia that meet certain criteria can use Form CNF-120opt.

Q: What is a worldwide unitary combined basis?

A: A worldwide unitary combined basis is a method of reporting income that combines the income of corporations that are part of a unitary group.

Q: Why would a corporation choose to report based on a worldwide unitary combined basis?

A: Corporations may choose to report based on a worldwide unitary combined basis to potentially reduce their overall tax liability.

Q: Are there any requirements or limitations for using Form CNF-120opt?

A: Yes, there are specific criteria and limitations outlined in the instructions for Form CNF-120opt.

Q: Is Form CNF-120opt applicable only to corporations in West Virginia?

A: Yes, Form CNF-120opt is specific to corporations in West Virginia.

Q: Can individuals use Form CNF-120opt?

A: No, Form CNF-120opt is only for corporations.

Q: Is Form CNF-120opt mandatory?

A: No, Form CNF-120opt is an election form, meaning corporations can choose whether or not to use it.

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CNF-120opt by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.