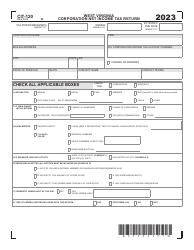

This version of the form is not currently in use and is provided for reference only. Download this version of

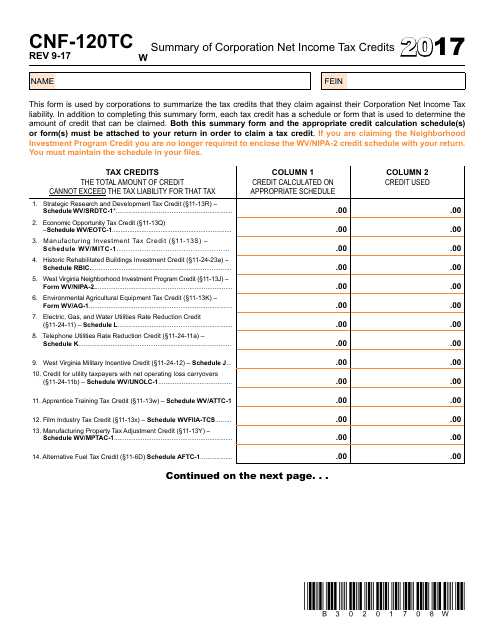

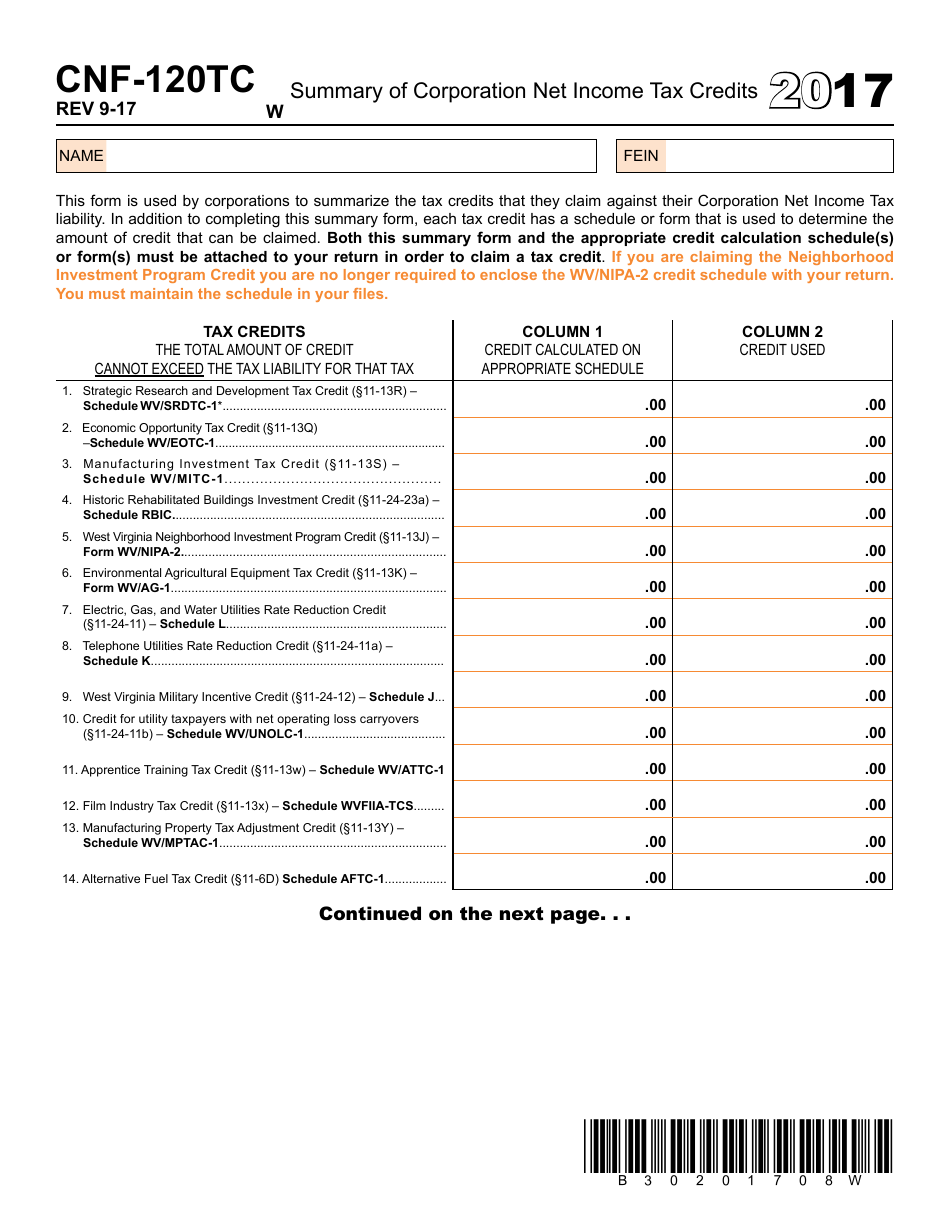

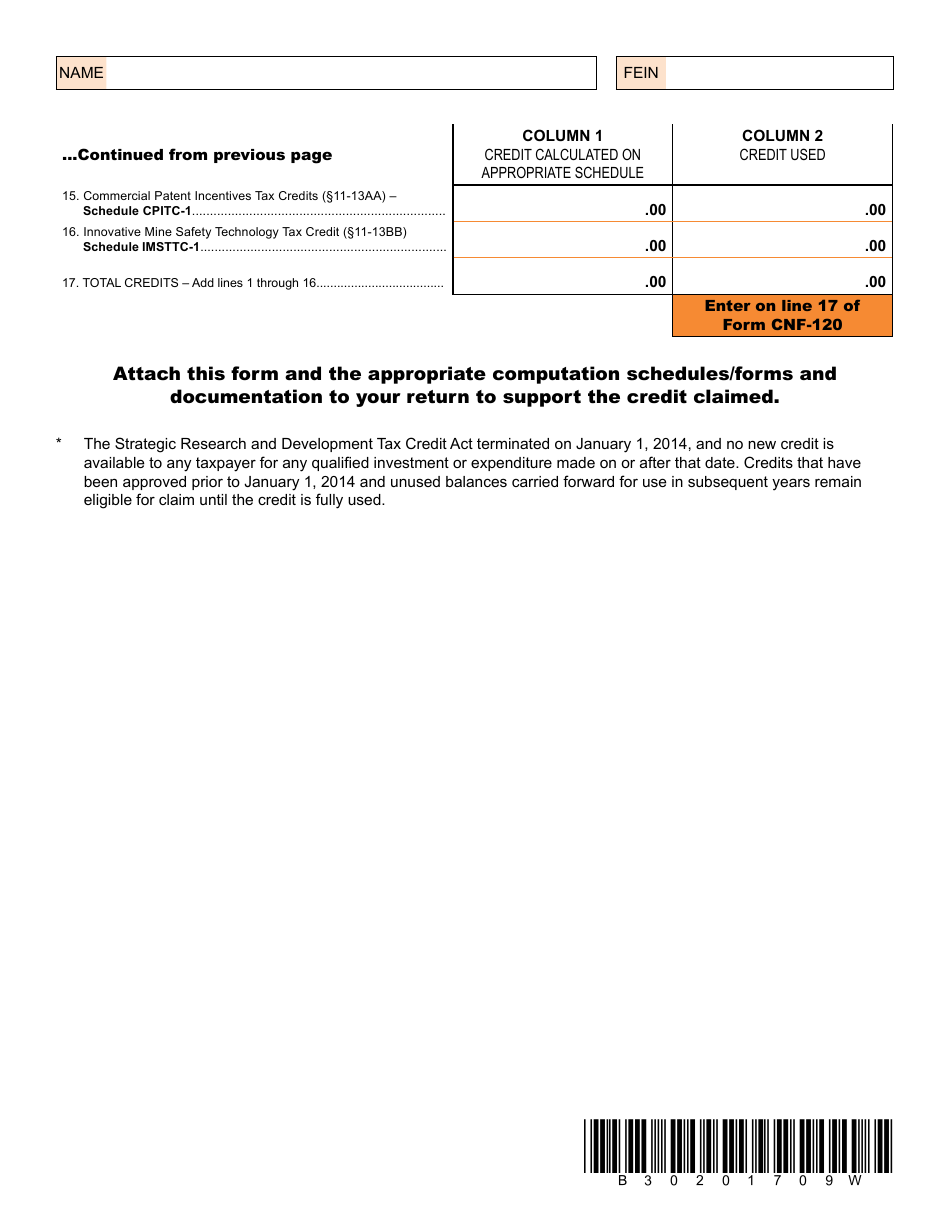

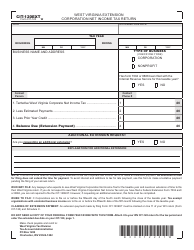

Form CNF-120tc

for the current year.

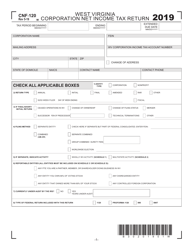

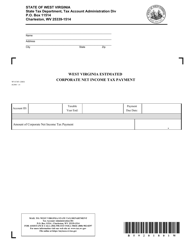

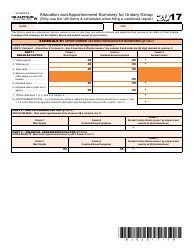

Form CNF-120tc Summary of Corporation Net Income Tax Credits - West Virginia

What Is Form CNF-120tc?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CNF-120tc?

A: Form CNF-120tc is a summary of corporation net income tax credits in West Virginia.

Q: What is the purpose of Form CNF-120tc?

A: The purpose of Form CNF-120tc is to provide a summary of corporation net income tax credits.

Q: Who needs to file Form CNF-120tc?

A: Corporations in West Virginia that have net incometax credits need to file Form CNF-120tc.

Q: What information is required on Form CNF-120tc?

A: Form CNF-120tc requires the corporation's identifying information, details of the net income tax credits, and any carryover amounts.

Q: When is the deadline to file Form CNF-120tc?

A: The deadline to file Form CNF-120tc is usually the same as the deadline for filing the corporation's annual tax return.

Q: Are there any penalties for not filing Form CNF-120tc?

A: Yes, failing to file Form CNF-120tc or filing it late may result in penalties imposed by the West Virginia Department of Revenue.

Form Details:

- Released on September 1, 2017;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CNF-120tc by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.