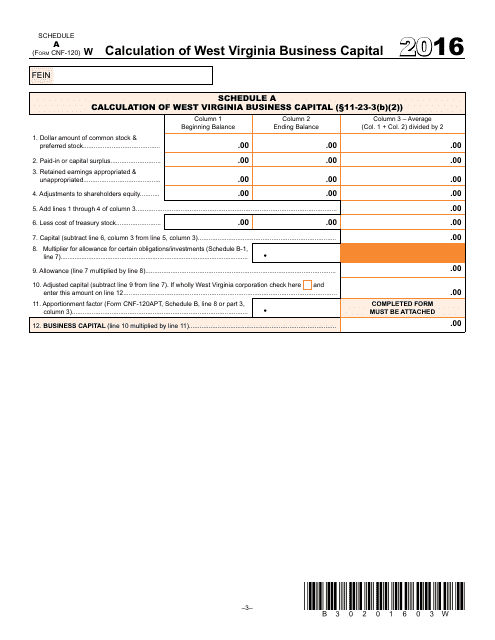

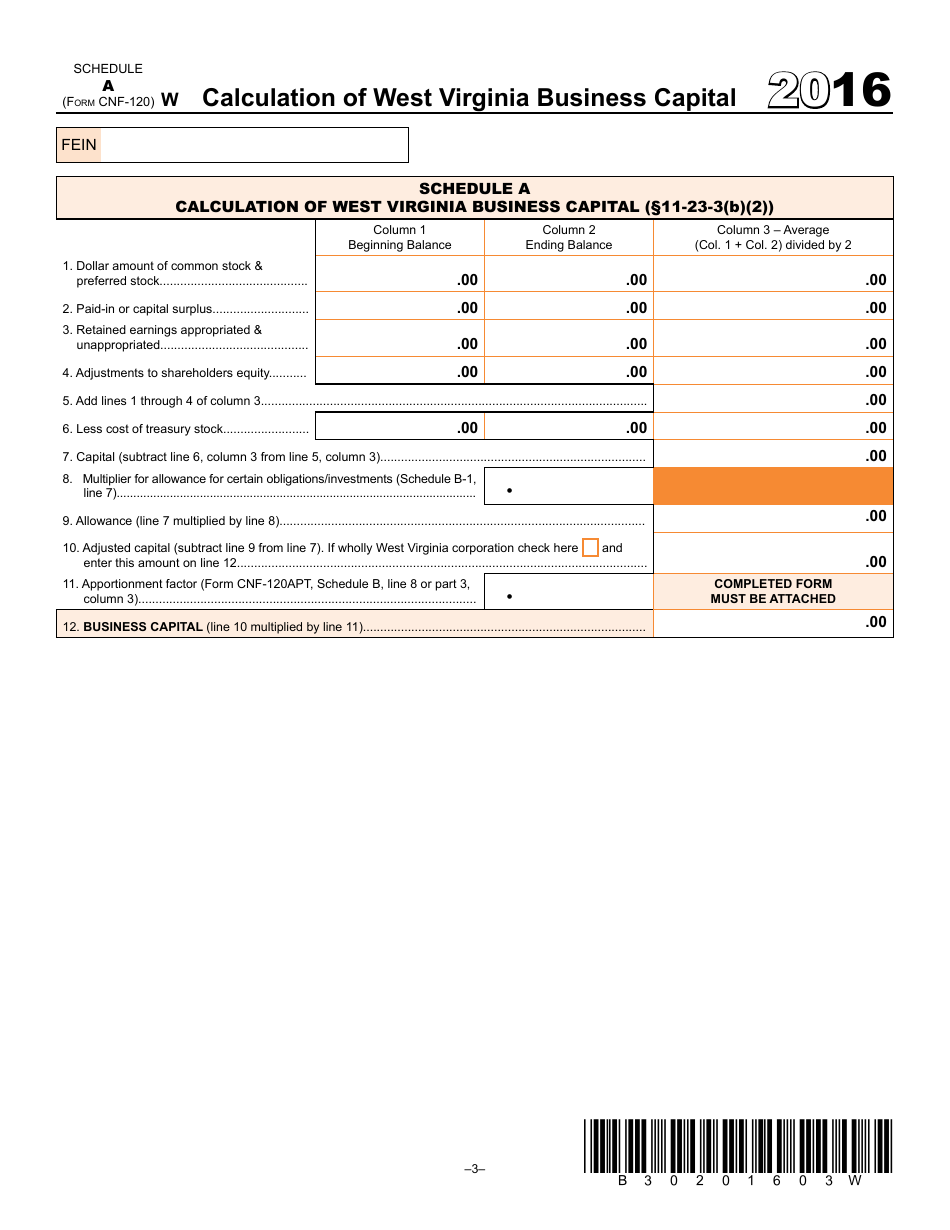

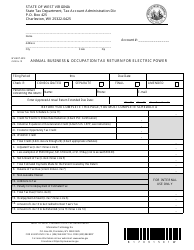

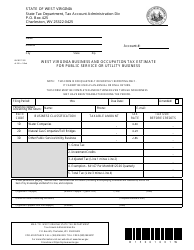

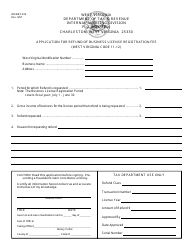

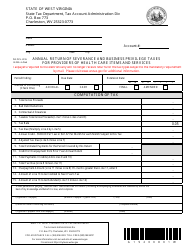

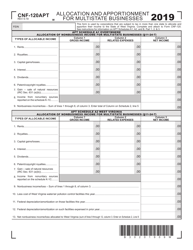

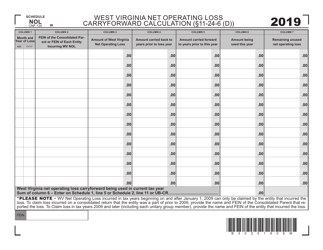

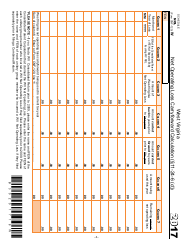

Form WV / CNF-120 Schedule A Calculation of West Virginia Business Capital - West Virginia

What Is Form WV/CNF-120 Schedule A?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is WV/CNF-120?

A: WV/CNF-120 is a form used in West Virginia to calculate the business capital of a company.

Q: What is Schedule A on form WV/CNF-120?

A: Schedule A is a specific section on the WV/CNF-120 form where you calculate the West Virginia business capital.

Q: What is the purpose of calculating West Virginia business capital?

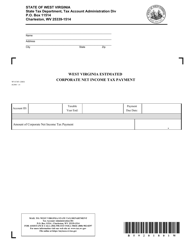

A: Calculating West Virginia business capital is necessary for tax purposes and determining the amount of taxes owed to the state.

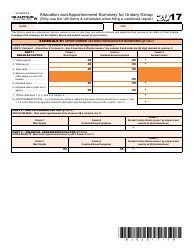

Q: How do I fill out Schedule A?

A: To fill out Schedule A on form WV/CNF-120, you will need to provide detailed information about your business assets, liabilities, and investments.

Q: Is it required to file WV/CNF-120 if I have a business in West Virginia?

A: Yes, if you have a business in West Virginia, it is required to file form WV/CNF-120 and complete Schedule A to calculate the business capital.

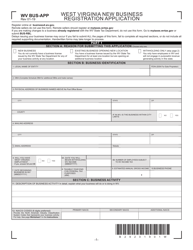

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form WV/CNF-120 Schedule A by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.