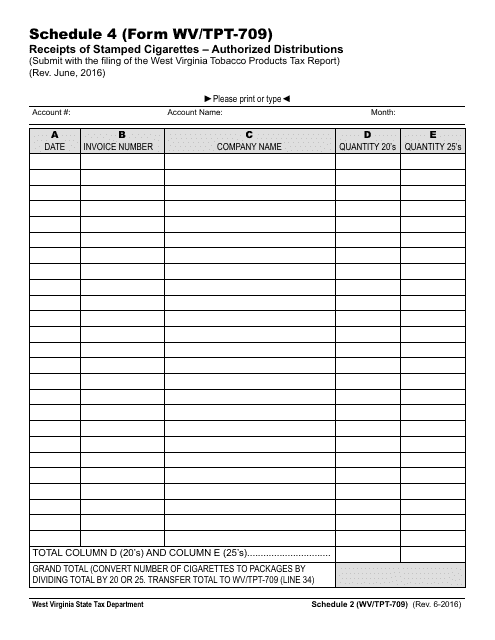

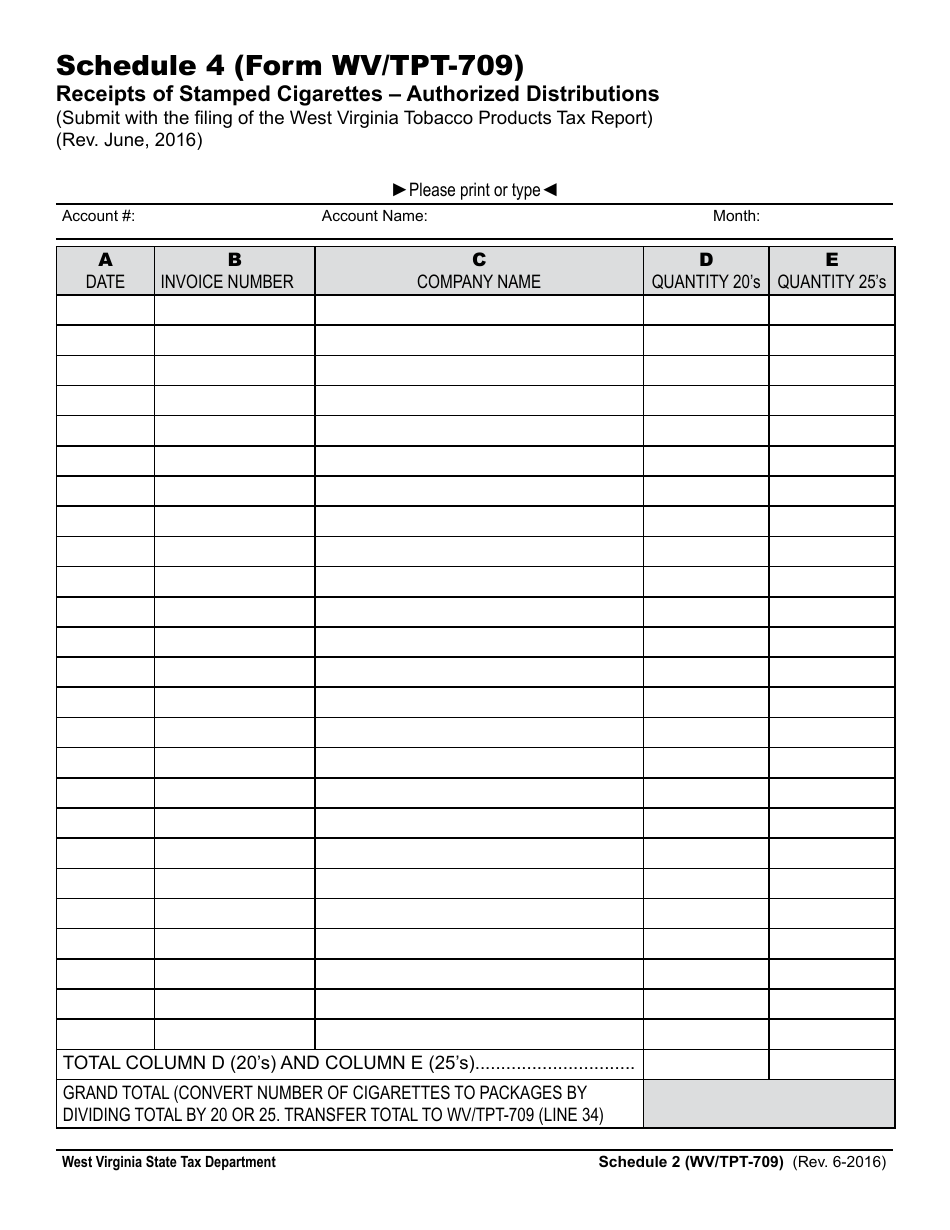

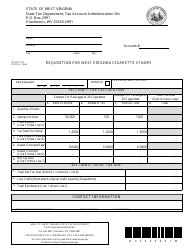

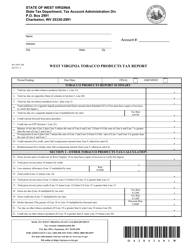

Form WV / TPT-709 Schedule 4 Receipts of Stamped Cigarettes - Authorized Distributions - West Virginia

What Is Form WV/TPT-709 Schedule 4?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia.The document is a supplement to Form WV/TPT-709, West Virginia Tobacco Products Tax Report. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form WV/TPT-709?

A: Form WV/TPT-709 is a schedule used to report the receipts of stamped cigarettes in West Virginia.

Q: What is Schedule 4?

A: Schedule 4 is a section within Form WV/TPT-709 where authorized distributions of stamped cigarettes are reported.

Q: What are receipts of stamped cigarettes?

A: Receipts of stamped cigarettes refer to the total number of cigarettes that have been received and stamped by the relevant authorities.

Q: What are authorized distributions?

A: Authorized distributions are the cigarettes that have been legally distributed by the entity or individual in compliance with the applicable regulations in West Virginia.

Form Details:

- Released on June 1, 2016;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form WV/TPT-709 Schedule 4 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.