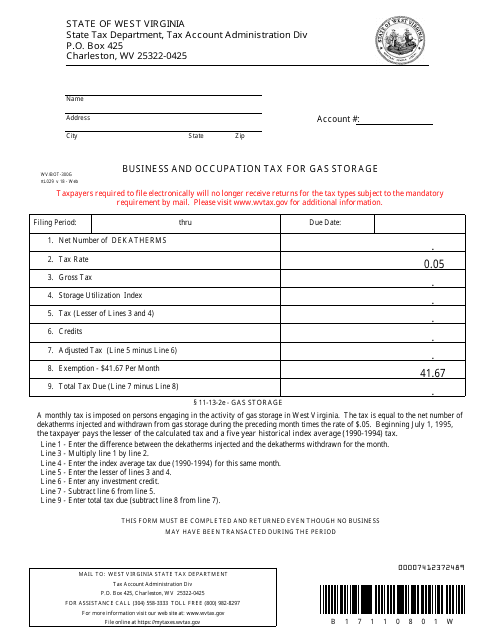

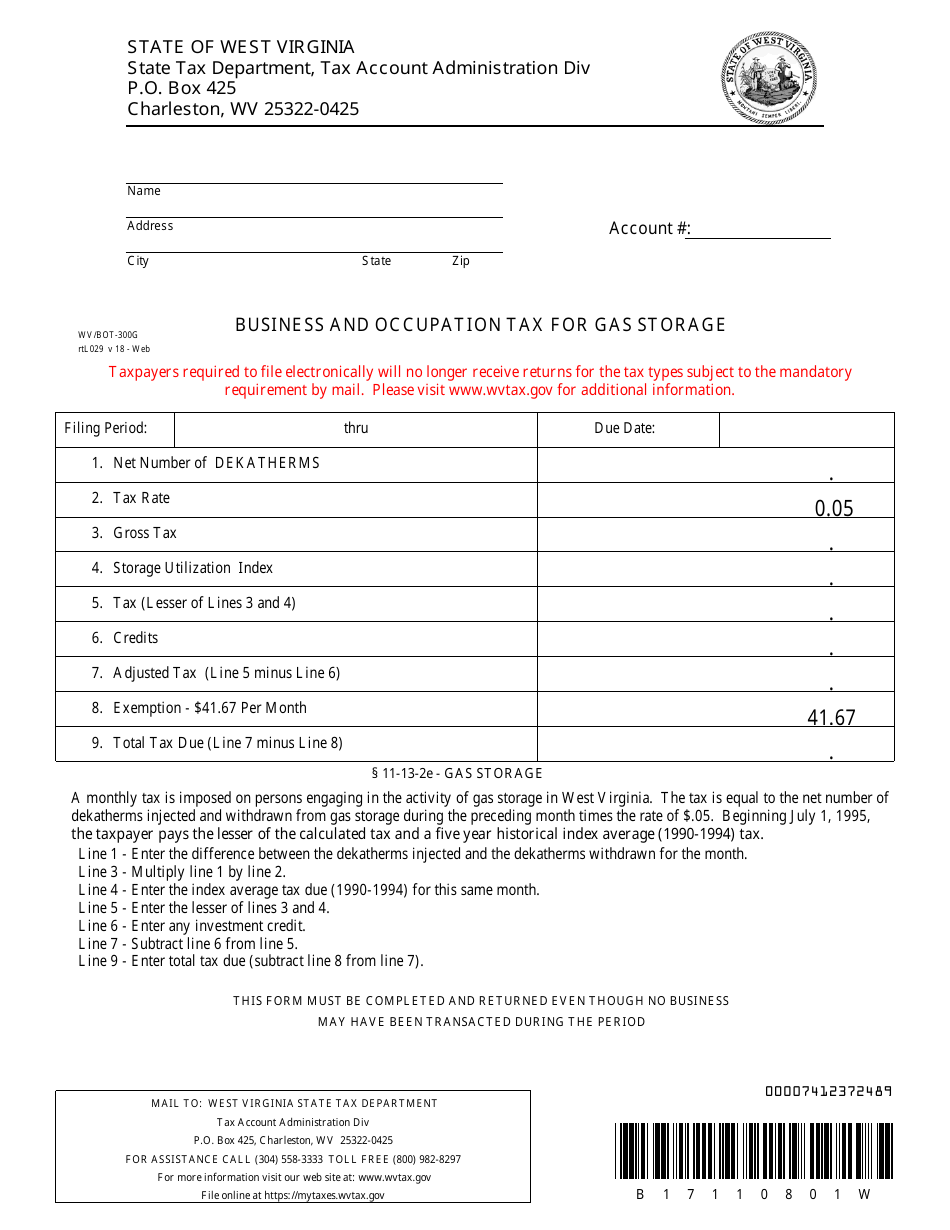

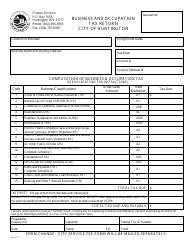

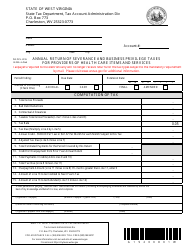

Form WV / BOT-300g Business and Occupation Tax for Gas Storage - West Virginia

What Is Form WV/BOT-300g?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is WV/BOT-300g?

A: WV/BOT-300g is the Business and Occupation Tax form for Gas Storage in West Virginia.

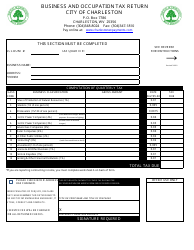

Q: Who needs to file WV/BOT-300g?

A: Anyone engaged in gas storage activities in West Virginia needs to file the WV/BOT-300g form.

Q: What is the purpose of WV/BOT-300g?

A: The purpose of WV/BOT-300g is to report and pay the Business and Occupation Tax for Gas Storage in West Virginia.

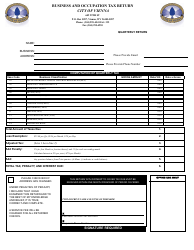

Q: How often does WV/BOT-300g need to be filed?

A: WV/BOT-300g needs to be filed on a quarterly basis.

Q: What information do I need to complete the WV/BOT-300g form?

A: You will need information about your gas storage activities and the corresponding tax liabilities.

Q: Are there any exemptions or deductions available with the WV/BOT-300g?

A: There may be exemptions or deductions available, depending on your specific situation. Please refer to the instructions and consult with a tax professional for more information.

Q: When is the deadline to file WV/BOT-300g?

A: The deadline to file WV/BOT-300g is the 20th day of the month following the end of each quarter.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form WV/BOT-300g by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.