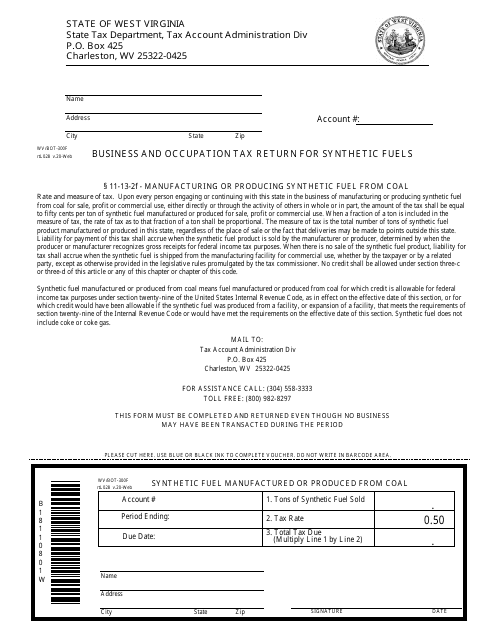

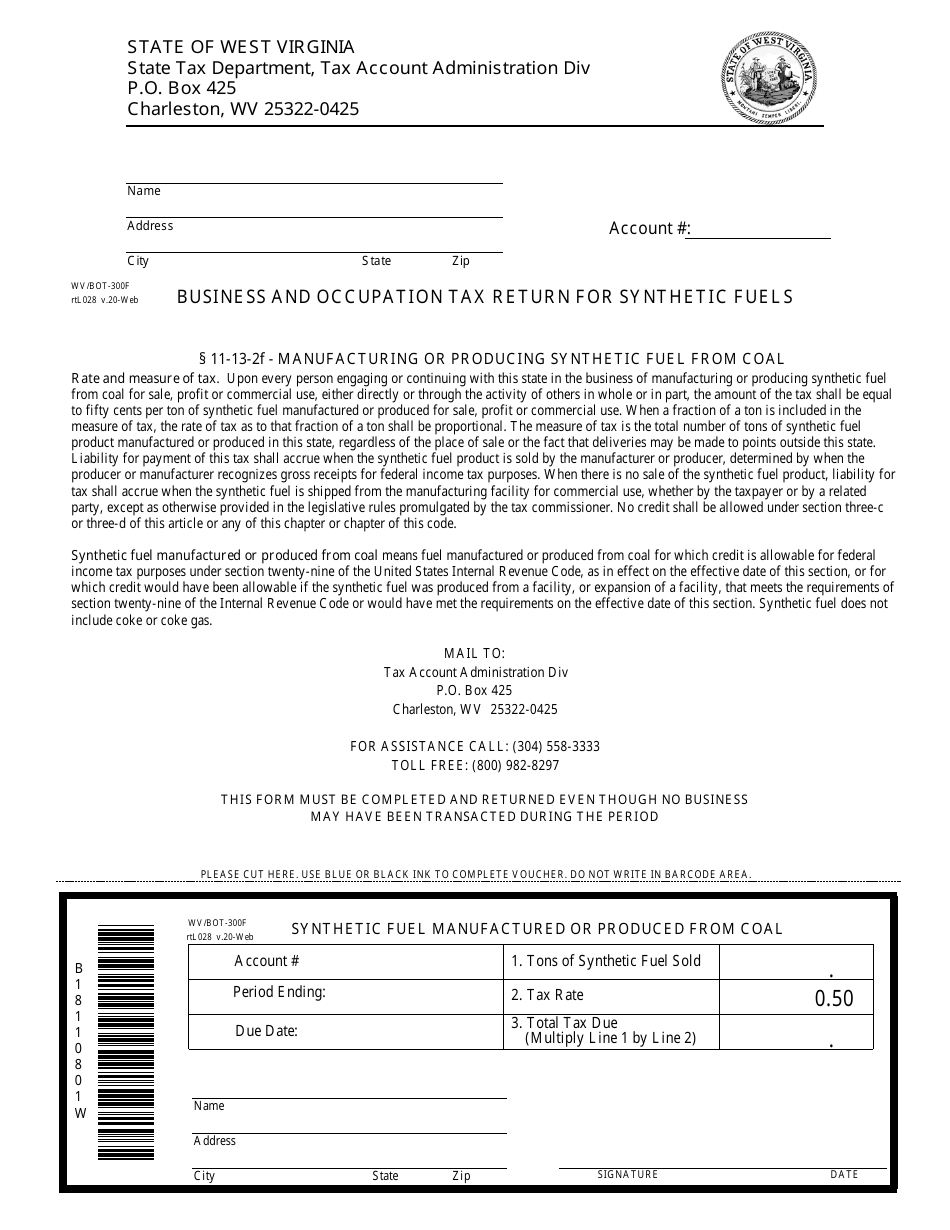

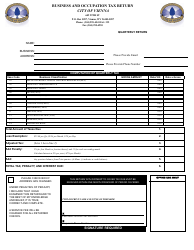

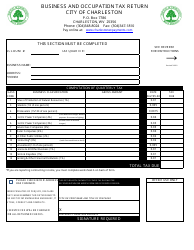

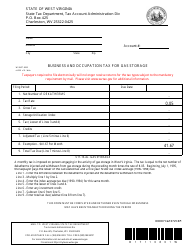

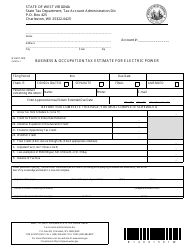

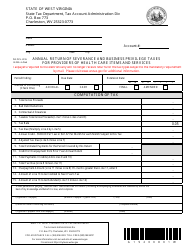

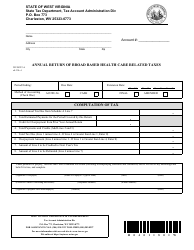

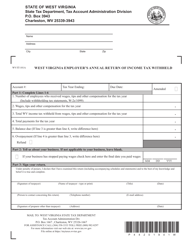

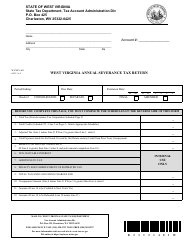

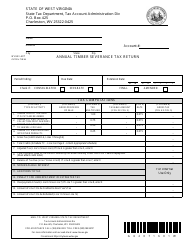

Form WV / BOT-300f Business and Occupation Tax Return for Synthetic Fuels - West Virginia

What Is Form WV/BOT-300f?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form WV/BOT-300f?

A: Form WV/BOT-300f is the Business and Occupation Tax Return for Synthetic Fuels in West Virginia.

Q: Who needs to file Form WV/BOT-300f?

A: Any business or entity engaged in the production or sale of synthetic fuels in West Virginia needs to file Form WV/BOT-300f.

Q: What is the purpose of Form WV/BOT-300f?

A: The purpose of Form WV/BOT-300f is to report and pay the Business and Occupation Tax for Synthetic Fuels in West Virginia.

Q: When is Form WV/BOT-300f due?

A: Form WV/BOT-300f is generally due on or before the 20th day of the month following the end of the reporting period.

Q: Are there any penalties for late filing of Form WV/BOT-300f?

A: Yes, there are penalties for late filing of Form WV/BOT-300f. Late filings may result in penalties and interest charges.

Q: Are there any instructions for filling out Form WV/BOT-300f?

A: Yes, instructions for filling out Form WV/BOT-300f are provided by the West Virginia State Tax Department along with the form.

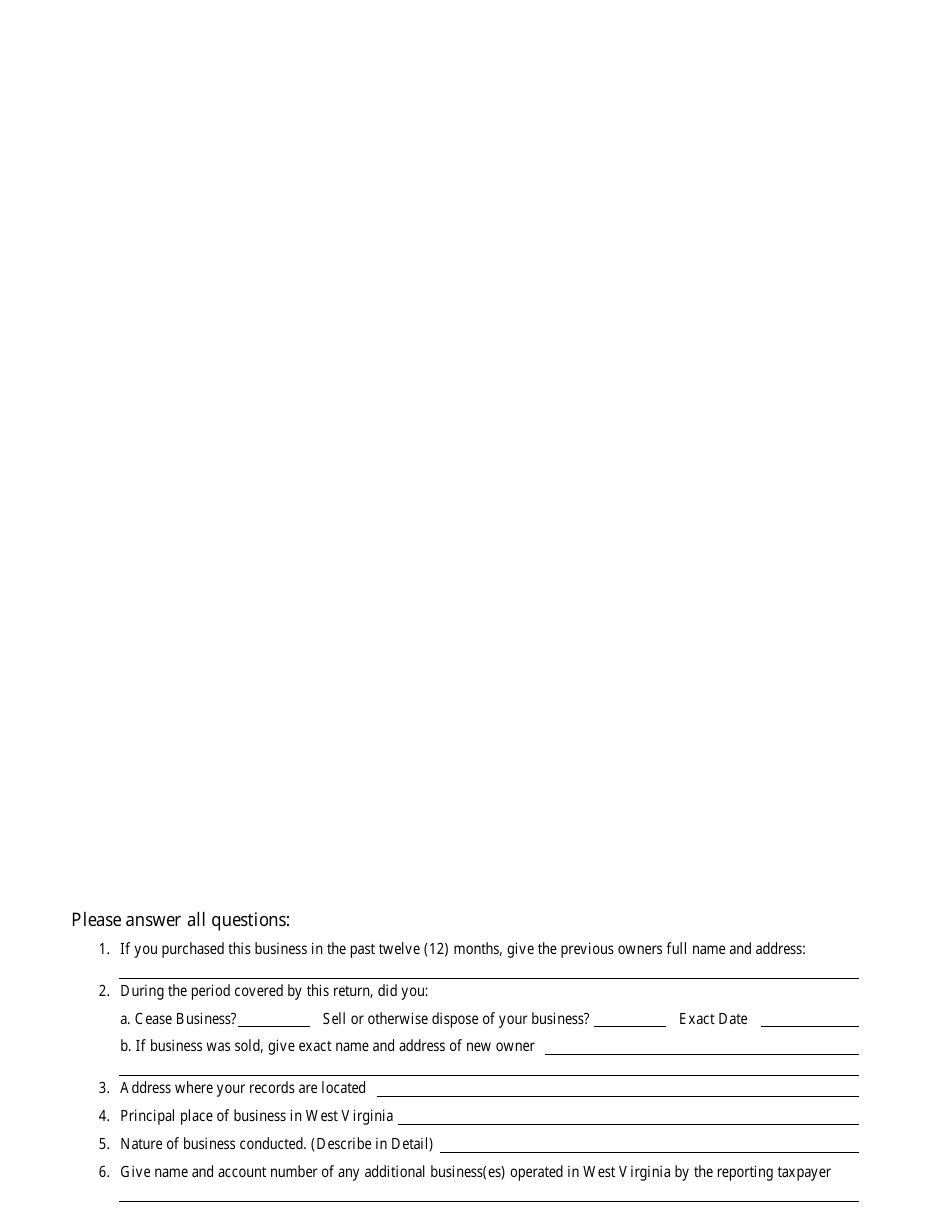

Q: What information do I need to have before filling out Form WV/BOT-300f?

A: Before filling out Form WV/BOT-300f, you will need to have information such as your business's gross receipts from synthetic fuel sales, deductions, and any credits you may be eligible for.

Q: Do I need to attach any supporting documents with Form WV/BOT-300f?

A: Yes, you may need to attach supporting documents such as schedules or additional forms depending on your specific circumstances. Refer to the instructions provided with Form WV/BOT-300f for more information.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form WV/BOT-300f by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.