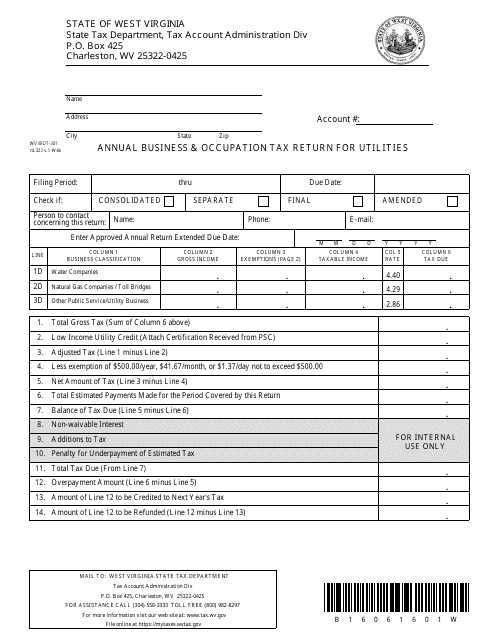

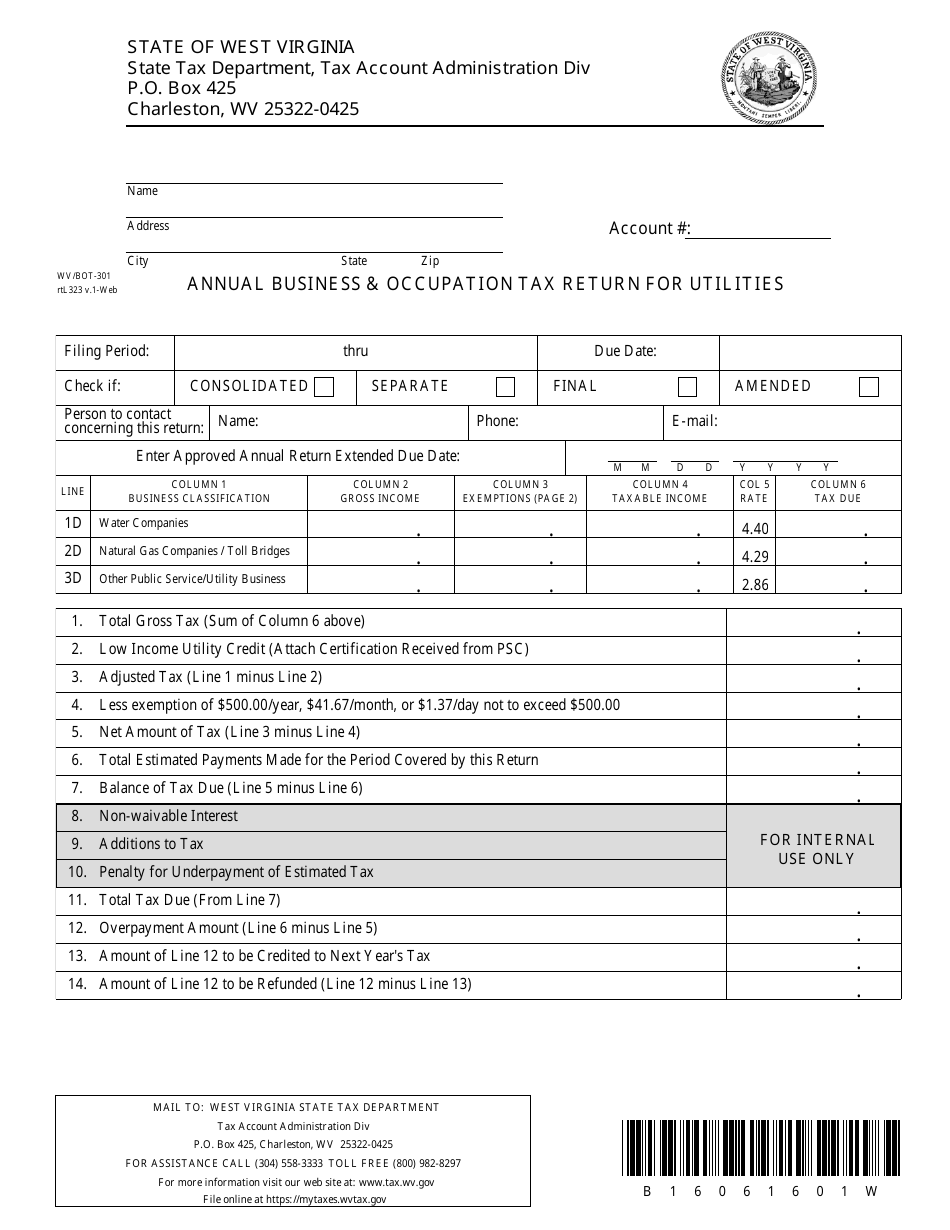

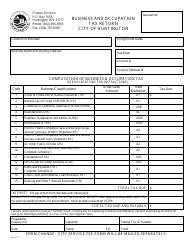

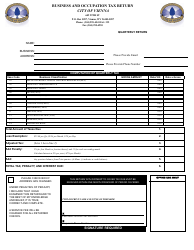

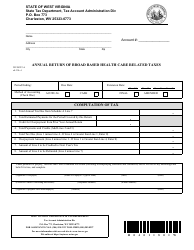

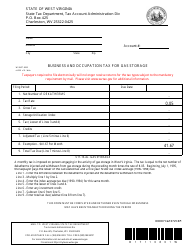

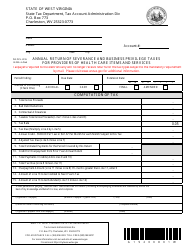

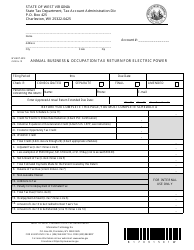

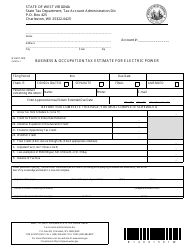

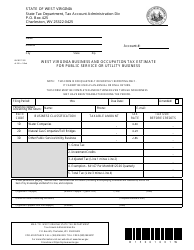

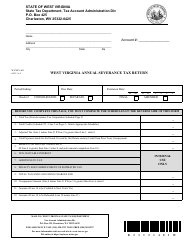

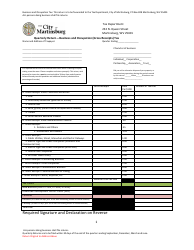

Form WV / BOT-301 Annual Business & Occupation Tax Return for Utilities - West Virginia

What Is Form WV/BOT-301?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. Check the official instructions before completing and submitting the form.

FAQ

Q: What is WV/BOT-301 Annual Business & Occupation Tax Return for Utilities?

A: The WV/BOT-301 is a form used to file the Annual Business & Occupation Tax Return specifically for utilities in West Virginia.

Q: Who is required to file WV/BOT-301 Annual Business & Occupation Tax Return for Utilities?

A: Utilities in West Virginia are required to file the WV/BOT-301 Annual Business & Occupation Tax Return.

Q: What taxes does the WV/BOT-301 Annual Business & Occupation Tax Return cover?

A: The WV/BOT-301 covers the Business & Occupation Tax for utilities in West Virginia.

Q: How often is the WV/BOT-301 Annual Business & Occupation Tax Return filed?

A: The WV/BOT-301 is filed annually, meaning it must be filed once a year.

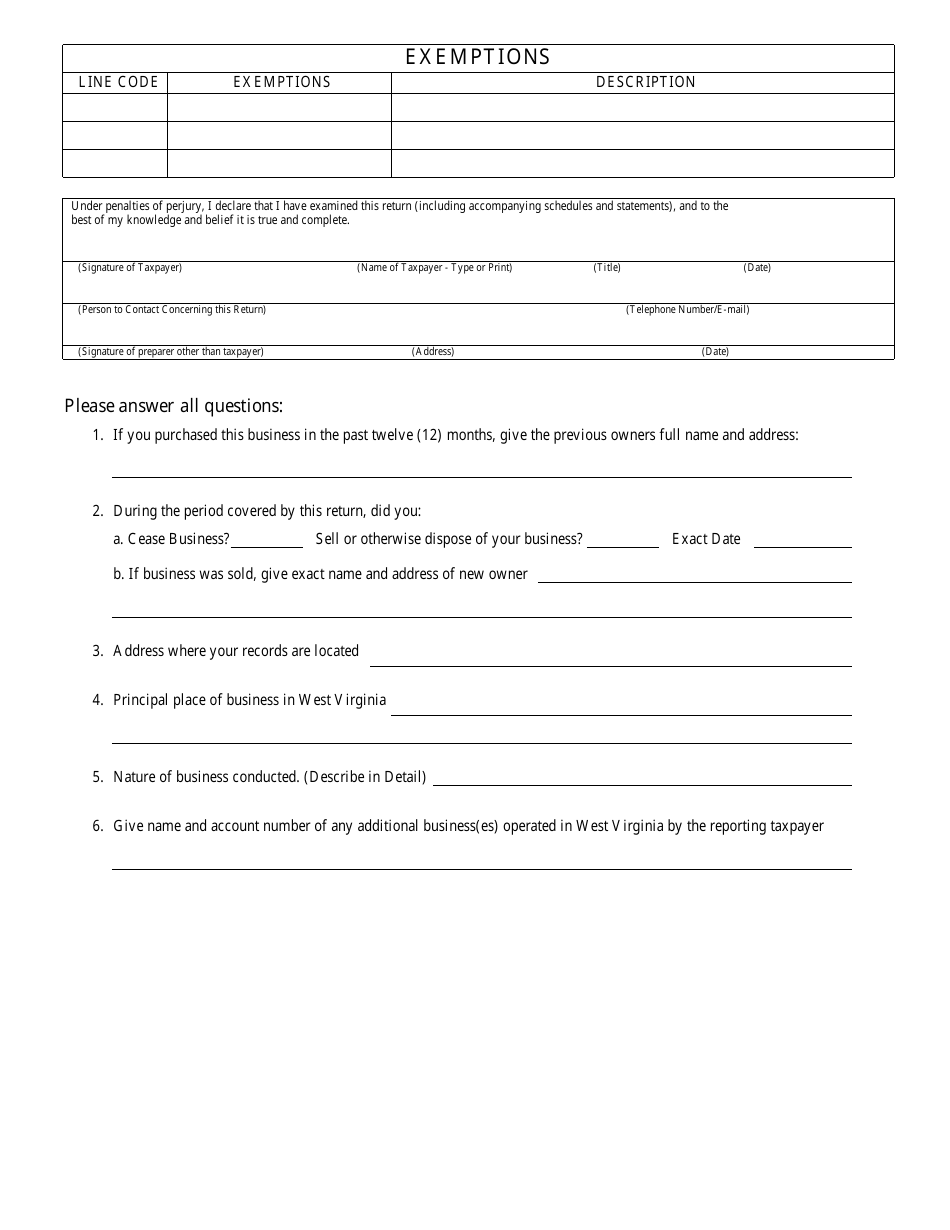

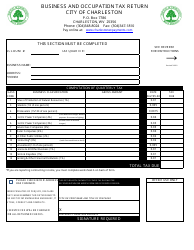

Q: Are there any specific instructions for filling out the WV/BOT-301 Annual Business & Occupation Tax Return?

A: Yes, there are specific instructions provided with the form that should be followed while filling it out.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form WV/BOT-301 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.