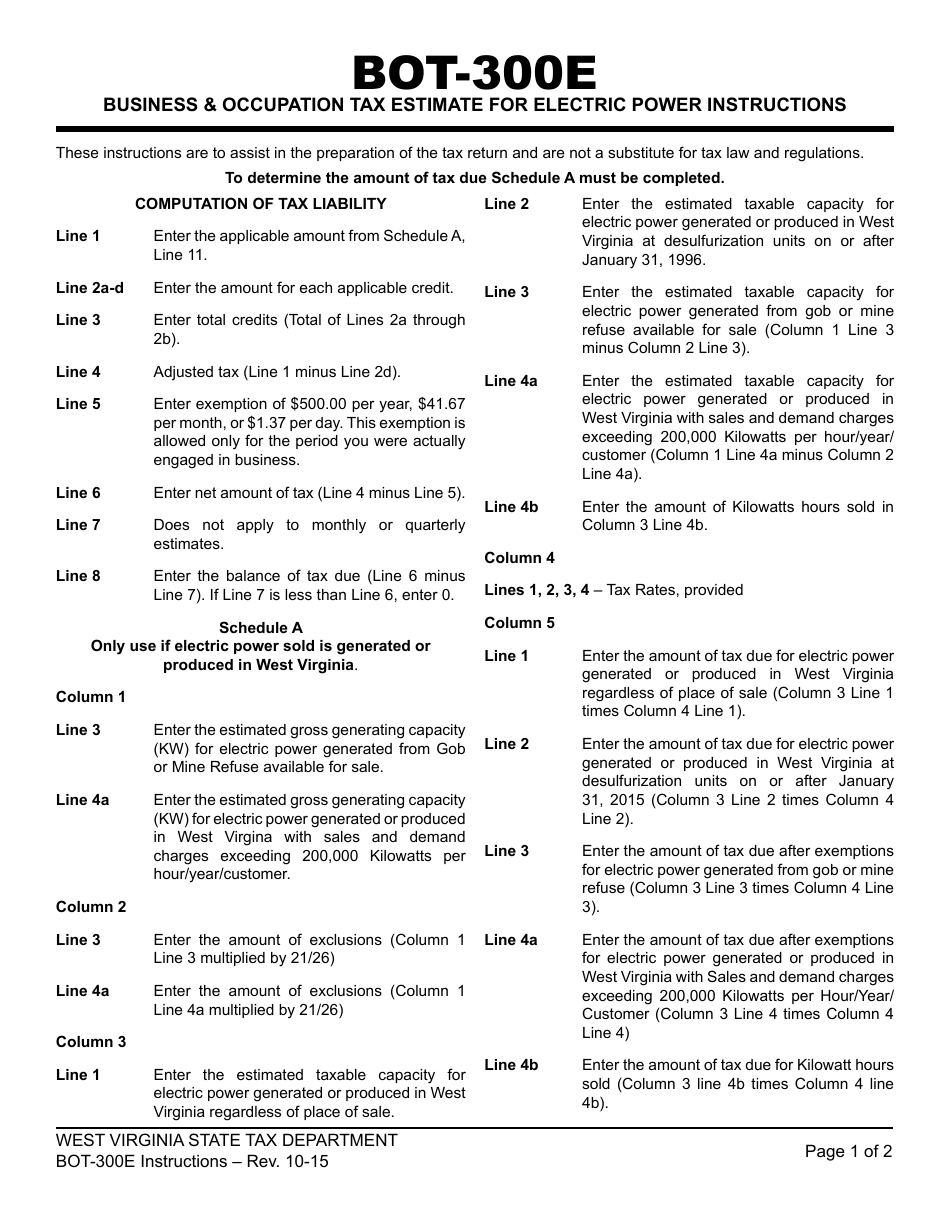

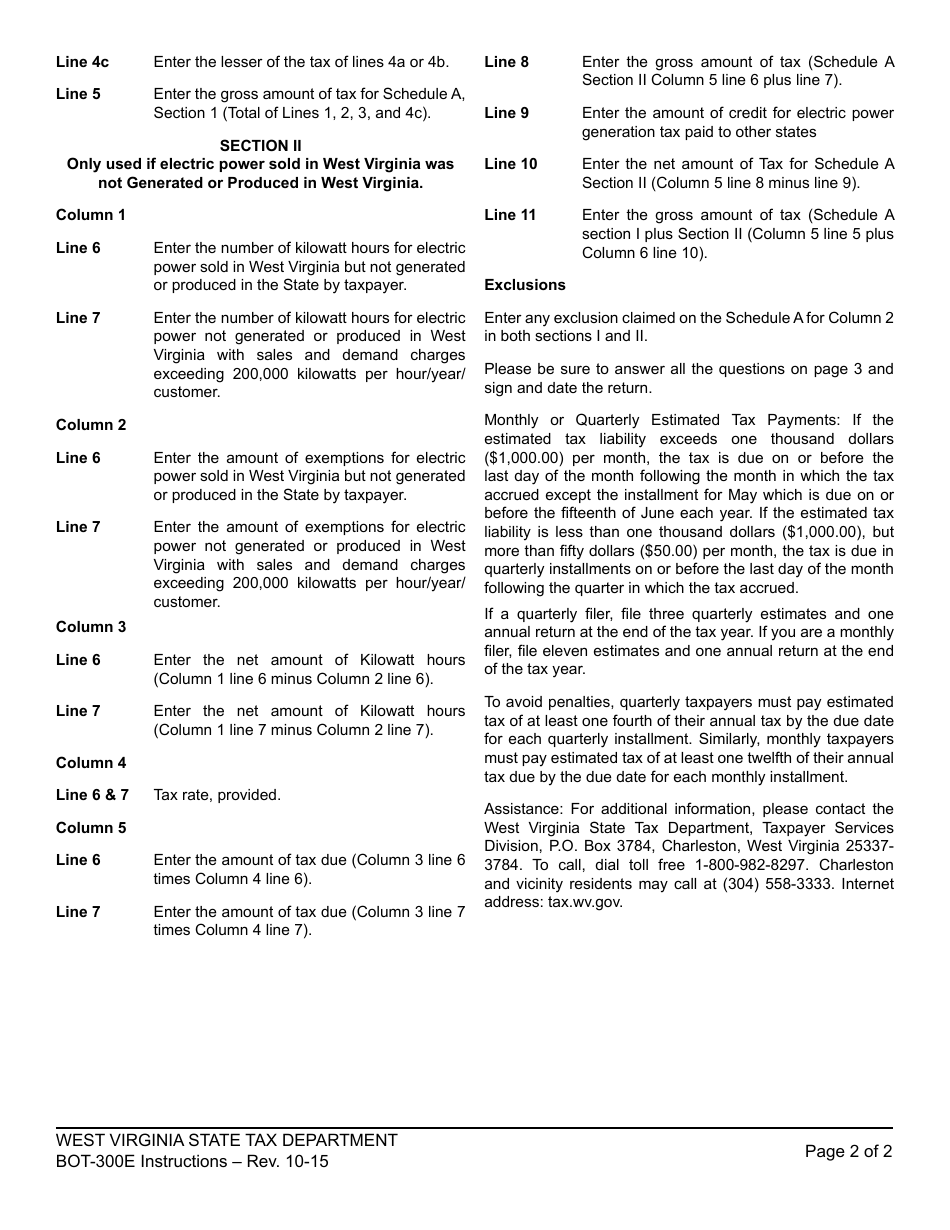

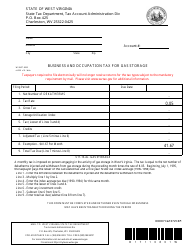

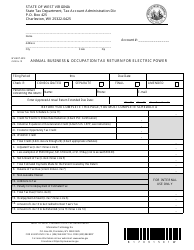

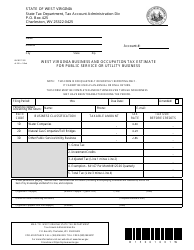

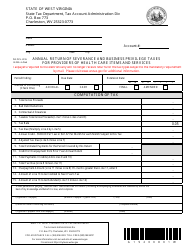

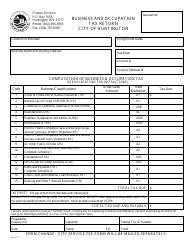

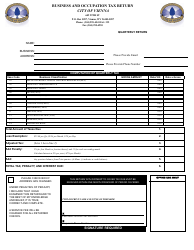

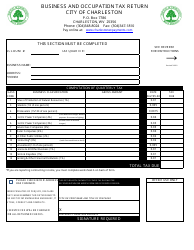

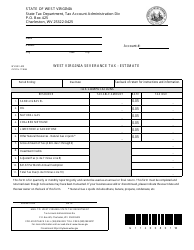

Instructions for Form WV / BOT-300E Business & Occupation Tax Estimate for Electric Power - West Virginia

This document contains official instructions for Form WV/BOT-300E , Business & Occupation Tax Estimate for Electric Power - a form released and collected by the West Virginia State Tax Department. An up-to-date fillable Form WV/BOT-300e is available for download through this link.

FAQ

Q: What is Form WV/BOT-300E?

A: Form WV/BOT-300E is a tax form used for estimating the Business & Occupation Tax for electric power in West Virginia.

Q: Who needs to file Form WV/BOT-300E?

A: Any business in West Virginia that generates or sells electric power needs to file Form WV/BOT-300E.

Q: What is the purpose of Form WV/BOT-300E?

A: The purpose of Form WV/BOT-300E is to estimate and report the Business & Occupation Tax for electric power generated or sold in West Virginia.

Q: When is the deadline to file Form WV/BOT-300E?

A: Form WV/BOT-300E should be filed on or before April 15th of each year for the preceding calendar year.

Q: What information is required on Form WV/BOT-300E?

A: Some of the information required on Form WV/BOT-300E includes the taxpayer's name, contact information, taxable gross revenue, and estimated tax amount.

Q: Are there any penalties for not filing Form WV/BOT-300E?

A: Yes, failure to file Form WV/BOT-300E or filing it late may result in penalties and interest charges.

Q: Can I pay the estimated tax amount electronically?

A: Yes, the West Virginia State Tax Department accepts electronic payments for the estimated tax amount.

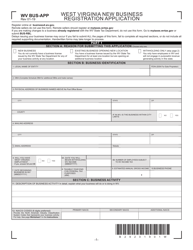

Q: Who can I contact for assistance with Form WV/BOT-300E?

A: For assistance with Form WV/BOT-300E, you can contact the West Virginia State Tax Department's customer service hotline or visit their local office.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the West Virginia State Tax Department.