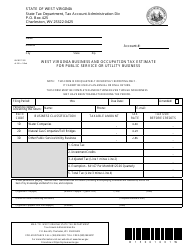

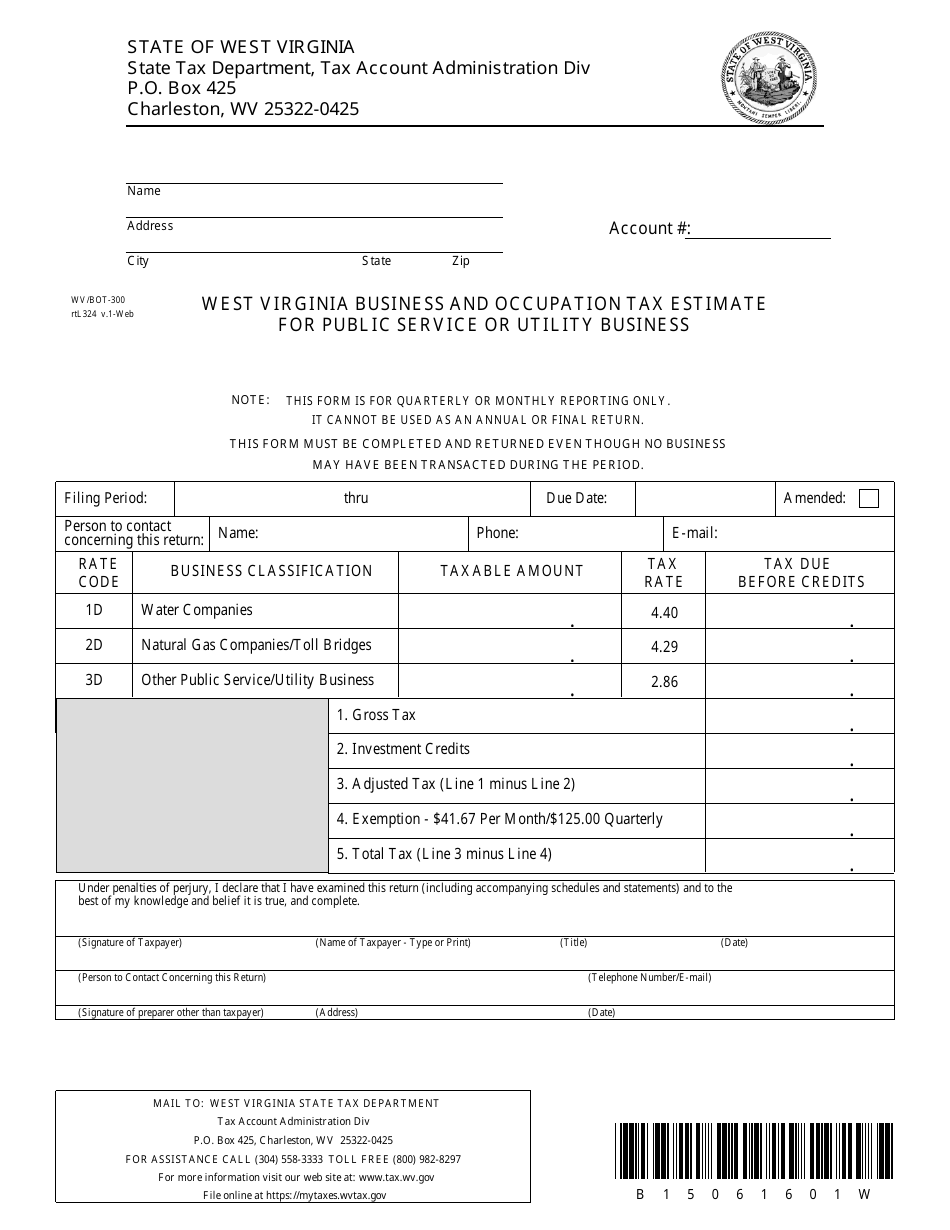

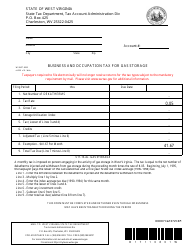

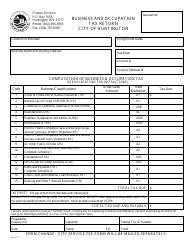

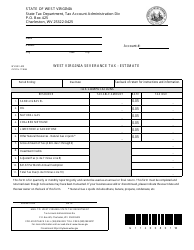

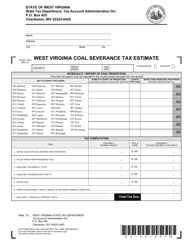

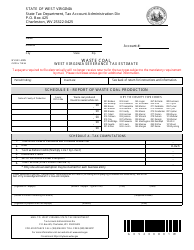

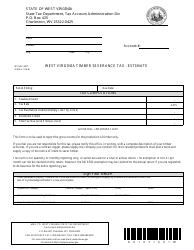

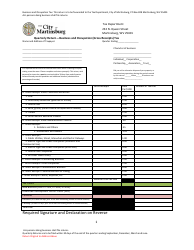

Form WV / BOT-300 West Virginia Business and Occupation Tax Estimate for Public Service or Utility Business - West Virginia

What Is Form WV/BOT-300?

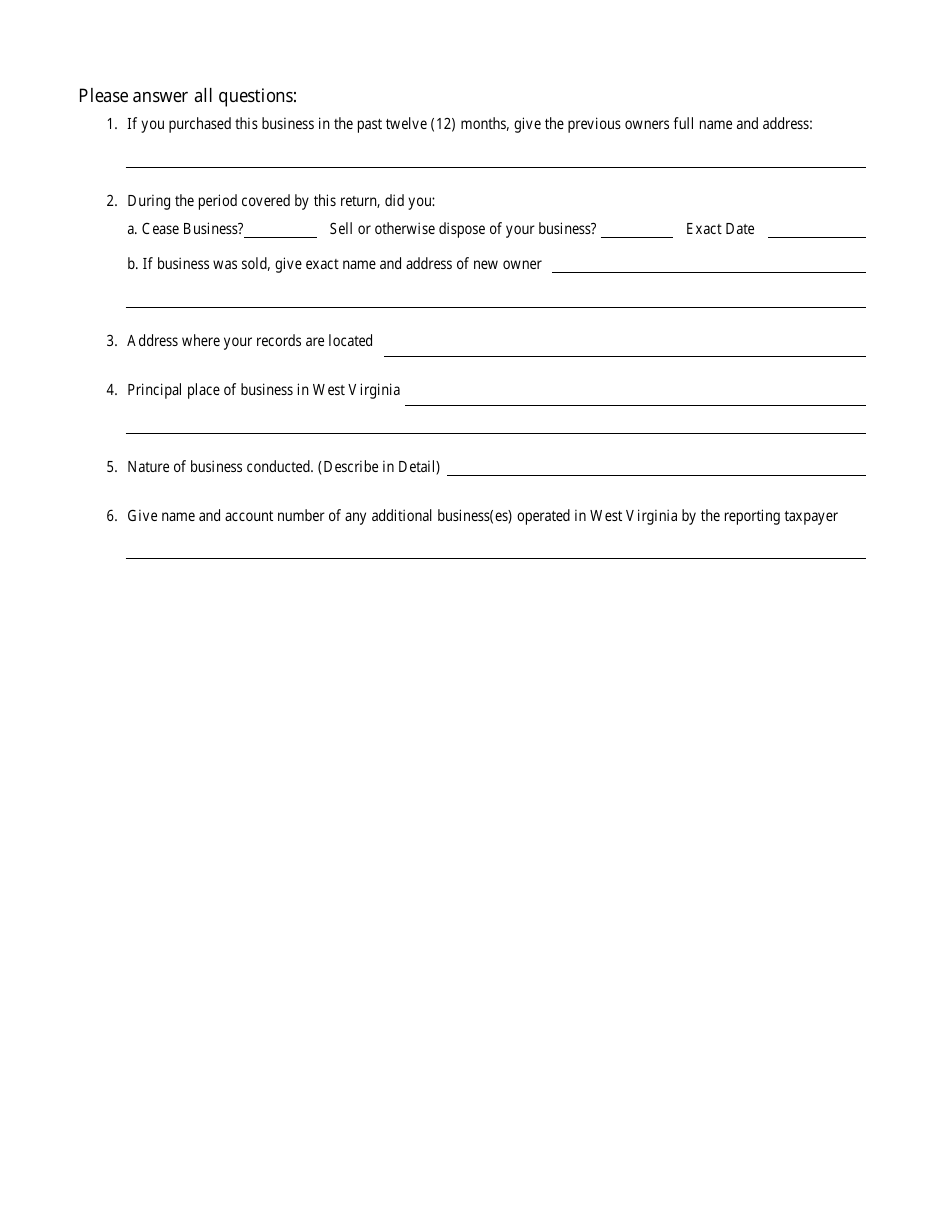

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form WV/BOT-300?

A: Form WV/BOT-300 is the West Virginia Business and Occupation Tax Estimate for Public Service or Utility Business.

Q: Who needs to file Form WV/BOT-300?

A: Public service or utility businesses in West Virginia need to file Form WV/BOT-300.

Q: What is the purpose of Form WV/BOT-300?

A: The purpose of Form WV/BOT-300 is to estimate the business and occupation tax for public service or utility businesses in West Virginia.

Q: When is Form WV/BOT-300 due?

A: Form WV/BOT-300 is due on or before the 15th day of the 4th month following the close of the taxable year.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form WV/BOT-300 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.