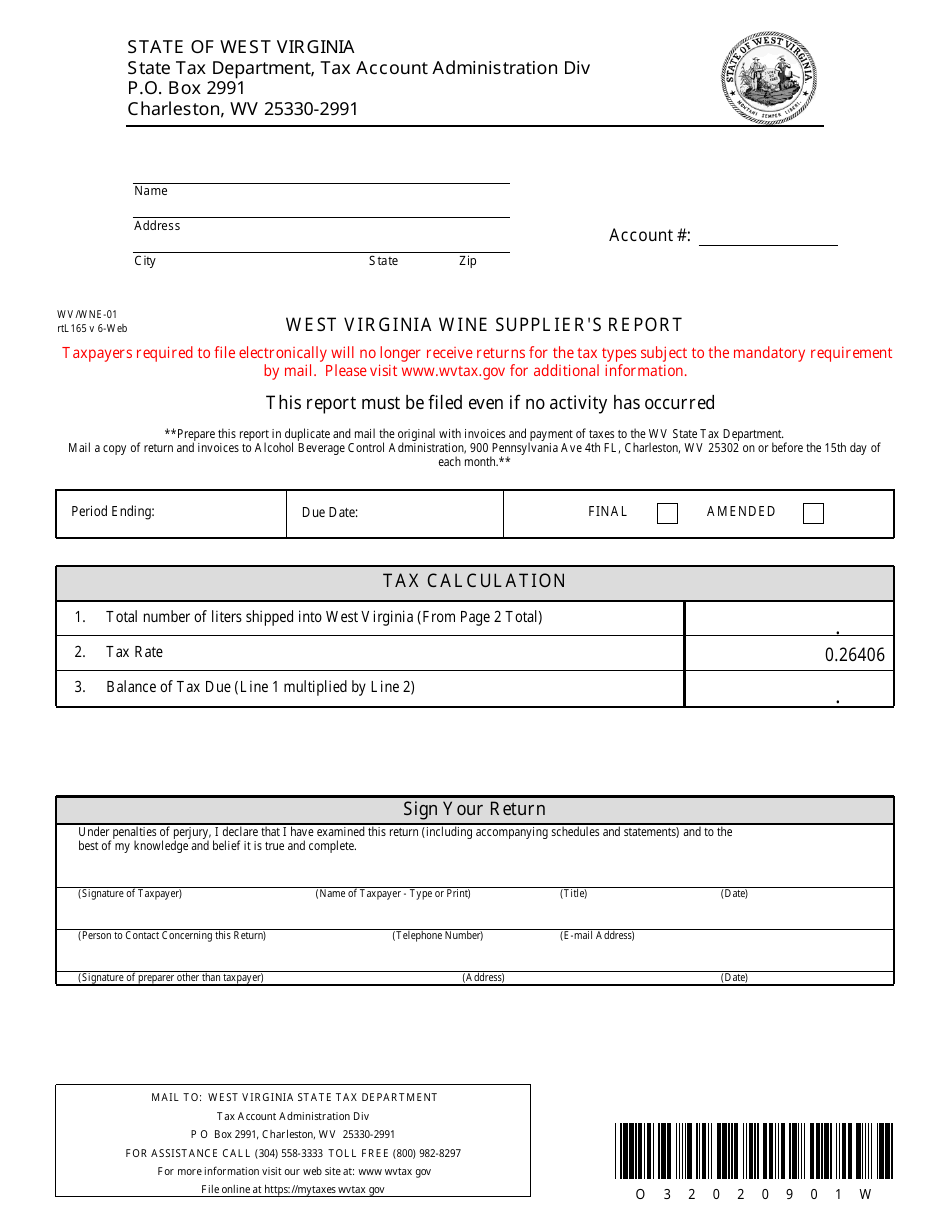

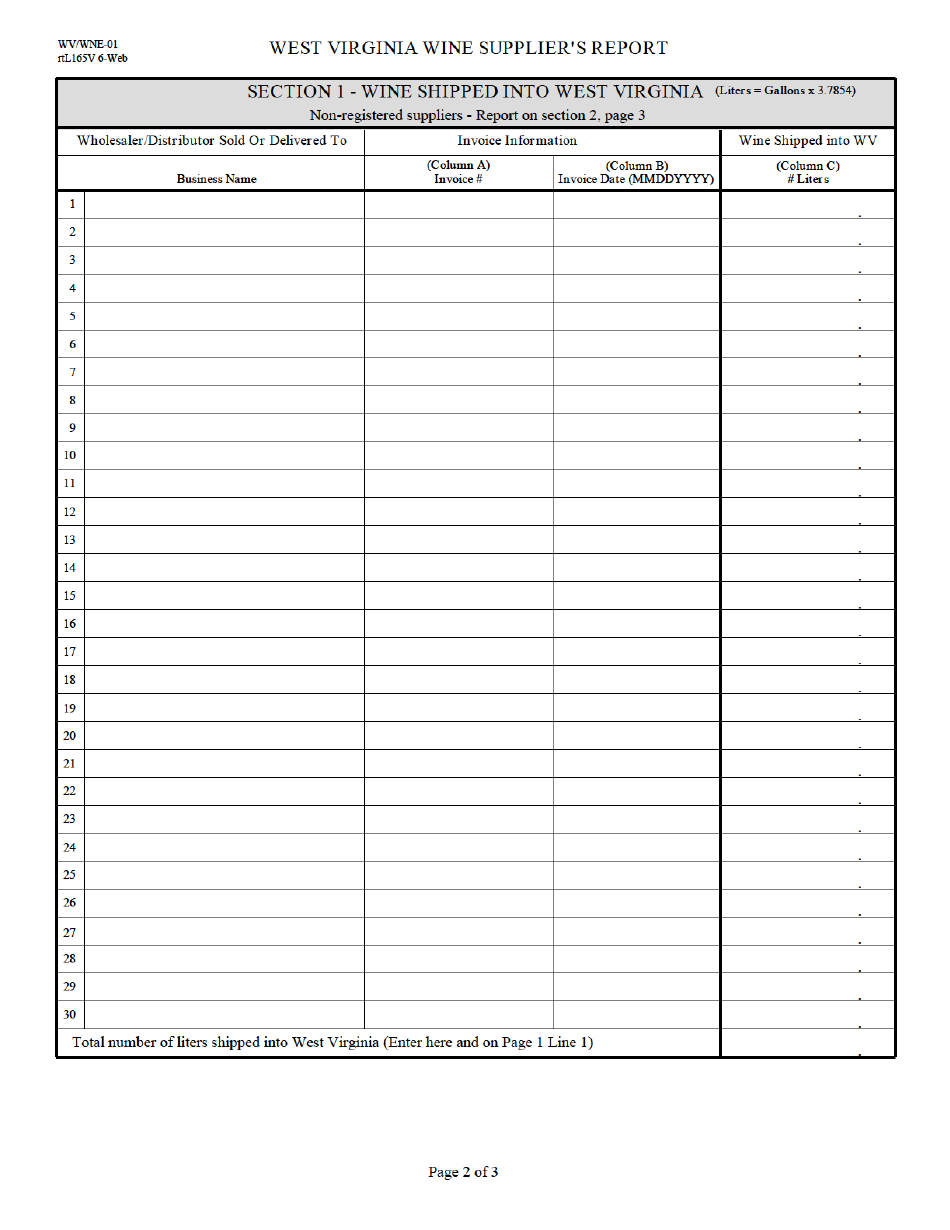

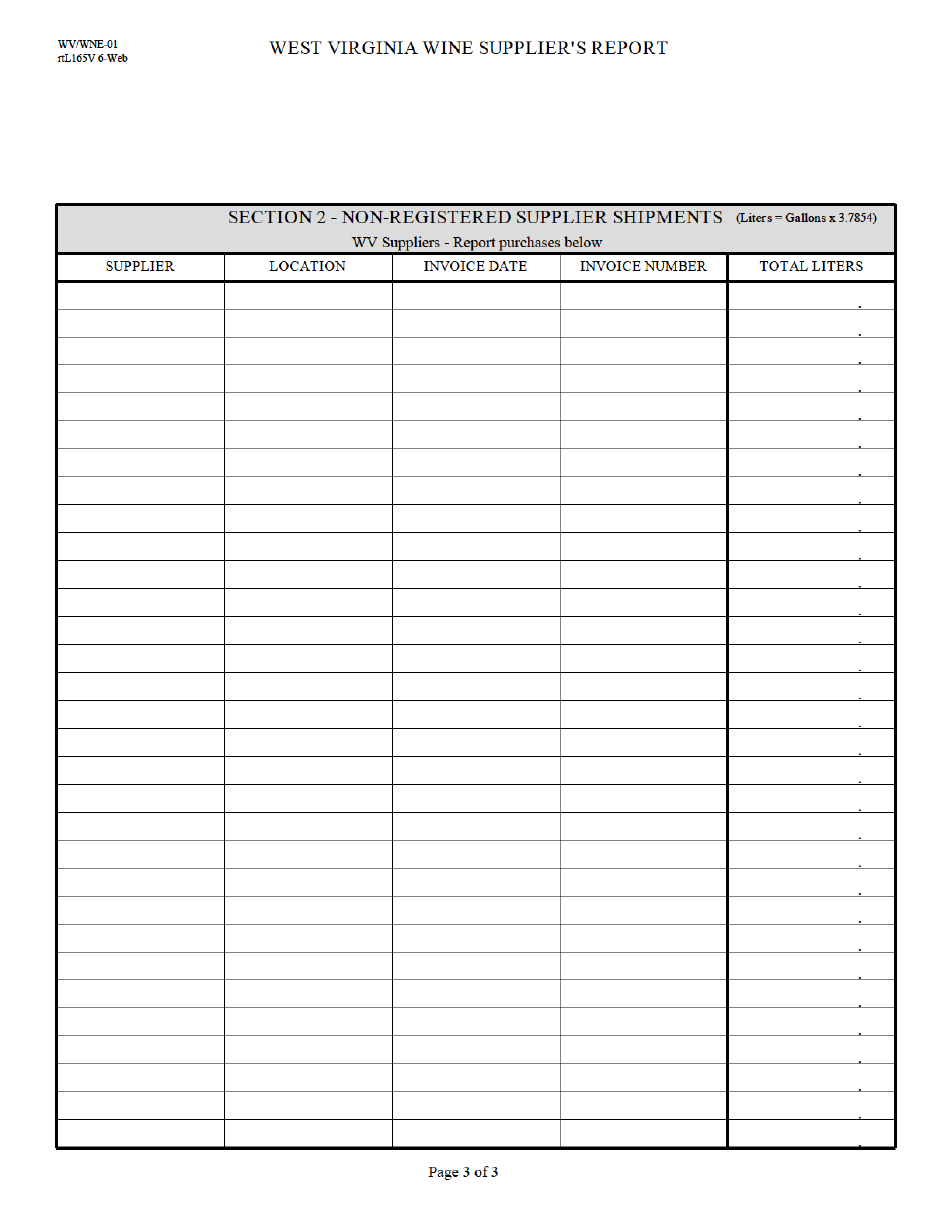

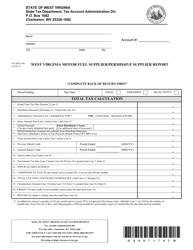

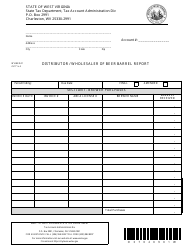

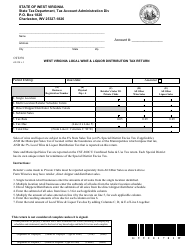

Form WV / WNE-01 West Virginia Wine Supplier's Report - West Virginia

What Is Form WV/WNE-01?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the WV/WNE-01 form?

A: The WV/WNE-01 form is the West Virginia Wine Supplier's Report.

Q: Who needs to file the WV/WNE-01 form?

A: Wine suppliers in West Virginia need to file the WV/WNE-01 form.

Q: What is the purpose of the WV/WNE-01 form?

A: The WV/WNE-01 form is used for reporting wine sales and distribution in West Virginia.

Q: When is the deadline for filing the WV/WNE-01 form?

A: The deadline for filing the WV/WNE-01 form is typically the 15th of each month.

Q: Are there any penalties for not filing the WV/WNE-01 form?

A: Yes, there can be penalties for not filing the WV/WNE-01 form, including fines and potential license suspension.

Q: What information is required to complete the WV/WNE-01 form?

A: The WV/WNE-01 form requires information such as total wine sales, sales by brand and type, and distribution details.

Q: Is the WV/WNE-01 form only for wineries in West Virginia?

A: No, the WV/WNE-01 form is for wine suppliers that distribute wine in West Virginia, including wineries located outside the state.

Q: Can I request an extension for filing the WV/WNE-01 form?

A: Yes, you can request an extension for filing the WV/WNE-01 form by contacting the West Virginia Department of Revenue.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form WV/WNE-01 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.