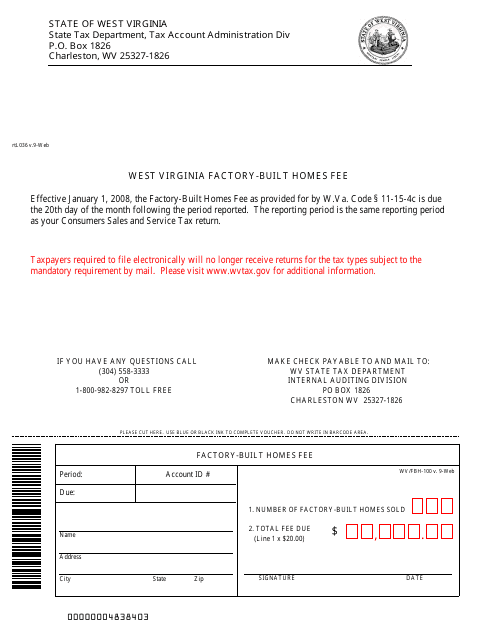

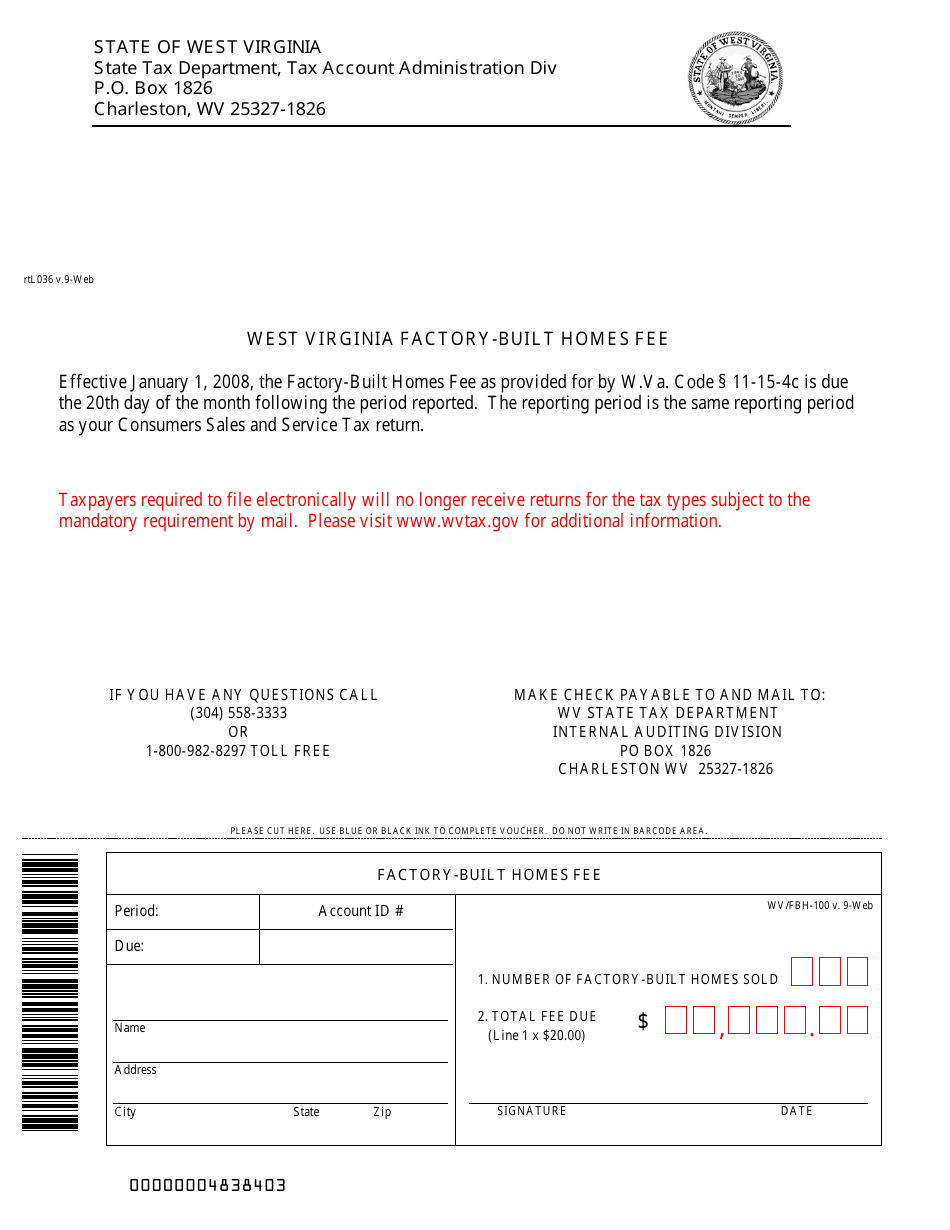

Form WV / FBH-100 West Virginia Factory - Built Homes Fee - West Virginia

What Is Form WV/FBH-100?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the WV/FBH-100 form used for?

A: The WV/FBH-100 form is used for paying the Factory-Built Homes fee in West Virginia.

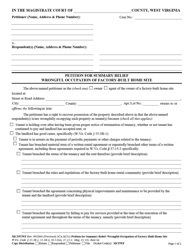

Q: What is the West Virginia Factory-Built Homes fee?

A: The West Virginia Factory-Built Homes fee is a fee required for manufactured and modular homes sold in West Virginia.

Q: Is the WV/FBH-100 form specific to West Virginia?

A: Yes, the WV/FBH-100 form is specific to West Virginia.

Q: What is the purpose of the WV/FBH-100 form?

A: The purpose of the WV/FBH-100 form is to collect the Factory-Built Homes fee in accordance with West Virginia laws.

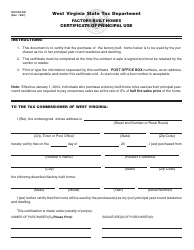

Q: Are there any exemptions to the Factory-Built Homes fee in West Virginia?

A: Yes, there are exemptions to the Factory-Built Homes fee in West Virginia. You should consult the West Virginia Department of Administration or a professional for specific information regarding exemptions.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form WV/FBH-100 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.